- United States

- /

- Banks

- /

- OTCPK:HONT

Honat Bancorp (HONT) Margin Gain Reinforces Defensive Narrative as Profitability Surges

Reviewed by Simply Wall St

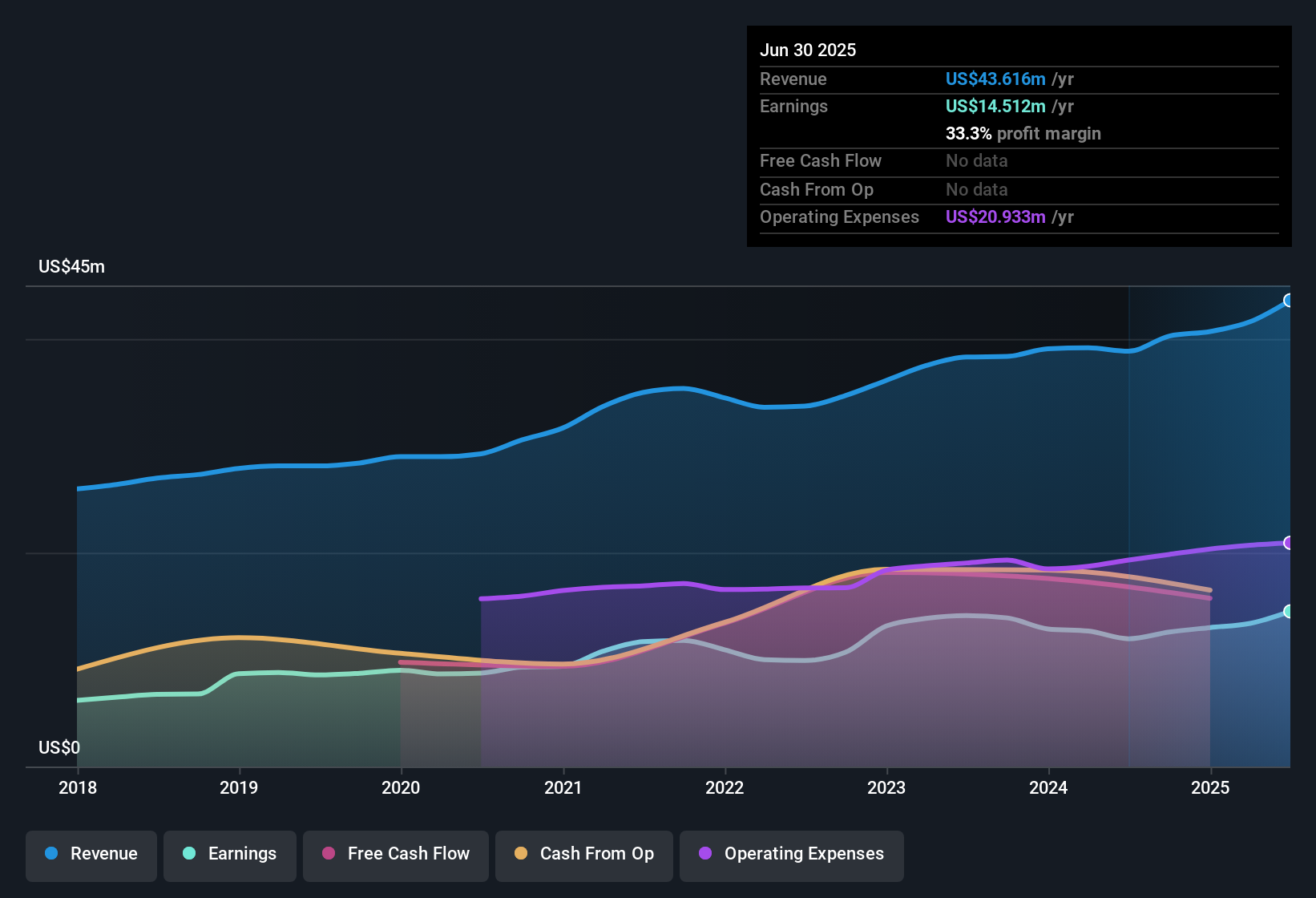

Honat Bancorp (HONT) reported a net profit margin of 33.3% for the latest year, up from 30.8% last year, and delivered earnings growth of 21.4%, well above its five-year average annual growth rate of 7.6%. Shares currently trade at $122.5, pricing the stock below the estimated fair value of $172.68 and setting a price-to-earnings ratio of 12.1x, lower than similar peers but slightly above the broader US banking average of 11.7x. The strong profit growth and consistently high-quality earnings tell a story of improved profitability, even as the recent share price has shown some volatility.

See our full analysis for Honat Bancorp.The next step is to see how these headline numbers stack up against the main narratives that investors and the community are following. Some perspectives may get reinforced, while others could be challenged by the latest data.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Strength at 33.3% Shows Quality Focus

- Net profit margin climbed to 33.3% from 30.8% last year, underscoring a notable improvement in profitability above the usual range for the sector.

- The recent margin boost aligns with the narrative that Honat is considered a defensive choice, rooted in steady, high-quality earnings and prudent capital management.

- For risk-averse investors, this level of margin stability reinforces the idea that Honat is prioritizing resilience over rapid growth. This approach can be especially appealing in an uncertain macro environment.

- The annualized margin stability not only exceeds peer averages but also strengthens the bank’s reputation for disciplined expense control and operational efficiency.

Valuation Gap: Shares Trade 29% Below DCF Fair Value

- With a share price of $122.50 against a DCF fair value estimate of $172.68, Honat is currently valued about 29% below this benchmark, while still maintaining a price-to-earnings ratio of 12.1x compared to peer banks at 13x and the industry at 11.7x.

- The narrative highlights that Honat’s discounted valuation relative to its estimated true worth, alongside strong earnings trends, positions the stock as a potential “under the radar” value play.

- Despite its conservative profile, the sizable discount suggests there is incremental upside if market sentiment around the sector improves, especially for investors looking for bargains backed by quality metrics.

- Attractive relative valuation metrics could draw increased investor interest if the operating environment remains favorable or Honat outpaces modest growth expectations.

Share Price Volatility: Risk for Short-Term Investors

- The company’s share price has not stayed stable over the past three months, introducing a risk factor for those seeking predictable short-term performance, even as headline fundamentals appear strong.

- This volatility introduces complexity for defensive investors, even as Honat’s strong margin and valuation signal underlying strength.

- While positive financial metrics support a case for long-term value, near-term share movement may test the patience of those prioritizing stability.

- The muted market reaction and continued volatility reinforce Honat’s positioning as a defensive, income-focused bank that may lag in sector rallies but could hold up better in downturns.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Honat Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

While Honat’s profitability and valuation are attractive, short-term share price volatility makes it less appealing for investors who prioritize price stability and consistent performance.

For a steadier ride, check out stable growth stocks screener to discover companies delivering robust earnings and revenue expansion quarter after quarter, regardless of the market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honat Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:HONT

Honat Bancorp

Operates as a holding company for The Honesdale National Bank that provides banking services in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives