- United States

- /

- Banks

- /

- NYSE:WAL

Is Western Alliance Bancorp Still Attractive After Solid Three Year Gains in 2025?

Reviewed by Bailey Pemberton

If you own Western Alliance Bancorporation stock or are thinking about adding it to your watchlist, you could be facing one of those classic investor dilemmas: stay the course, buy more, or take some chips off the table. After all, bank stocks can make headlines for all the right and wrong reasons, and this one has certainly seen its share of both.

The stock currently sits at $86.75. Over the last week it dipped by 0.4%, and over the past month it lost 4.3%. But step back and the bigger picture is far more appealing. Western Alliance shares are up 4.6% year-to-date, 5.1% over the last year, and a remarkable 45.0% in three years. The five-year return is an impressive 154.9%. That kind of performance hints at real staying power and suggests many investors believe in the company’s long-term story, even as market volatility and shifting perceptions of regional bank risk have nudged prices around lately.

So, is the stock worth its current price, or is there still some hidden value others are missing? When we ran Western Alliance through a gauntlet of six tough valuation tests, it emerged undervalued in five out of six checks. This gives it a value score of 5. This is a strong result and it invites a closer look at why the stock appears underrated by the numbers.

Let’s break down each of these valuation angles to see where the company stands. Then we will explore an even sharper lens for understanding what Western Alliance Bancorporation is truly worth in today’s market.

Why Western Alliance Bancorporation is lagging behind its peers

Approach 1: Western Alliance Bancorporation Excess Returns Analysis

The Excess Returns model measures whether a company generates returns above its cost of equity, essentially determining if it adds real value for shareholders beyond what they could earn elsewhere for similar risk. This approach focuses closely on the profitability of Western Alliance Bancorporation's investments and its capacity to grow shareholder value over time.

For Western Alliance Bancorporation, the numbers look promising. The company's current Book Value stands at $62.57 per share, with analysts projecting a stable Book Value of $74.31 per share in the future, based on input from nine analysts. Its Stable Earnings Per Share (EPS) is estimated at $10.58, with a robust Average Return on Equity of 14.24 percent, both drawn from consensus forecasts. The calculated Cost of Equity is $6.10 per share, meaning the bank is generating an Excess Return of $4.49 per share above what investors might otherwise expect for this level of risk.

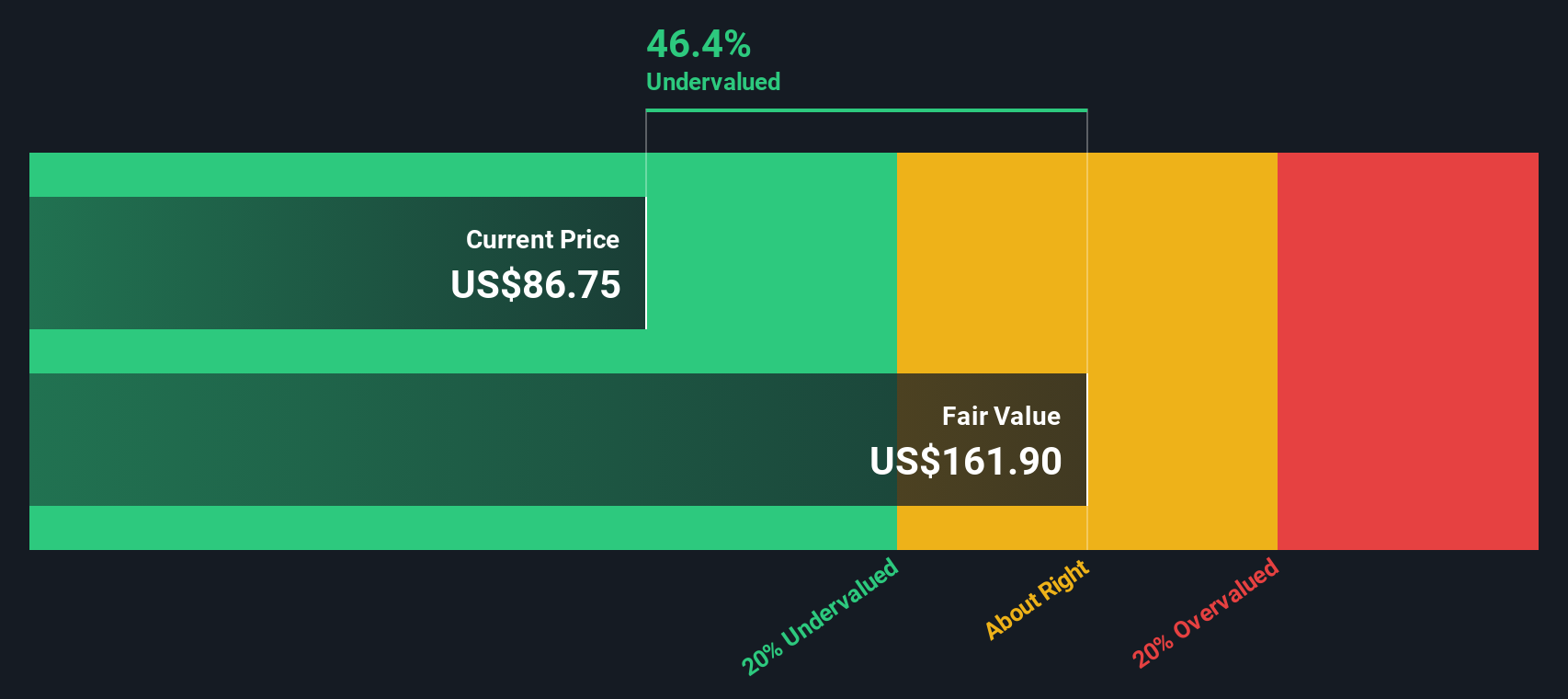

Applying this method, the intrinsic value of Western Alliance Bancorporation is estimated at $161.90 per share, which is significantly higher than its current trading price of $86.75. This implies the stock is about 46.4 percent undervalued according to the Excess Returns approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests Western Alliance Bancorporation is undervalued by 46.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Western Alliance Bancorporation Price vs Earnings

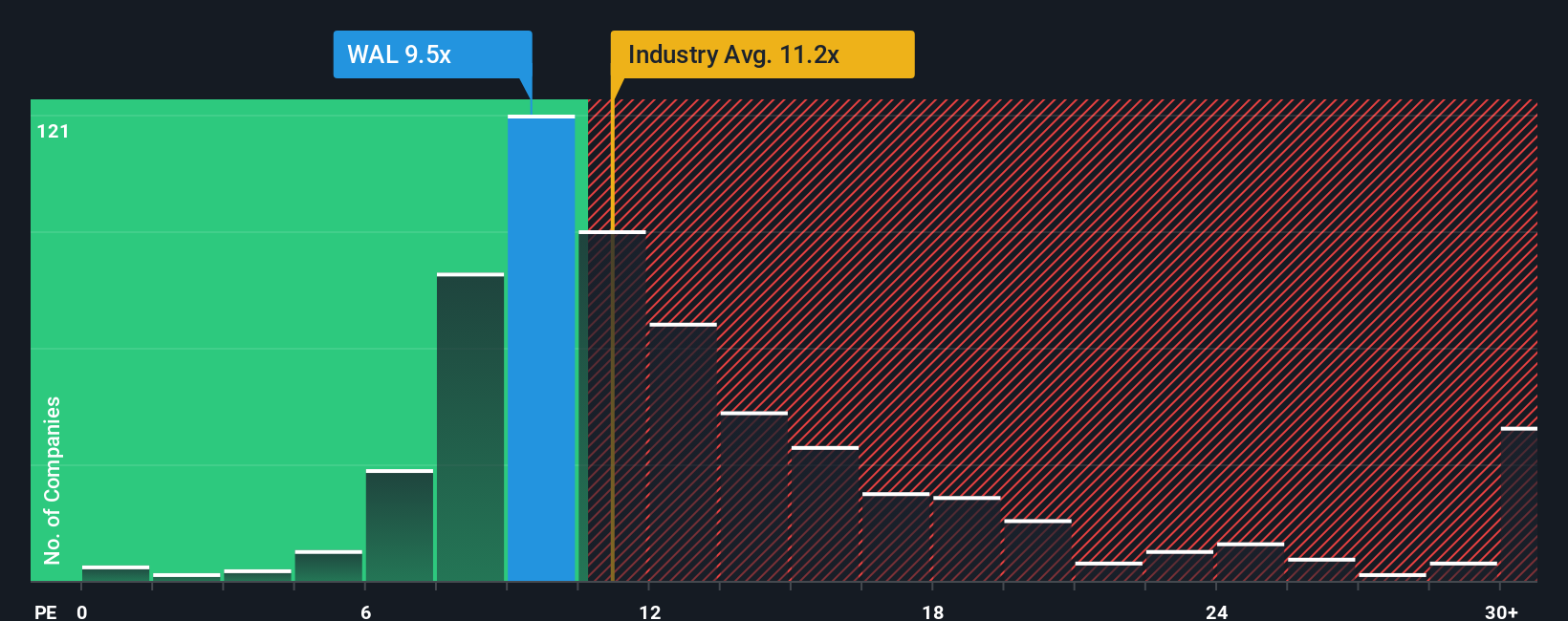

The Price-to-Earnings (PE) ratio is a widely used measure for valuing profitable companies, offering a straightforward way to gauge how much investors are paying for a dollar of current earnings. Profitable banks like Western Alliance Bancorporation often attract analysis through their PE ratio because ongoing earnings are the core of their business and a reliable reference point for valuation.

Growth prospects and perceived risk both play significant roles in what investors consider a “normal” or “fair” PE ratio for any given company. If a company is expected to grow faster or is perceived as less risky, it generally commands a higher multiple. Conversely, slower growth or higher uncertainty tends to compress the PE ratio.

Currently, Western Alliance Bancorporation is trading at a PE ratio of 11.34x. This is just below the Banks industry average of 11.80x and notably lower than the peer average of 14.31x. Simply Wall St’s proprietary “Fair Ratio” for Western Alliance is 15.98x. This reflects the company’s unique blend of earnings growth, risk profile, profit margins, market cap, and industry dynamics. Unlike a basic comparison to the average, the Fair Ratio adjusts for circumstances specific to Western Alliance rather than treating all banks as equally risky or promising. This leads to a more tailored assessment.

Compared to its Fair Ratio of 15.98x, the company’s current 11.34x multiple suggests Western Alliance Bancorporation shares remain undervalued from this perspective.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Alliance Bancorporation Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, where you connect your perspective on its future prospects, risks, and opportunities directly to your financial forecasts, including what you believe is a fair value and how you see future revenue, earnings, and profit margins playing out.

Narratives make analysis more powerful by linking the story behind the numbers to a concrete financial outlook and valuation, helping you understand not just what a company is worth, but why. They are easy to use and available to everyone on Simply Wall St’s Community page, trusted by millions of investors. Narratives empower you to decide when to buy or sell by comparing your Fair Value to the current share price. Because they update automatically as news, results, and company updates come in, your view is always current.

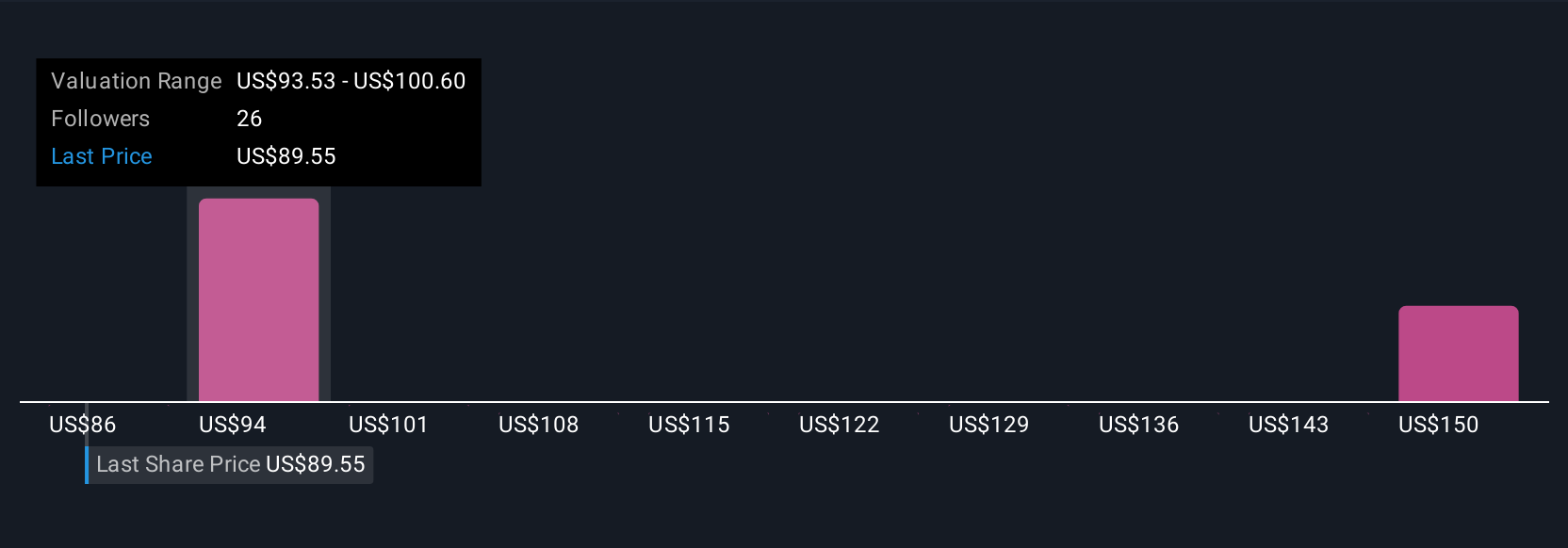

For example, with Western Alliance Bancorporation, one investor’s Narrative might focus on fast-growing Sun Belt markets and digital banking, leading them to see a fair value as high as $105.00. Another might highlight real estate risks and set their fair value lower, around $85.00. Narratives let you see and compare these different views instantly.

Do you think there's more to the story for Western Alliance Bancorporation? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Alliance Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAL

Western Alliance Bancorporation

Operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives