- United States

- /

- Banks

- /

- NYSE:WAL

Western Alliance Bancorporation (NYSE:WAL) Navigates Challenges with Strong Loan Growth and Undervaluation

Reviewed by Simply Wall St

See the full analysis report here for a deeper understanding of Western Alliance Bancorporation.

Innovative Factors Supporting Western Alliance Bancorporation

Western Alliance Bancorporation has demonstrated strong growth and earnings performance, as evidenced by its impressive third-quarter results with earnings of $1.80 per share. This success underscores its ability to maintain diversified loan and deposit momentum, even in a fluctuating rate environment. The bank reported a healthy deposit growth of $1.8 billion, an 11% annualized increase, alongside HFI loan growth of $916 million, translating to a 7% annualized growth. Such achievements highlight the strategic acumen of its leadership, particularly Kenneth Vecchione, the President and CEO. Furthermore, the bank's asset quality remains stable, with nonperforming assets to total assets declining by 6 basis points to 45 basis points, and a CET1 ratio increase to 11.2%, as noted by CFO Dale Gibbons. These strengths are complemented by the company's current trading price of $93.74, significantly below its estimated fair value of $166.97, suggesting it is undervalued.

Challenges Constraining Western Alliance Bancorporation's Potential

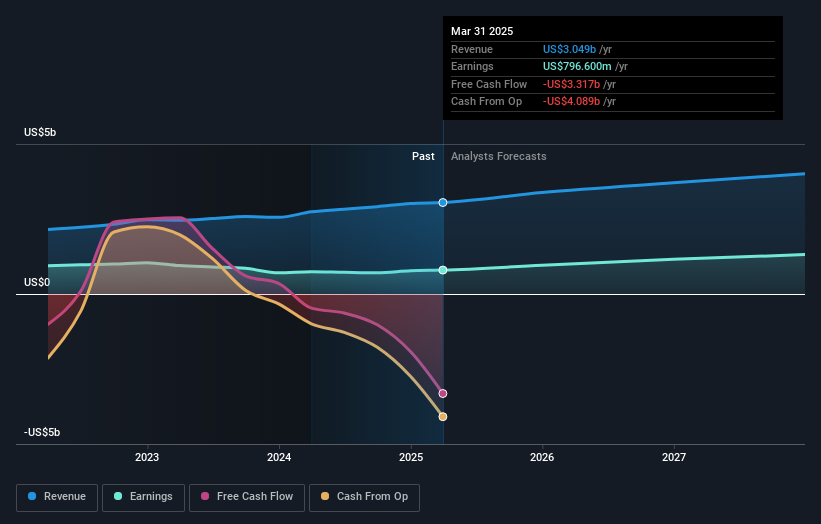

The bank faces certain challenges, including a compression in net interest margin by 2 basis points due to lower yields on variable rate loans. This margin compression poses a challenge in maintaining profitability. Additionally, the bank's Q3 earnings were impacted by elevated deposit costs, stemming from a $4 billion growth in mortgage warehouse deposits. Noninterest income growth was also tempered by a decline in mortgage banking income, which increased by $11 million or 10% quarter-over-quarter. Moreover, the current net profit margin of 24.3% is lower than the previous year's 33.1%, and the return on equity stands at a modest 10.8%, below the industry benchmark. These factors highlight areas where the bank needs to focus on improving efficiency and profitability.

Areas for Expansion and Innovation for Western Alliance Bancorporation

The bank is well-positioned to capitalize on future opportunities, particularly with anticipated funding cost savings from continued interest rate cuts. This will benefit both interest-bearing and ECR-related deposits. There is also significant potential in expanding mortgage warehouse and C&I lending, with substantial contributions to loan growth expected from these areas. The bank projects noninterest income to increase by 8% to 12% next quarter, driven by commercial banking fee opportunities and a strengthening mortgage banking income. These initiatives could enhance the bank's market position and drive performance, offering a pathway to leverage emerging opportunities effectively.

Regulatory Challenges Facing Western Alliance Bancorporation

The bank must navigate several external threats, including economic and rate environment uncertainties. The transitional period to a lower rate environment presents challenges, with market-tied variable loans repricing slightly ahead of funding costs. Additionally, the bank's mortgage banking income remains vulnerable to rate fluctuations and consumer behavior, as loan servicing revenue was impacted by accelerated prepayment speeds. Seasonal deposit outflows are expected to temporarily decline by $2 billion in Q4, which could affect liquidity. These factors underscore the need for strategic risk management to safeguard against potential volatility.

Conclusion

Western Alliance Bancorporation's strategic leadership and stable asset quality have positioned it well to navigate current challenges and capitalize on future opportunities. The bank's diversified loan and deposit growth, alongside its potential for expanding mortgage warehouse and C&I lending, suggest a strong foundation for future performance. The bank's trading price of $93.74, significantly below its estimated fair value of $166.97, highlights a potential opportunity for investors, as it reflects the market's undervaluation of the bank's intrinsic strengths and growth prospects. With strategic risk management and efficiency improvements, Western Alliance can enhance profitability and align closer to its fair value, offering a promising outlook for stakeholders.

Seize The Opportunity

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Western Alliance Bancorporation, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Western Alliance Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAL

Western Alliance Bancorporation

Operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives