- United States

- /

- Banks

- /

- NYSE:PNC

PNC Financial Services (PNC): Exploring Valuation After Recent 9% Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for PNC Financial Services Group.

PNC Financial Services Group’s shares have faced some pressure in the past month, sliding nearly 9%. This continues a modest downward trend seen since the start of the year. While recent price moves have been challenging, the company’s longer-term track record remains compelling, with a 1-year total shareholder return of 1.1% and a robust 5-year total shareholder return of 98.5%. These figures highlight sustained value creation for patient investors even as short-term momentum fades.

If you’re curious how other sectors compare during market shifts like this, it’s a great moment to broaden your investing scope and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to both analyst targets and intrinsic value, investors are left to consider whether this pullback reveals an underappreciated opportunity or if the current price already reflects future growth expectations.

Most Popular Narrative: 16% Undervalued

With the fair value estimated at $220 versus the recent close at $183.95, the prevailing narrative points to meaningful upside, as analyst consensus builds on optimistic drivers beyond short-term sentiment.

PNC has implemented forward starting swaps to reduce interest rate sensitivity and lock in fixed-rate asset repricing, stabilizing future margins and supporting consistent earnings growth. The appointment of a new President with a strong background in financial services and technology positions PNC to enhance its strategic execution, potentially leading to improved operational efficiencies and higher net margins.

Want to know what’s fueling this bullish outlook? The real intrigue lies in the future profit profile, built on higher earnings forecasts and a bold margin play. Uncover the hidden assumptions and the tension between rising valuations and cautious analyst expectations. The details behind this jump in fair value might surprise you.

Result: Fair Value of $220 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing economic uncertainties and volatility in capital markets could challenge PNC's earnings growth assumptions and put pressure on noninterest income.

Find out about the key risks to this PNC Financial Services Group narrative.

Another Perspective: Market Ratios Tell a Different Story

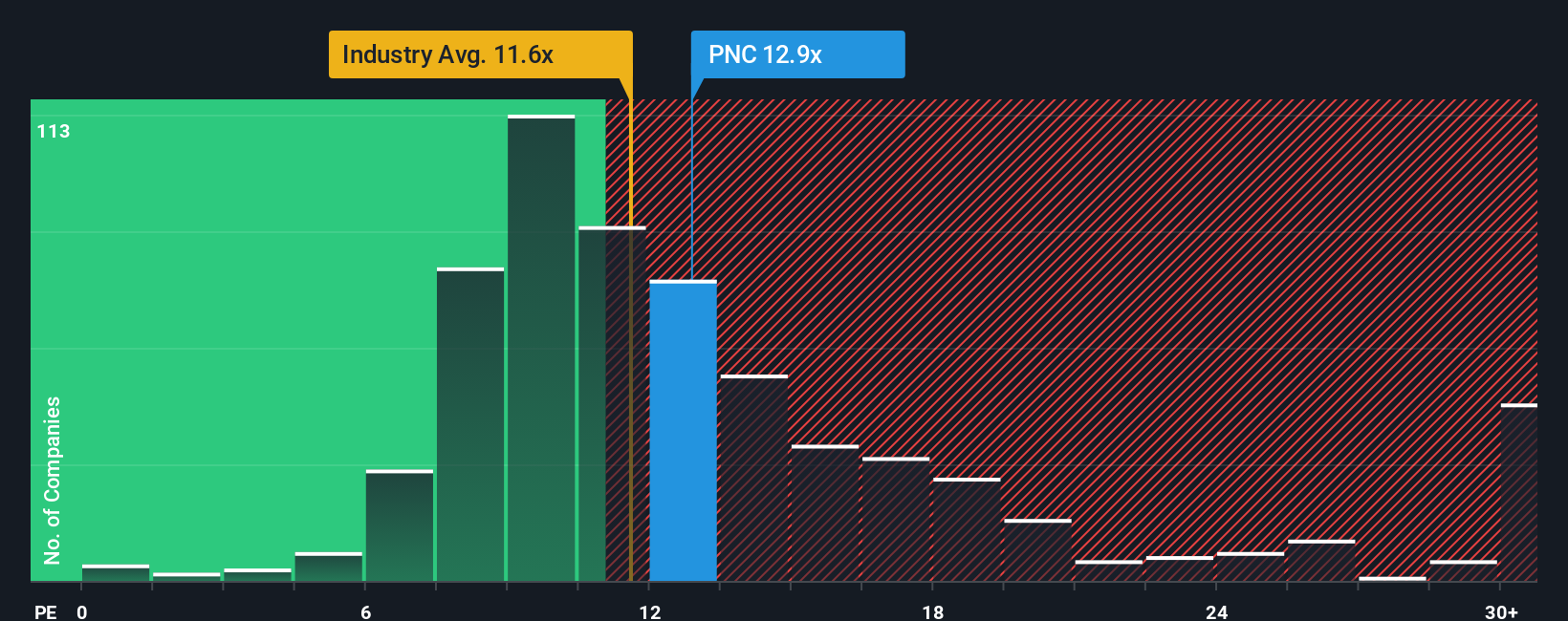

While the fair value estimate suggests PNC is undervalued, a look at the company's price-to-earnings ratio adds nuance. Currently at 12.4x, it is higher than the US Banks industry average of 11.3x but well below its peer average of 17x and the fair ratio of 14.1x. This split perspective hints at both opportunity and risk. Will the market narrow this gap or push valuations lower?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PNC Financial Services Group Narrative

If you have your own perspective or want to dive deeper into the numbers, you can shape your own narrative in just a few minutes. Go ahead and Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding PNC Financial Services Group.

Ready for More Smart Investment Moves?

Don’t limit your strategy to just one stock. Add fresh ideas to your watchlist and get ahead of the crowd with handpicked opportunities others might overlook.

- Tap into the potential of the digital asset revolution by checking out these 79 cryptocurrency and blockchain stocks that are reshaping global finance and technology.

- Capture stable income streams when you review these 19 dividend stocks with yields > 3% with reliable yields above 3% to help strengthen your portfolio’s cash flow.

- Stay ahead with cutting-edge breakthroughs in medicine by exploring these 33 healthcare AI stocks at the intersection of AI and healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNC

PNC Financial Services Group

Operates as a diversified financial services company in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives