- United States

- /

- Banks

- /

- NYSE:RNST

Is Renasant Fairly Priced After Recent Share Price Recovery in 2025?

Reviewed by Bailey Pemberton

- Wondering if Renasant at around $36 is quietly undervalued or just fairly priced? This article is going to break down what the numbers are really saying about the stock.

- Over the last month the share price has climbed 6.8%, adding to a 1.6% rise in the past week, even though the 1 year return is still slightly negative at -0.3% and only modestly up 21.3% over 5 years.

- That recent move has come as investors refocus on regional banks with solid balance sheets and steady deposit bases, while still being cautious after the broader sector volatility of the last couple of years. For Renasant, the market seems to be slowly pricing in lower perceived risk and a more stable operating backdrop rather than chasing a hype driven growth story.

- On our framework, Renasant scores a 2/6 valuation check, which means it appears undervalued on only a couple of metrics. That is exactly what we will unpack next by comparing different valuation approaches and, later on, exploring a more powerful way to think about what “fair value” really means for this stock.

Renasant scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Renasant Excess Returns Analysis

The Excess Returns model looks at how much profit a bank can generate above the return that shareholders demand on their capital, then capitalizes those extra profits into a fair value per share. It is especially useful for financial institutions like Renasant where book value and return on equity drive long term value more than headline growth stories.

For Renasant, the analysis starts with a Book Value of $40.26 per share and a Stable EPS of $3.24 per share, based on weighted future Return on Equity estimates from 5 analysts. With an Average Return on Equity of 7.46% and a Cost of Equity of $3.02 per share, the model calculates an Excess Return of $0.22 per share on a Stable Book Value that is expected to edge up to $43.49 per share, using projections from 7 analysts.

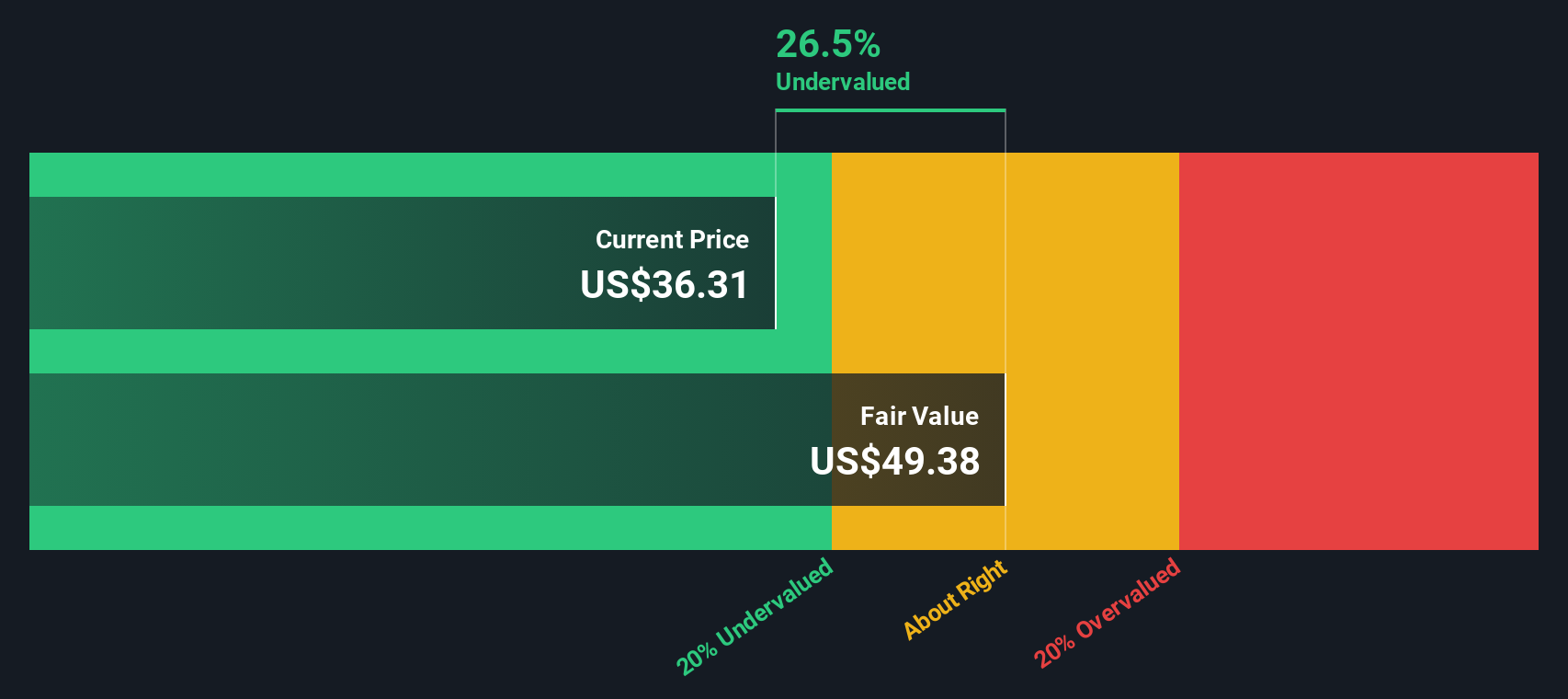

When these excess returns are projected and discounted, the model arrives at an intrinsic value of about $49.38 per share, implying the stock is roughly 26.8% undervalued versus the current price near $36.

Result: UNDERVALUED

Our Excess Returns analysis suggests Renasant is undervalued by 26.8%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Renasant Price vs Earnings

For a consistently profitable bank like Renasant, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. In general, companies with stronger growth prospects and lower perceived risk tend to justify higher PE multiples, while slower growth or higher risk usually calls for a discount.

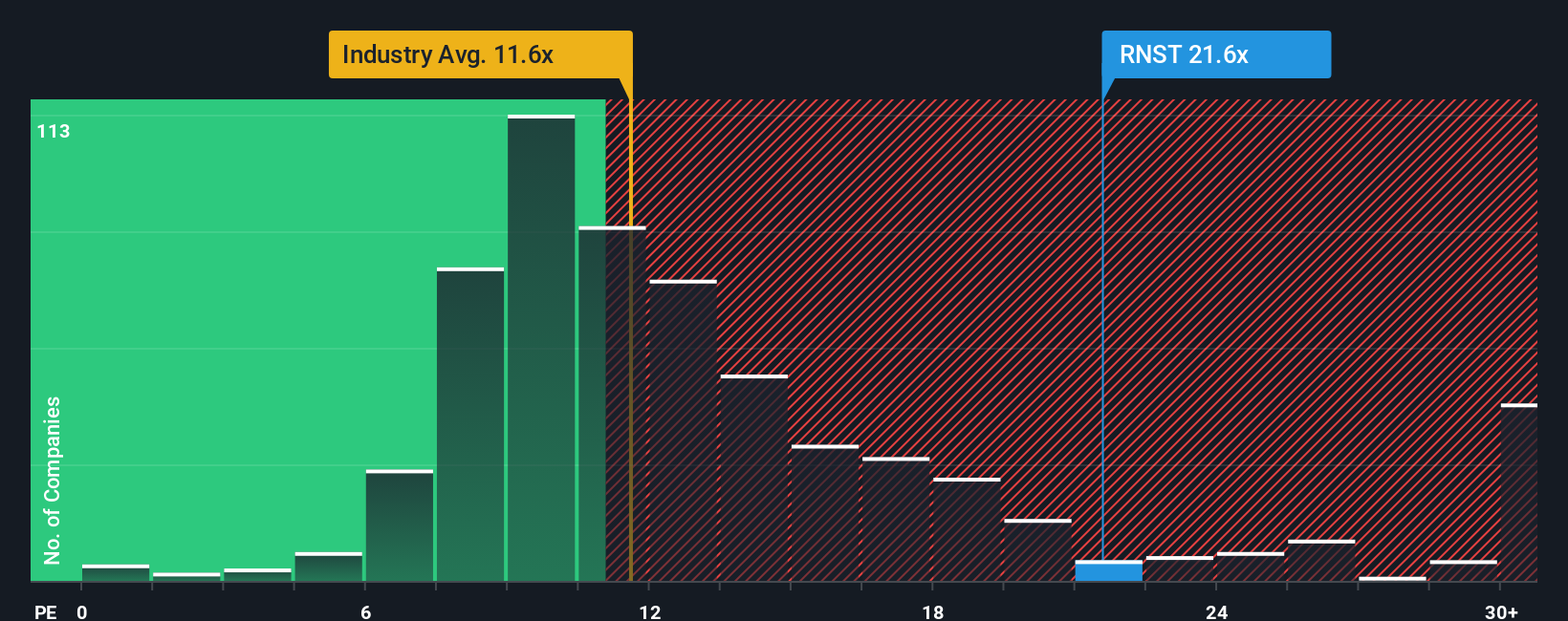

Renasant currently trades on a PE of about 23.36x, which is well above the broader Banks industry average of around 11.65x and also higher than the peer group average of roughly 16.44x. On the surface, that makes the stock look relatively expensive compared to many regional banking peers.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what a reasonable PE should be for Renasant given its specific earnings growth profile, profitability, size, industry positioning, and risk factors. For Renasant, that Fair Ratio is 20.04x, suggesting investors are paying a premium to what the fundamentals justify. Because the actual PE of 23.36x sits notably above this Fair Ratio, the PE based view points to the shares being somewhat richly priced at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Renasant Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Renasant’s story with a concrete financial forecast and a fair value estimate. A Narrative is your own explanation for where the bank is heading, built from your assumptions about future revenue, earnings, and margins, which the Simply Wall St platform then turns into a forward looking model and fair value that you can directly compare to today’s share price. Narratives live inside the Community page, where millions of investors share and refine these story driven forecasts, and they update dynamically as new news, earnings, or guidance are released so your fair value never goes stale. For Renasant, one investor might build a bullish Narrative around rapid Southeastern expansion, successful merger synergies and rising digital efficiency to justify a fair value well above $40, while a more cautious investor could focus on regional concentration, real estate credit risk, and integration challenges to support a fair value closer to the current price.

Do you think there's more to the story for Renasant? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNST

Renasant

Operates as a bank holding company for Renasant Bank that provides a range of financial, wealth management, fiduciary, and insurance services to retail and commercial customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026