- United States

- /

- Banks

- /

- NYSE:WAL

A Look at Western Alliance Bancorporation’s Valuation Following Its $300 Million Share Buyback Announcement

Reviewed by Kshitija Bhandaru

Western Alliance Bancorporation Announces $300 Million Share Buyback: What Does It Mean for Investors?

Western Alliance Bancorporation (WAL) is making waves with a fresh share repurchase program, greenlighted by its Board of Directors. The company has authorized the buyback of up to $300 million worth of its own shares, a move that usually signals confidence from management in its current valuation and future prospects. With no end date on this buyback, investors now have a clear sign that leadership sees tangible value in putting cash to work in its own stock.

This news comes on the heels of steady performance for Western Alliance Bancorporation, as the stock has gained about 7% over the past year and soared nearly 20% since early summer. These gains follow a period of strong revenue and net income growth for the bank, setting a pace that stands out compared to many peers. Momentum, especially in recent months, seems to be building rather than fading. Investors are considering whether renewed optimism is justified or if risk profiles are in flux.

With shares continuing to rise and a buyback just announced, is there real upside left for investors, or has the market already baked future growth into the current price?

Most Popular Narrative: 7% Undervalued

According to the most widely followed analyst narrative, Western Alliance Bancorporation is currently trading below its estimated fair value by about 7 percent. This indicates that the company may be seen as undervalued by the market right now, relative to the projected growth and outlook built into the analyst consensus.

The ongoing digital transformation, highlighted by unified branding, increased digital channel activity, and investment in technology, positions the bank to improve operating efficiency and customer reach. This supports further expansion in both topline revenues and operating leverage.

Want to discover the formula behind this attractive valuation? The narrative hinges on a blend of bold profit margin expansion, revenue acceleration, and ambitious future financial targets. Interested in the precise drivers that fuel this upbeat outlook and shape the fair value? Unlock the full story to find out exactly which numbers make this call stand out to analysts.

Result: Fair Value of $97.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, concentration in commercial real estate and rising regulatory costs could still challenge Western Alliance’s growth outlook if conditions change unexpectedly.

Find out about the key risks to this Western Alliance Bancorporation narrative.Another View: Our DCF Model Offers a Second Opinion

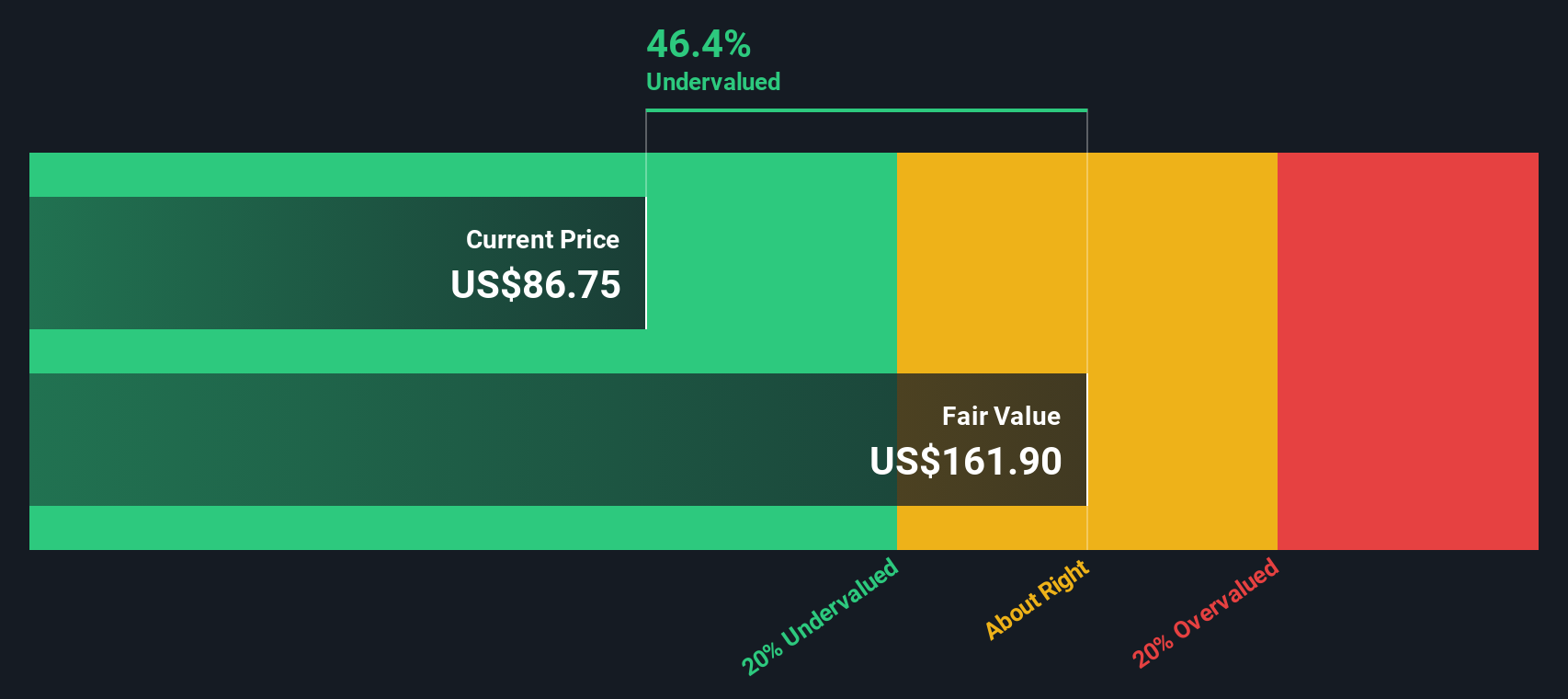

Some investors prefer our SWS DCF model, which takes Western Alliance Bancorporation's expected cash flows and discounts them to today’s terms. By this method, shares appear undervalued. Could the real value run even deeper?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Western Alliance Bancorporation Narrative

If you want to dig into the numbers yourself or think there’s another angle worth exploring, you can build your own narrative in just minutes. Do it your way

A great starting point for your Western Alliance Bancorporation research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your investment playbook and get ahead of the crowd by checking out these handpicked opportunities using the Simply Wall Street Screener. Don’t miss your chance to spot winners early, capture growth, and uncover resilient income sources before others do.

- Uncover overlooked gems by searching for undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Capitalize on tomorrow’s breakthroughs by tapping into the world of AI penny stocks shaping the next generation of smart technology.

- Secure steady cash flow by targeting dividend stocks with yields > 3% and boost your long-term returns with reliable yield.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Alliance Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAL

Western Alliance Bancorporation

Operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives