- United States

- /

- Banks

- /

- NYSEAM:TMP

How Piper Sandler’s Neutral Initiation Will Impact Tompkins Financial (TMP) Investors

Reviewed by Sasha Jovanovic

- Piper Sandler recently initiated coverage on Tompkins Financial Corporation, assigning a Neutral rating and publishing its first formal assessment of the bank.

- This initial analyst coverage adds a new institutional viewpoint to the stock, potentially shaping how a broader set of investors evaluates Tompkins Financial.

- Next, we’ll examine how Piper Sandler’s Neutral initiation influences Tompkins Financial’s investment narrative and what it might signal for investors’ expectations.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Tompkins Financial's Investment Narrative?

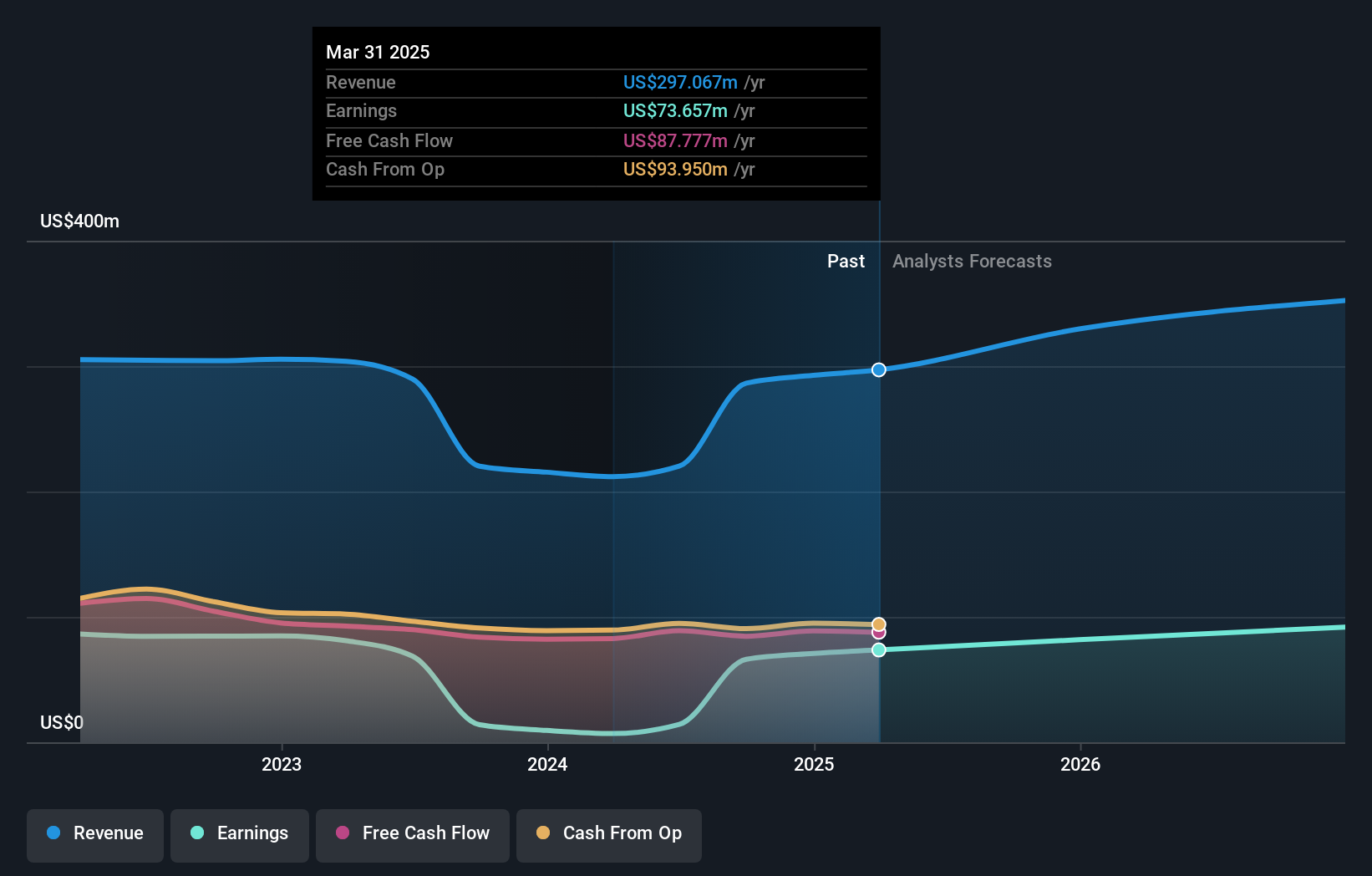

For someone owning Tompkins Financial, the core belief is that this is a steady regional bank that can keep turning solid net interest income into consistent earnings and a dependable dividend, even if industry growth is modest. Recent results show improving profitability and margin recovery after a tough 2024, but consensus still points to slight earnings declines ahead and a return on equity that stays in the low double digits. In that context, Piper Sandler’s new Neutral rating and US$74 price target mostly validates the current market view rather than resetting it, so it is unlikely to alter the key near term catalysts: credit quality trends, loan growth in its core markets, and management’s capital decisions. The rating does, however, underline existing concerns about valuation and slower expected growth.

However, there is one emerging risk investors should not ignore. Tompkins Financial's shares have been on the rise but are still potentially undervalued by 45%. Find out what it's worth.Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for Tompkins Financial span roughly US$73 to just under US$131 across 4 different views, showing how far apart individual expectations can be. Set that against Piper Sandler’s fresh Neutral stance and modest upside target, and you can see why many are watching how credit costs and earnings trends shape the next leg of the story. Together, these perspectives invite you to weigh both optimism and caution before forming your own view on the bank’s prospects.

Explore 4 other fair value estimates on Tompkins Financial - why the stock might be worth just $73.07!

Build Your Own Tompkins Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tompkins Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tompkins Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tompkins Financial's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tompkins Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:TMP

Tompkins Financial

A financial holding company, provides commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, and insurance services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026