- United States

- /

- Banks

- /

- NYSE:WAL

Will Western Alliance (WAL) Expand Its California Ambitions With a New Real Estate Finance Leader?

Reviewed by Sasha Jovanovic

- Western Alliance Bank recently announced that commercial real estate veteran Todd Popovich has joined as Managing Director for Institutional Commercial Real Estate Finance, California, where he will lead efforts to expand financing across the state.

- This move aims to boost Western Alliance’s footprint in California, specifically targeting markets with high growth potential that have historically lacked sufficient real estate financing options.

- We’ll explore how the addition of a seasoned real estate leader could influence Western Alliance Bancorporation’s growth narrative and market positioning.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Western Alliance Bancorporation Investment Narrative Recap

To be a shareholder in Western Alliance Bancorporation, you generally need to believe in the ongoing potential for strong loan growth and deposit momentum in high-opportunity Western U.S. markets, with disciplined risk management in commercial real estate lending. The recent appointment of Todd Popovich to spearhead California commercial real estate efforts could help broaden the bank’s access to new growth areas, but by itself is not likely to materially affect the near-term catalyst of accelerating loan and fee growth or alleviate the key concentration risk in commercial real estate.

Among recent announcements, the board’s approval of a US$300 million share repurchase program stands out as the most pertinent to the current growth and earnings narrative. While leadership additions can support operational goals, the repurchase program more directly signals confidence in the company’s capital position, enhancing flexibility around capital deployment as Western Alliance pursues its expansion across California and other core markets.

But for investors, it’s equally important to consider what could happen if...

Read the full narrative on Western Alliance Bancorporation (it's free!)

Western Alliance Bancorporation's narrative projects $4.4 billion revenue and $1.4 billion earnings by 2028. This requires 11.9% yearly revenue growth and a $566.6 million earnings increase from $833.4 million today.

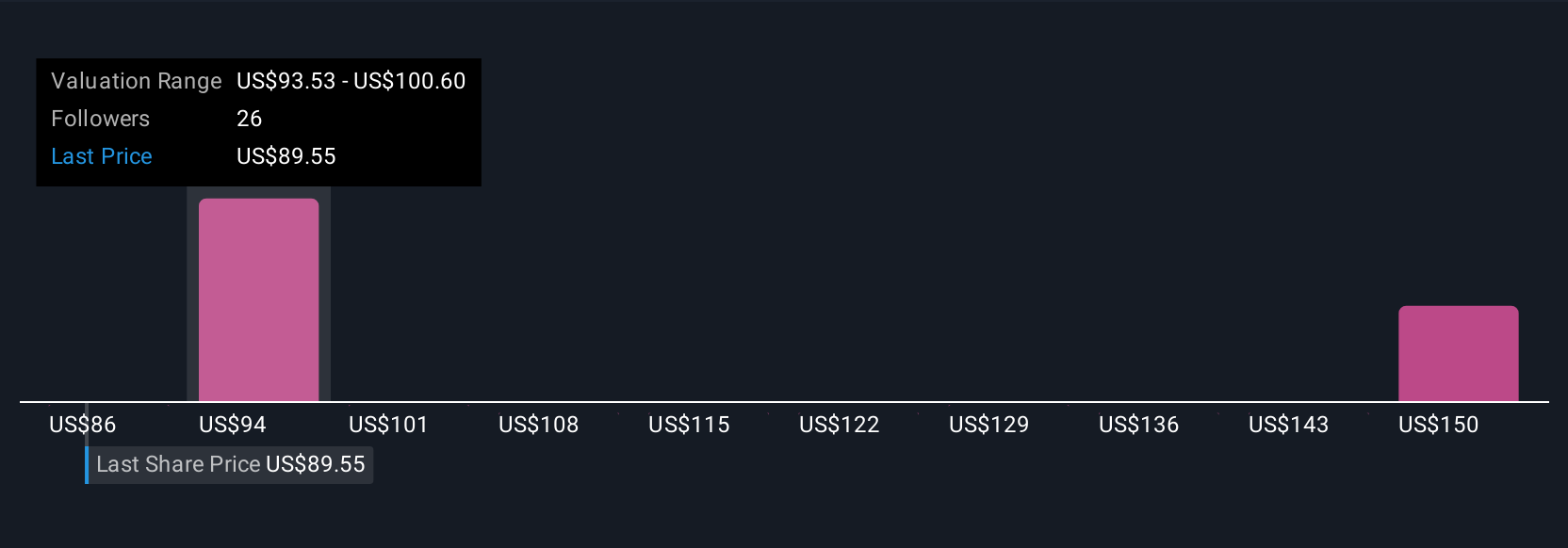

Uncover how Western Alliance Bancorporation's forecasts yield a $100.12 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have submitted seven fair value estimates for Western Alliance ranging from US$86.46 up to US$161.85 per share. As the bank positions itself for further growth in California, keep in mind that concentration in commercial real estate lending could increase risk under changing market conditions, opinions on value and performance can differ widely, so explore several perspectives before forming your own view.

Explore 7 other fair value estimates on Western Alliance Bancorporation - why the stock might be worth just $86.46!

Build Your Own Western Alliance Bancorporation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Alliance Bancorporation research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Western Alliance Bancorporation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Alliance Bancorporation's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Alliance Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAL

Western Alliance Bancorporation

Operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives