- United States

- /

- Banks

- /

- NYSE:WAL

Is There Now an Opportunity in Western Alliance Bancorporation After Moody’s Credit Outlook Shift?

Reviewed by Bailey Pemberton

If you own or are eyeing Western Alliance Bancorporation shares, you know the past year has been a rollercoaster. The stock is down 13.7% in the past twelve months, and the year-to-date return sits at -12.6%. At first glance, that might look like a red flag, but dig a little deeper and it starts to get interesting. Despite the recent drop and a choppy 30 days that saw a decline of 18.4%, the long-term story is a different picture, with the stock up 90.4% over five years. That's a rare combination of short-term volatility and long-haul outperformance that tends to draw in both skeptics and bargain-seekers.

Some of that recent downside lines up with concerns around bank liquidity and market-wide nerves in the regional banking sector. News about shifting interest rates and evolving regulatory chatter hasn’t helped sentiment, but sometimes the story the market tells in the moment isn’t the full one. For valuation-focused investors, this nervousness might represent an opportunity rather than a warning sign.

And here’s the attention-grabber: a value score of 6 out of 6. Western Alliance Bancorporation stands out on every valuation metric in our framework, signaling that it’s currently considered undervalued across the board. That’s not something you see every day, especially not in a sector as headline-driven as banking.

But do all those value checks really tell the full story? We’re about to take a closer look at exactly how Western Alliance stacks up by the numbers, and later, explore one powerful angle that many investors overlook when weighing a bank’s true worth.

Approach 1: Western Alliance Bancorporation Excess Returns Analysis

The Excess Returns model evaluates a company by looking at how much value it generates beyond its cost of equity, focusing on return on invested capital and the ability to compound returns over time. This approach is especially helpful for banks, where classic valuation models sometimes miss the value created from strong lending and reinvestment strategies.

For Western Alliance Bancorporation, here is how the numbers stack up:

- Book Value: $62.57 per share

- Stable EPS: $10.76 per share (Source: Weighted future Return on Equity estimates from 12 analysts.)

- Cost of Equity: $6.13 per share

- Excess Return: $4.63 per share

- Average Return on Equity: 14.42%

- Stable Book Value: $74.63 per share (Source: Weighted future Book Value estimates from 8 analysts.)

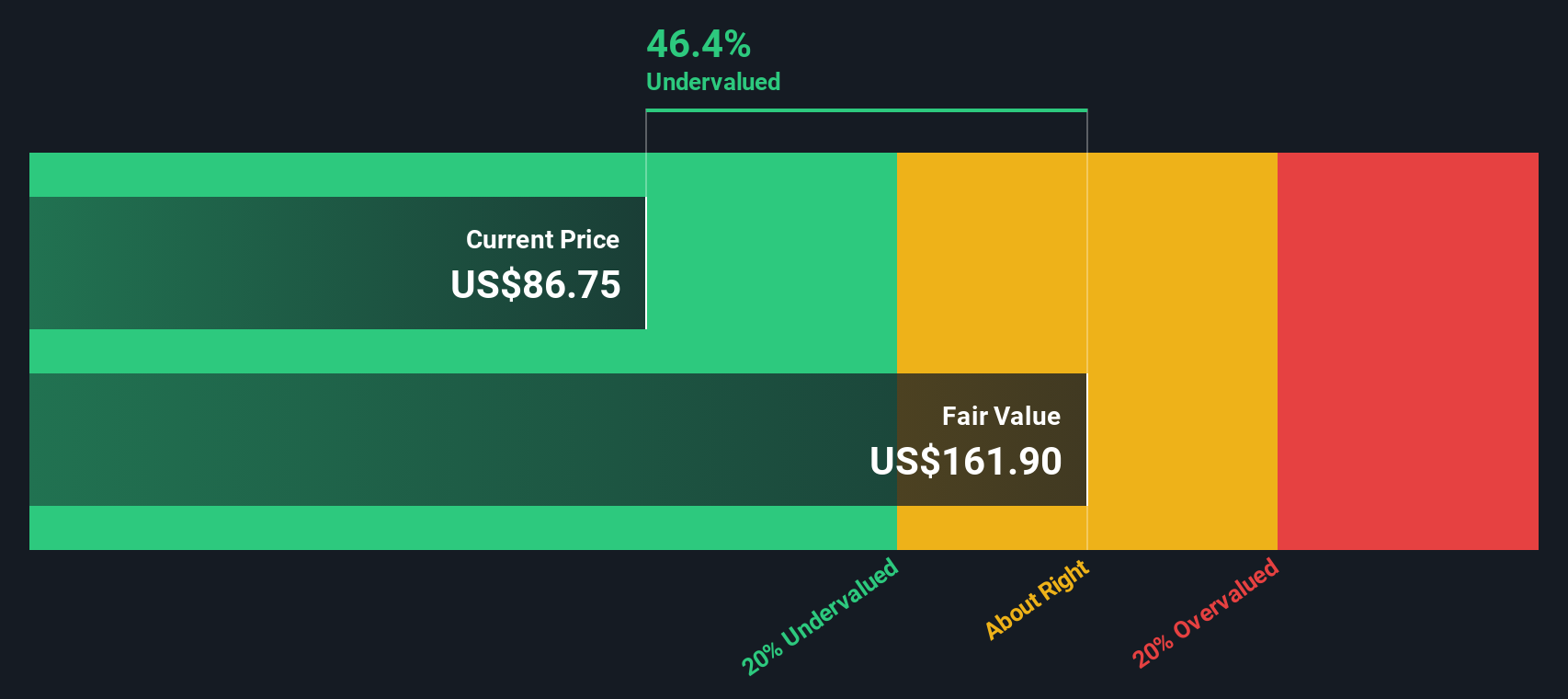

Based on these figures, the Excess Returns valuation estimates the intrinsic value of Western Alliance Bancorporation at $164.68 per share. With the stock currently trading at a steep 56.0% discount to this value, the model signals that shares are significantly undervalued relative to their long-term earning power and capital efficiency.

Result: UNDERVALUED

Our Excess Returns analysis suggests Western Alliance Bancorporation is undervalued by 56.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Western Alliance Bancorporation Price vs Earnings

The price-to-earnings (PE) ratio is a time-tested metric for evaluating profitable companies like Western Alliance Bancorporation. It shows how much investors are willing to pay for each dollar of earnings, which makes it a strong indicator of market sentiment and expectations. For companies generating solid profits, the PE provides a direct link between market price and actual bottom-line performance.

The "normal" or fair PE ratio for any business is shaped by a combination of growth prospects and risks. Higher future growth and strong fundamentals typically support a higher PE, while more risk or slower growth might warrant a lower one. It is important to remember that these numbers are always relative and need context to mean much.

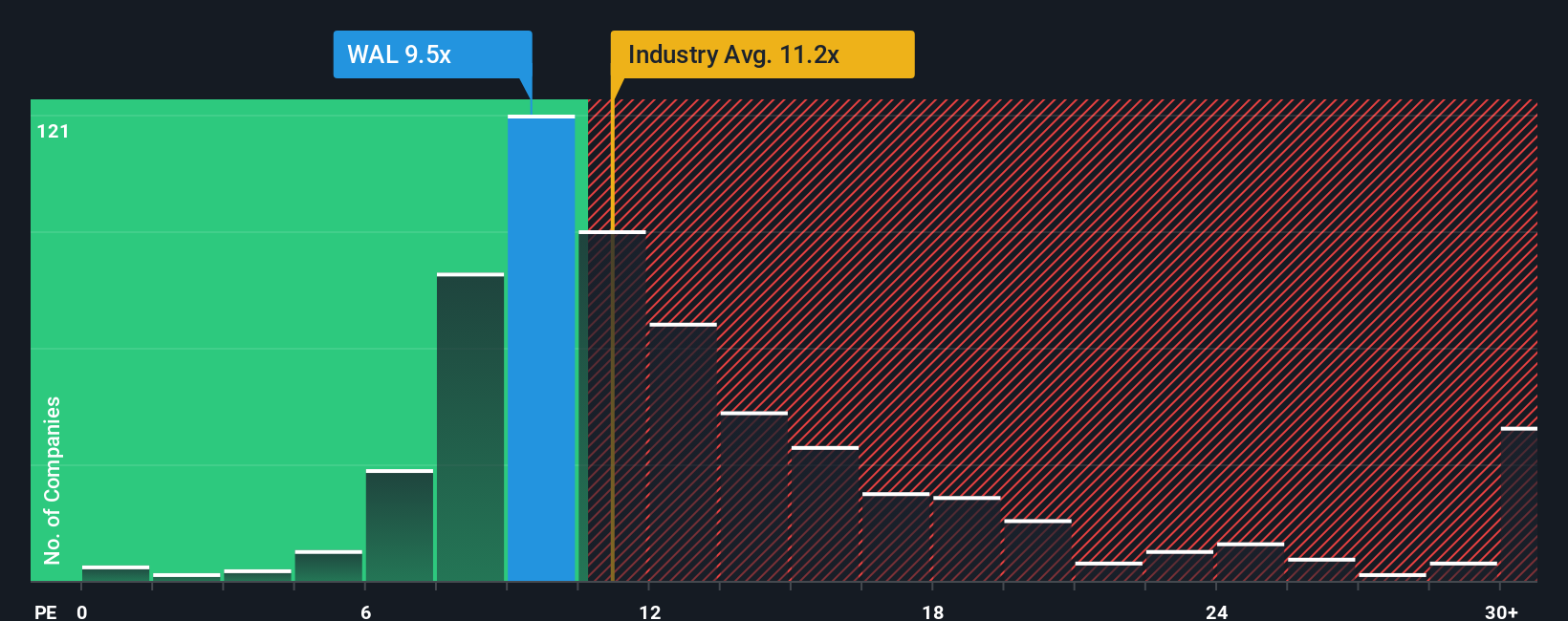

Right now, Western Alliance’s PE ratio stands at 9.5x. That is below both the industry average of 11.2x and the peer average of 13.7x, signaling a notable discount to the broader sector. However, Simply Wall St’s proprietary Fair Ratio for Western Alliance is 15.9x. This Fair Ratio goes beyond the typical industry or peer comparison as it builds in key factors like the company’s projected earnings growth, relative risks, profit margin strength, sector profile, and overall market capitalization. By capturing this fuller picture, the Fair Ratio provides a refined estimate of what a truly reasonable valuation multiple looks like for this business right now.

With Western Alliance trading at 9.5x and a Fair Ratio of 15.9x, the company’s shares appear undervalued when stacking up actual pricing against fundamental expectations.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Alliance Bancorporation Narrative

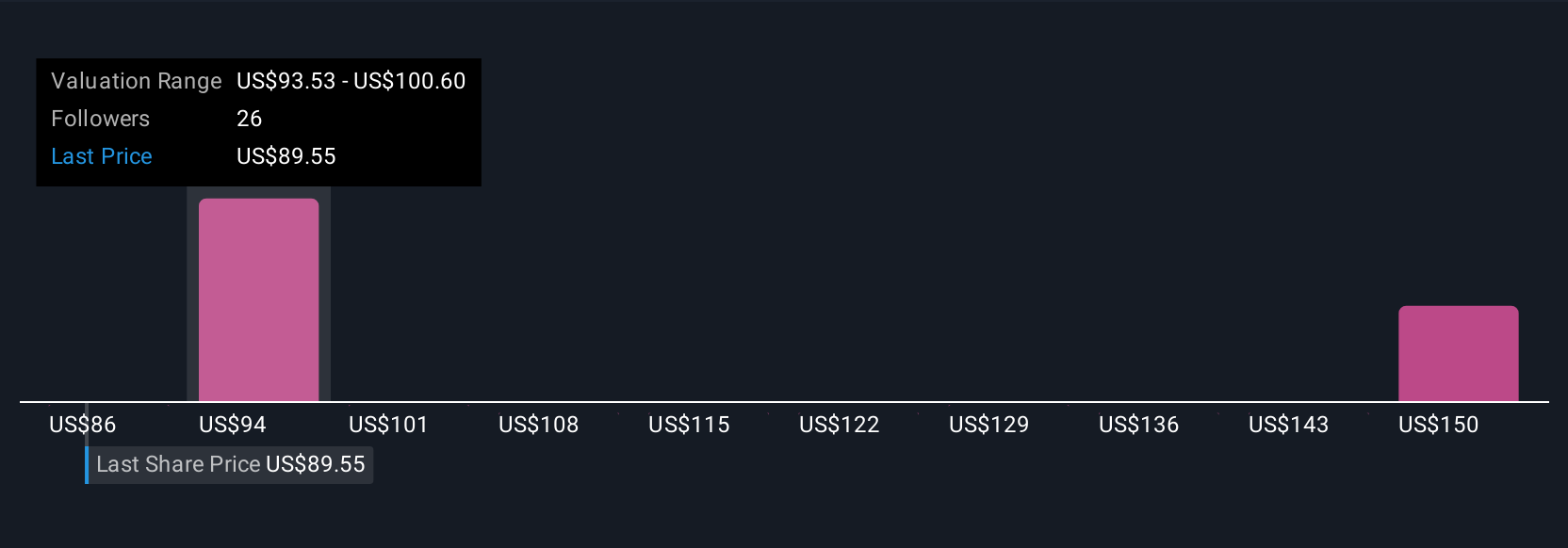

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, an approach that empowers you to see a company through your own lens. With Narratives, you can build a personalized story about Western Alliance Bancorporation, grounded in your own estimates for fair value, future revenue, earnings, and profit margins. This method connects the dots from the business story to a financial forecast and finally to a fair value, helping you clarify whether the current price aligns with your outlook.

Narratives are easy to use and widely accessible on Simply Wall St’s Community page, where millions of investors share perspectives and compare their assumptions. These Narratives do not just sit still; they update dynamically as new information, such as earnings releases or breaking news, comes in, reflecting the ever-changing reality of the market and letting you refine your view over time.

Say you believe Western Alliance’s digital and Sun Belt expansion will keep driving double-digit revenue growth. You might set a higher fair value near $105 per share. On the other hand, if you are more cautious about the risks in commercial real estate or rising compliance pressures, your Narrative could justify a lower fair value, closer to $85 per share. Comparing your fair value to the current price helps decide whether now is a moment to buy, hold, or sell, with decision making based on your own Narrative.

Do you think there's more to the story for Western Alliance Bancorporation? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Alliance Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAL

Western Alliance Bancorporation

Operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives