- United States

- /

- Banks

- /

- NYSE:SSB

Does SouthState Bank’s Strong Five-Year Growth Signal Further Gains in 2025?

Reviewed by Bailey Pemberton

Thinking about SouthState Bank? If you’ve been watching the ticker and wondering whether it’s time to buy, hold, or move on, you’re not alone. The stock’s been showing a bit of everything lately: a 1.2% boost over the past week, but a dip of 2.9% over the last month. Look further back and a steady upward climb appears. Year-to-date, it’s up 3.1%, rising to 7.6% for the past 12 months, and gaining 109.8% over the last five years. That sort of performance turns casual interest into serious research.

Much of this momentum traces back to broader market optimism and evolving economic trends favoring regional financial institutions like SouthState Bank. Investors, it seems, are starting to reward steady growth stories and renewed stability in the country’s banking sector. However, the mixed performance in shorter timeframes reveals how quickly sentiment can shift.

Here is where things get interesting. From a valuation perspective, SouthState Bank currently has a score of 2 out of 6, meaning it appears undervalued in just two of our standard checks. Does that mean it is a bargain, or are investors right to be cautious?

Let’s break down what those valuation checks really tell us, and why understanding how different approaches work is key for making the best decision. Stick around for a special take on valuation that might shed an even brighter light on SouthState Bank’s stock.

SouthState Bank scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SouthState Bank Excess Returns Analysis

The Excess Returns valuation approach estimates the true value of a company by comparing the returns generated on its invested equity against the required cost of that equity. In plain terms, it measures how much value SouthState Bank is creating for shareholders above the minimum return investors expect.

For SouthState Bank, this model paints a detailed picture with the following key figures:

- Book Value: $86.71 per share

- Stable EPS: $9.47 per share

(Source: Weighted future Return on Equity estimates from 9 analysts.) - Cost of Equity: $7.83 per share

- Excess Return: $1.64 per share

- Average Return on Equity: 9.92%

- Stable Book Value: $95.45 per share

(Source: Weighted future Book Value estimates from 10 analysts.)

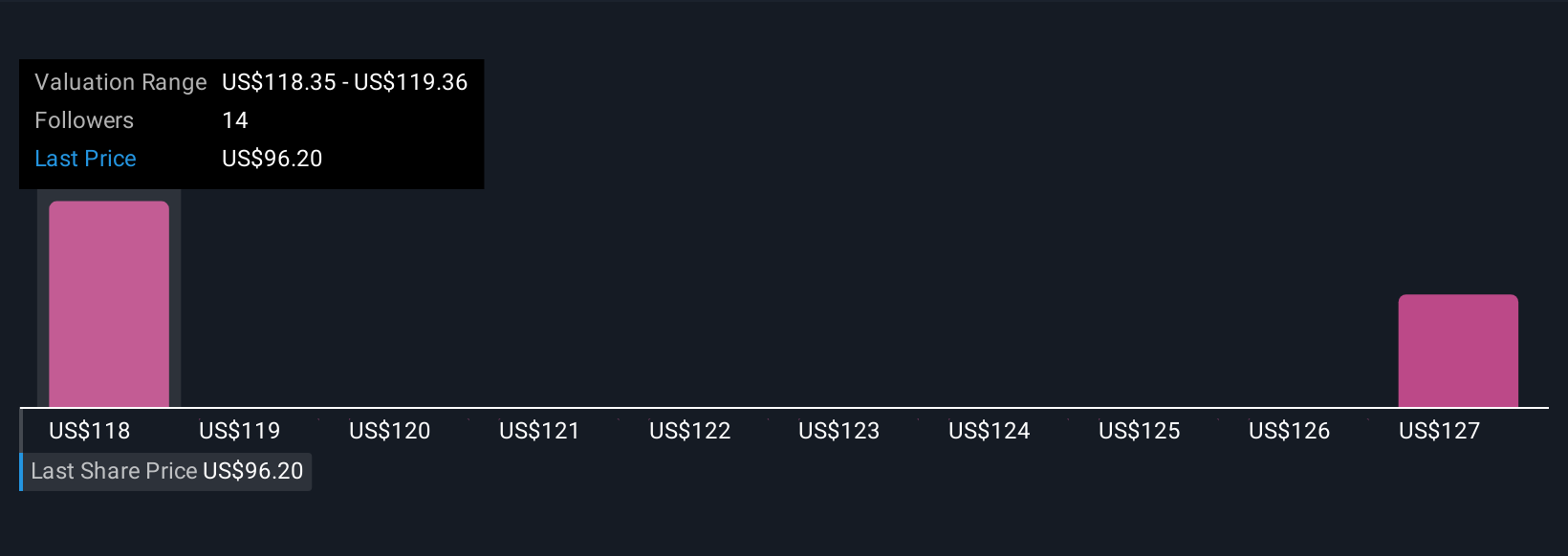

This method calculates an intrinsic value of $127.41 per share. With the Excess Returns implication pointing to the stock being 21.5% undervalued, SouthState Bank is priced well below what the underlying fundamentals suggest it is worth. This indicates the market may be overlooking its ability to deliver returns above its cost of capital, which is an important sign for value-focused investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests SouthState Bank is undervalued by 21.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

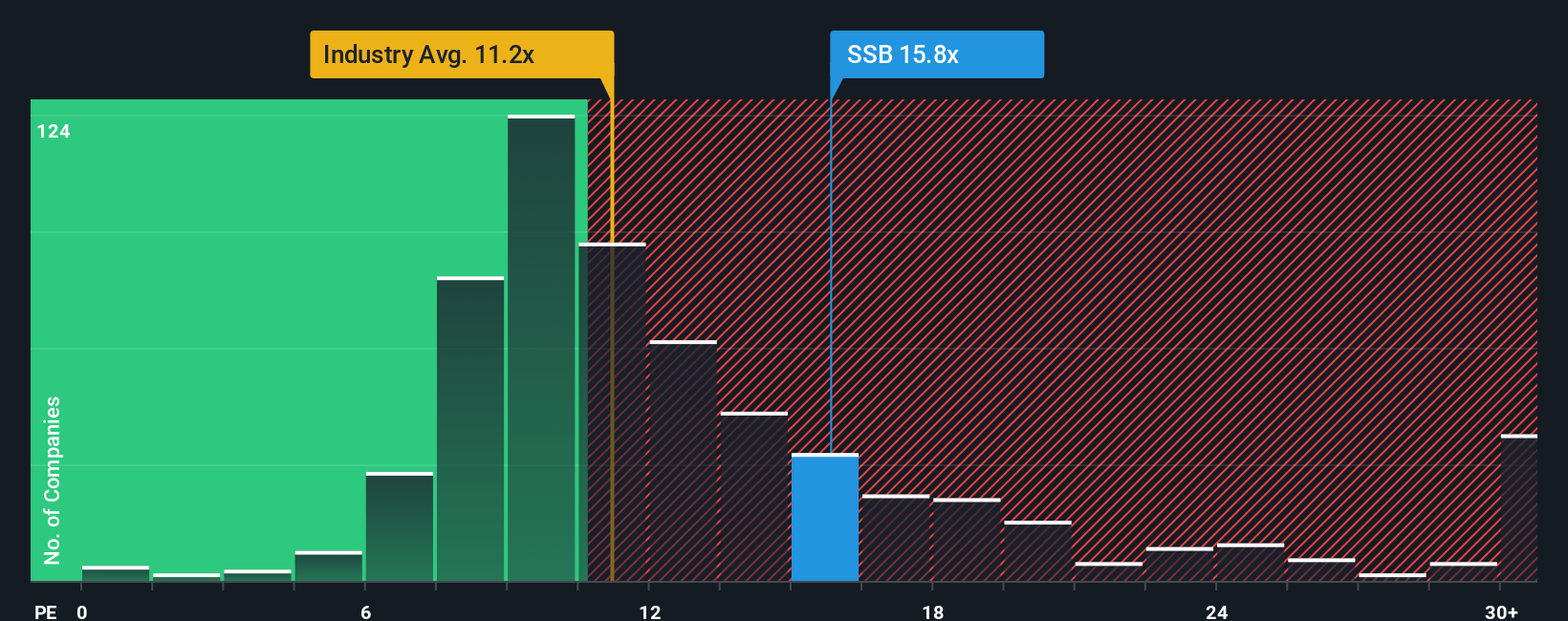

Approach 2: SouthState Bank Price vs Earnings

The price-to-earnings (PE) ratio is one of the most popular ways to value established, profitable companies like SouthState Bank. It offers investors a quick snapshot of how much the market is currently willing to pay for each dollar of the company’s earnings. A reasonable PE tends to account for both the company’s growth prospects and its perceived risks. Higher growth or lower risk usually justifies a higher PE, while lower growth or higher risk calls for a lower one.

Right now, SouthState Bank trades at a PE ratio of 17.1x. For context, this is above the Banks industry average of 11.7x and also above the group of peer banks at 13.2x. This appears elevated at first glance, but numbers do not tell the full story on their own, especially for banks with distinct business models or growth trajectories.

That is where Simply Wall St’s Fair Ratio steps in. The Fair Ratio is a more nuanced benchmark, estimating what PE multiple is justified for SouthState Bank by examining factors like its historical and expected earnings growth, profit margins, industry sector, market cap, and risk profile. For SouthState Bank, the Fair Ratio is 16.3x. Because this calculation integrates so many company-specific elements, it offers a more accurate target than generic industry averages or peer group medians.

Comparing these numbers, SouthState Bank’s current PE of 17.1x sits just slightly above its Fair Ratio of 16.3x. The small difference suggests the market is pricing the stock about right given its financial profile, leaving little room for a strong value argument but also avoiding signs of major overvaluation.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SouthState Bank Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story about a company; it is how you interpret the facts, numbers, and outlook to create a perspective about the company's potential future.

Narratives link a company’s business story directly to a financial forecast, and then to a fair value. This allows you to base your investment decisions on clear evidence and your own expectations. Using the Simply Wall St platform, millions of investors can easily create, share, or explore these Narratives on the Community page, making it an accessible and dynamic tool for everyone.

Narratives help you decide whether to buy or sell by comparing your Fair Value estimate to the current Price. The story updates automatically as new information, news, or earnings reports become available, so your perspective is always up to date.

For example, one SouthState Bank investor might build a Narrative expecting rapid revenue growth and margin expansion from successful acquisitions, producing a Fair Value of $117 per share. Another may emphasize risks around geographic concentration or commercial real estate, resulting in a much more cautious valuation of $101 per share.

Do you think there's more to the story for SouthState Bank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SSB

SouthState Bank

Operates as the bank holding company for SouthState Bank, National Association that provides a range of banking services and products to individuals and companies in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives