- United States

- /

- Banks

- /

- NYSE:USB

Profit Jump And Rising Institutional Interest Could Be A Game Changer For U.S. Bancorp (USB)

Reviewed by Sasha Jovanovic

- In the past quarter, U.S. Bancorp reported an 18% jump in Q3 2025 net income to US$1.89 billion, supported by 9.5% fee income growth across areas such as capital markets and trust and investment management.

- At the same time, institutional investor Mackenzie Financial Corp increased its U.S. Bancorp holdings by 13.3% to 244,191 shares, highlighting how recent financial strength is drawing renewed attention to the bank’s fee-driven business model.

- We’ll now examine how this strong profit and fee income performance fits into, and potentially reshapes, U.S. Bancorp’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

U.S. Bancorp Investment Narrative Recap

To own U.S. Bancorp, you need to believe its mix of fee-based businesses and a solid deposit franchise can offset structural pressures on loan growth and margins. The latest 18% net income rise and 9.5% fee income growth support that thesis near term, but they do not materially change the key catalyst of sustaining digital and payments growth, nor the biggest risk from rising competition in digital finance and open banking.

The recent launch of the U.S. Bank Split World Mastercard is particularly relevant here, as it reinforces the bank’s push into differentiated, digital-first payment products that support fee income. Together with the Edward Jones co-branded products, this suggests management is leaning into payments and wealth-adjacent services as an important offset if traditional lending or commercial real estate exposures become more challenging.

However, against this stronger fee story, investors should still keep a close eye on how quickly new fintech entrants could chip away at U.S. Bancorp’s payments and digital banking economics...

Read the full narrative on U.S. Bancorp (it's free!)

U.S. Bancorp's narrative projects $32.6 billion revenue and $7.4 billion earnings by 2028.

Uncover how U.S. Bancorp's forecasts yield a $55.63 fair value, a 9% upside to its current price.

Exploring Other Perspectives

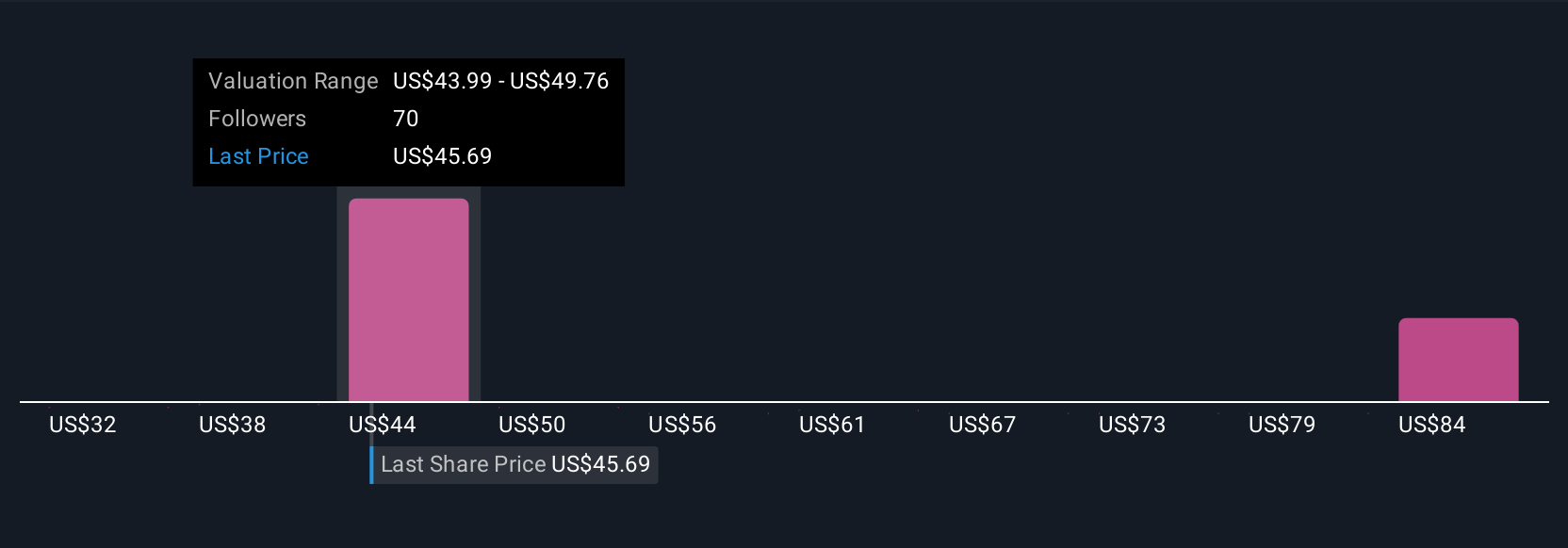

Ten fair value estimates from the Simply Wall St Community span roughly US$39 to US$85 per share, showing how far apart individual views can be. When you set those opinions against U.S. Bancorp’s growing fee income emphasis, it underlines why many investors want to compare several perspectives before deciding how resilient the current earnings mix might prove.

Explore 10 other fair value estimates on U.S. Bancorp - why the stock might be worth 23% less than the current price!

Build Your Own U.S. Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your U.S. Bancorp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free U.S. Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate U.S. Bancorp's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USB

U.S. Bancorp

A financial services holding company, provides various financial services to individuals, businesses, institutional organizations, governmental entities, and other financial institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026