- United States

- /

- Banks

- /

- NYSE:TFC

How Investors Are Reacting To Truist Financial (TFC) Surpassing Q3 Estimates and Launching AI-Driven Branch Expansion

Reviewed by Sasha Jovanovic

- Truist Financial Corporation recently reported third-quarter results that exceeded analyst expectations, driven by diversified revenue growth, expansion in wealth management and payments, and disciplined expense management, while announcing ambitious plans to open AI-driven branches and renovate over 300 locations for accelerated growth and enhanced client engagement.

- The company also introduced new executive hires to strengthen its position in commercial, corporate, energy, and technology banking, signaling an investment in future growth and industry expertise.

- We’ll explore how Truist’s commitment to digital and physical growth, highlighted by these branch expansions and leadership hires, influences its investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Truist Financial Investment Narrative Recap

To believe in Truist Financial as a shareholder, you need confidence in its ability to translate branch modernization and technology investments into real earnings growth while managing credit and cost risks. The latest leadership appointments in energy and technology banking reinforce the company's growth ambitions, but do not materially affect the key short-term catalyst of sustained net interest income expansion or the most pressing risk of elevated commercial real estate exposure, which remains unchanged for now.

Among recent developments, the announcement of a $1.25 billion fixed-to-floating rate senior notes offering is particularly relevant as Truist balances funding for branch expansion and digital upgrades with prudent capital management, an important factor for investors watching near-term operating leverage and profitability trends.

However, investors should also be aware that legal risks are mounting as Truist faces a new class action lawsuit alleging rate fixing related to consumer and small business loans...

Read the full narrative on Truist Financial (it's free!)

Truist Financial's narrative projects $22.5 billion in revenue and $6.3 billion in earnings by 2028. This requires 7.5% yearly revenue growth and a $1.4 billion earnings increase from $4.9 billion today.

Uncover how Truist Financial's forecasts yield a $49.53 fair value, a 13% upside to its current price.

Exploring Other Perspectives

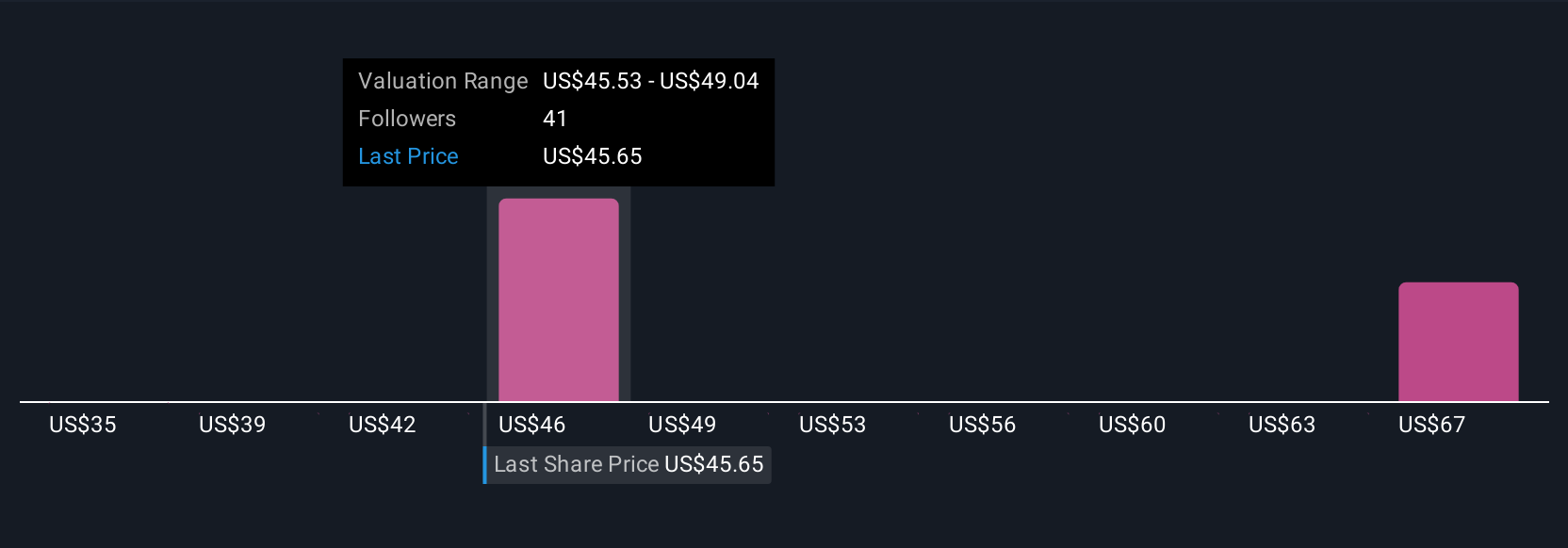

Simply Wall St Community members offered four different fair value estimates for Truist Financial, ranging from US$35 to US$60.80 per share, showing diverse expectations. Against this backdrop, Truist’s ongoing investments in digital and physical branch growth could play a significant role in shaping its future performance, so it pays to examine all viewpoints.

Explore 4 other fair value estimates on Truist Financial - why the stock might be worth 20% less than the current price!

Build Your Own Truist Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Truist Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Truist Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Truist Financial's overall financial health at a glance.

No Opportunity In Truist Financial?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFC

Truist Financial

A financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives