- United States

- /

- Banks

- /

- NYSE:STEL

Stellar Bancorp (STEL): Assessing Valuation in Light of Fresh Regional Bank Loan Worries

Reviewed by Kshitija Bhandaru

Several regional banks revealed fresh loan problems this week, sparking new concerns about credit quality and exposure across the industry. Stellar Bancorp (STEL) found itself included in the conversation as investors grew more cautious.

See our latest analysis for Stellar Bancorp.

Stellar Bancorp’s share price has pulled back around 5% in the past month, with sentiment across regional banks dented by industry-wide worries over commercial real estate exposure and credit quality. However, the stock’s 1-year total shareholder return is a solid 15.7%, reflecting longer-term optimism even as recent momentum softens.

If today’s market volatility has you weighing new ideas, now could be an ideal moment to see what else is out there and discover fast growing stocks with high insider ownership

With nervousness spreading among regional banks, is Stellar Bancorp’s latest pullback signaling an undervalued opportunity? Or are investors simply adjusting expectations as future earnings risks are already priced in?

Most Popular Narrative: 7.5% Undervalued

The crowd-favorite narrative points to Stellar Bancorp trading at a notable discount to its estimated fair value of $31.60, with the last close at $29.23. This gap has drawn interest as analysts sharply raise their expectations, fueled by new forecasts and shifting profit assumptions.

"Valuation overlooks challenges from geographic concentration, integration risks, and rising compliance and technology costs, threatening long-term earnings stability. Favorable market trends, strong expense discipline, and strategic investments position Stellar Bancorp for resilient growth, improved profitability, and continued shareholder value enhancement."

What’s behind this revised price target? The narrative leans on a bold blend of higher profit margins and surprisingly optimistic long-term market trends. Which assumptions tip the scales in this fair value? Uncover the full set of forecasted metrics and strategic moves fueling this projection. Your next investment insight may be lurking in the details.

Result: Fair Value of $31.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust growth in the Texas market or successful digital investments could defy expectations. This may fuel stronger earnings and challenge assumptions that margins will shrink.

Find out about the key risks to this Stellar Bancorp narrative.

Another View: Is the Market Pricing Too Much?

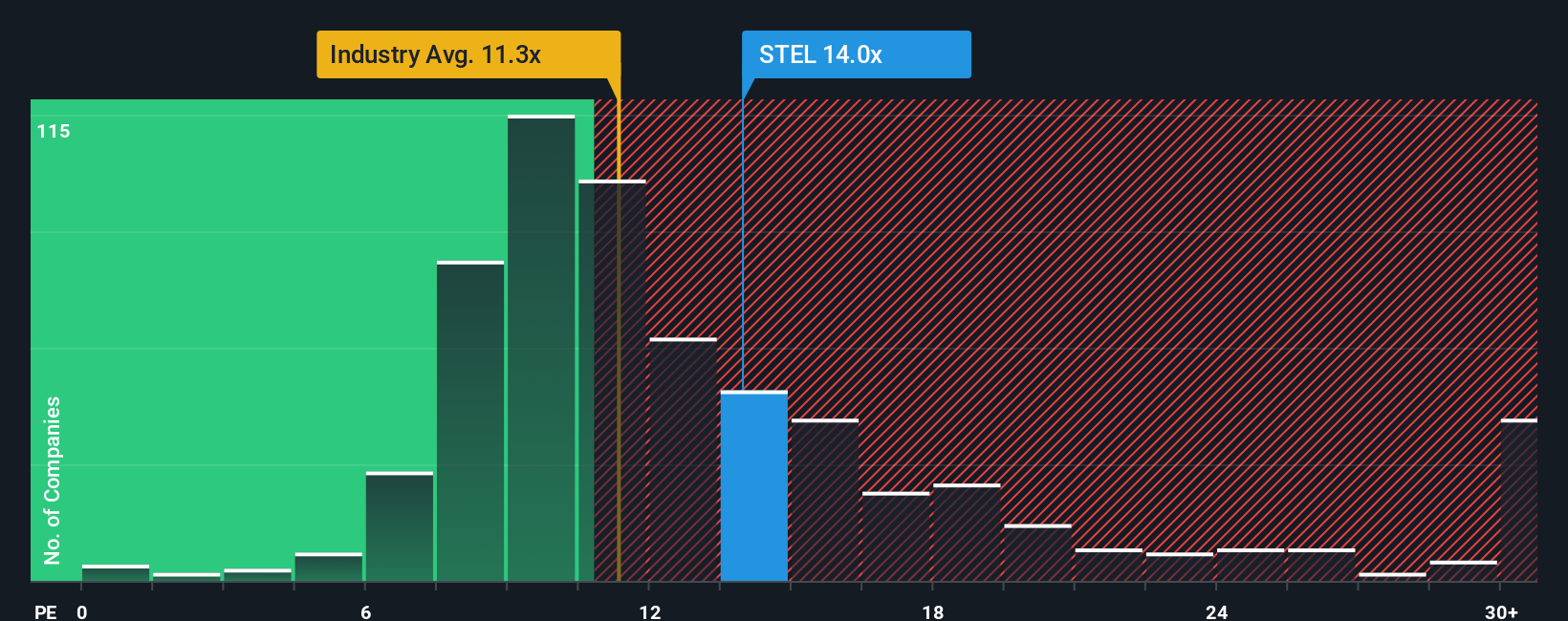

Looking through the lens of earnings multiples, Stellar Bancorp currently trades at a price-to-earnings ratio of 13.6x, which is lower than its peer average of 17.8x but higher than the industry’s 11.2x. However, it stands well above the estimated fair ratio of 9.8x. This gap highlights a balancing act between perceived value and potential risk. Are investors being too optimistic, or is there still room to surprise?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stellar Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stellar Bancorp Narrative

If you want to dive deeper or question the story, you can explore the numbers and shape your own take in just a few minutes with Do it your way.

A great starting point for your Stellar Bancorp research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors like you never stand still. Find out what you could be missing by checking these handpicked opportunities shaping the next wave of stock market wins:

- Secure lasting income streams and get ahead of the market by reviewing these 18 dividend stocks with yields > 3% offering yields greater than 3%.

- Unleash your portfolio’s potential with these 868 undervalued stocks based on cash flows targeting strong cash flow and attractive entry points before others spot the bargain.

- Ride the tech transformation and tap into exponential innovation via these 24 AI penny stocks set to disrupt entire industries with artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STEL

Stellar Bancorp

Operates as the bank holding company that provides a range of commercial banking products and services primarily to small and medium-sized businesses, professionals, and individual customers.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives