Stock Analysis

- United States

- /

- Banks

- /

- NYSE:PFS

Exploring Undervalued Small Caps With Insider Actions In The United States July 2024

Reviewed by Simply Wall St

As the broader U.S. market faces a downturn, with significant indices like the S&P 500 and Russell 2000 experiencing sharp declines, small-cap stocks are also feeling the pressure. Amidst this challenging environment, identifying undervalued small-cap stocks that show potential for resilience or growth becomes particularly compelling.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 9.0x | 2.1x | 45.23% | ★★★★★☆ |

| Ramaco Resources | 13.9x | 1.1x | 12.91% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 28.06% | ★★★★★☆ |

| AtriCure | NA | 2.9x | 45.43% | ★★★★★☆ |

| Columbus McKinnon | 22.7x | 1.0x | 45.84% | ★★★★☆☆ |

| Franklin Financial Services | 9.3x | 1.9x | 34.57% | ★★★★☆☆ |

| Citizens & Northern | 13.2x | 3.0x | 37.27% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.2x | -223.48% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -120.10% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hertz Global Holdings (NasdaqGS:HTZ)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hertz Global Holdings operates as a vehicle rental company primarily through its two segments, Americas RAC and International RAC, with a market capitalization of approximately $5.27 billion.

Operations: Americas RAC and International RAC generated revenues of $7.73 billion and $1.67 billion respectively, highlighting a significant geographical distribution in earnings. The company's gross profit margin has shown variability over the periods, with recent figures at 25.10% as of the latest reporting date, indicating the proportion of revenue exceeding direct costs associated with goods sold.

PE: 5.4x

Amidst a challenging landscape, Hertz Global Holdings has shown signs of strategic rejuvenation with recent executive appointments aimed at enhancing operational efficiency and profitability. Despite dropping from several Russell indexes recently, the company was added to the Russell 2000 Index on July 1, 2024. This inclusion highlights its potential as an undervalued entity in the market. Insider confidence is evident as they recently purchased shares, signaling belief in the company's direction and management overhaul. Moreover, Hertz's financial maneuvers include exploring significant debt sales to improve liquidity following setbacks with their electric vehicle investments. These strategic shifts suggest a focused path forward for this seasoned player in the transportation sector.

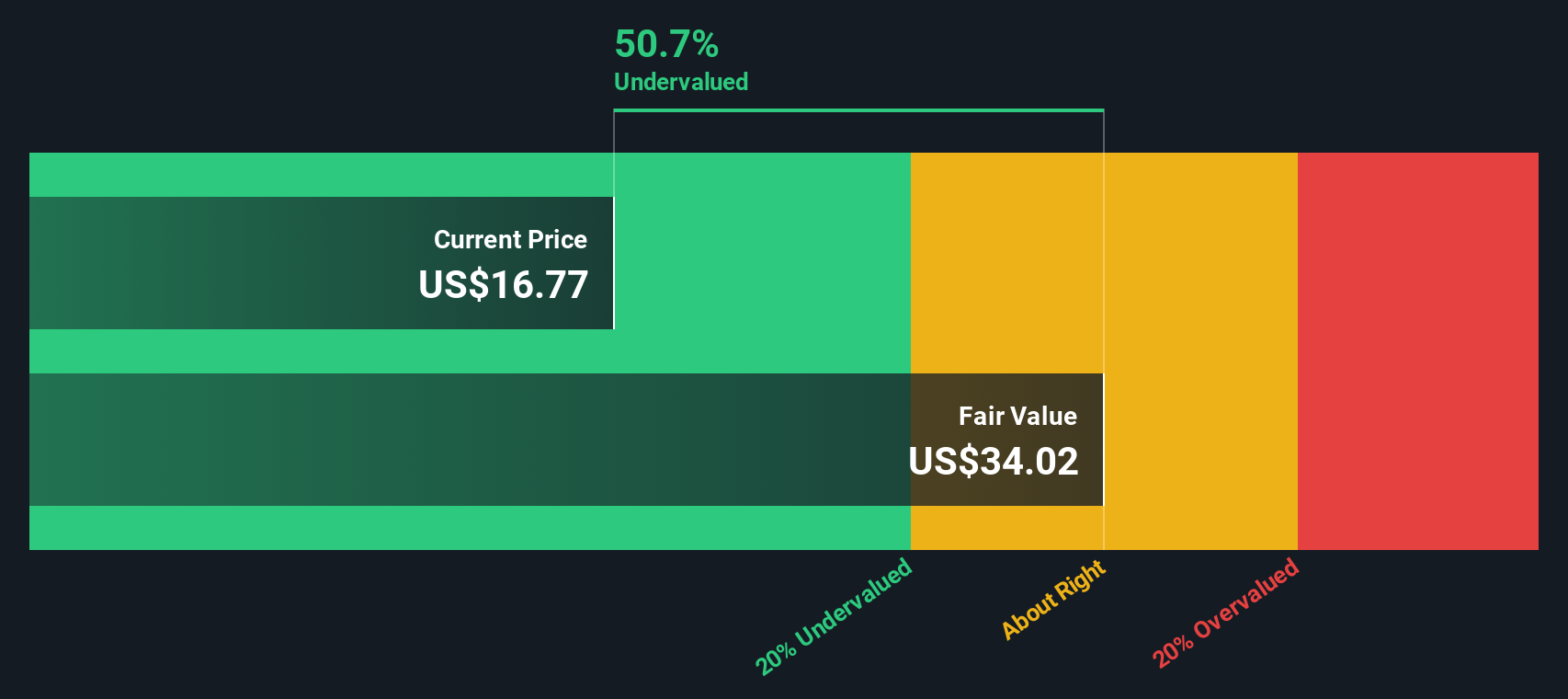

Byline Bancorp (NYSE:BY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Byline Bancorp is a bank holding company primarily involved in offering banking products and services, with a market capitalization of approximately $1.2 billion.

Operations: Banking operations generate a consistent gross profit margin of 100%, with revenue increasing to $366.62 million. Net income has grown, reflecting a net income margin improvement to approximately 31.20%.

PE: 10.8x

Byline Bancorp has shown a notable increase in net interest income and net income, as evidenced by its first quarter results with revenues jumping to US$85.54 million from US$75.72 million year-over-year, and net income rising to US$30.44 million from US$23.95 million. Despite an average forecasted earnings decline of 1.6% over the next three years, insider confidence remains robust with recent share purchases signaling positive internal expectations for future growth and stability within the financial sector context.

- Take a closer look at Byline Bancorp's potential here in our valuation report.

Gain insights into Byline Bancorp's historical performance by reviewing our past performance report.

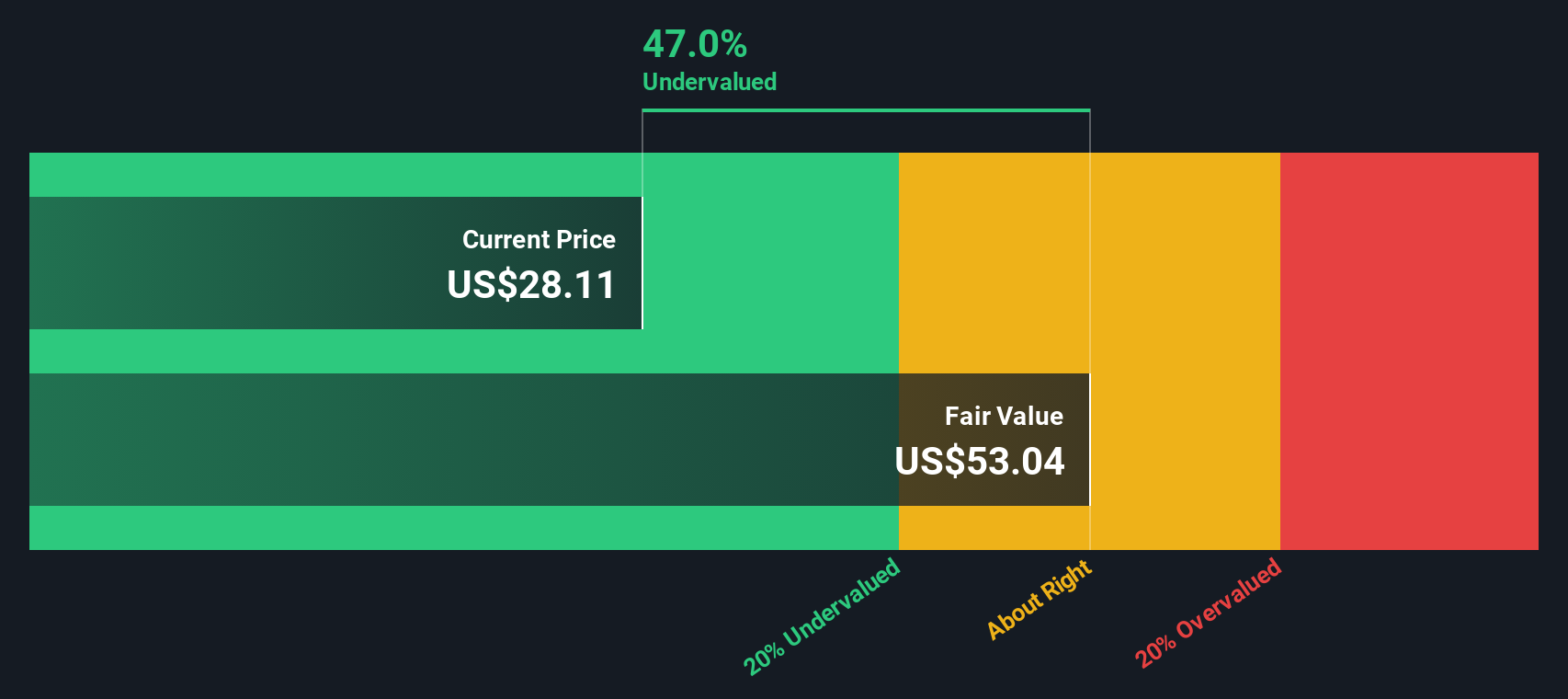

Provident Financial Services (NYSE:PFS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Provident Financial Services is a financial institution that offers traditional banking and other financial services, with a market capitalization of approximately $1.22 billion.

Operations: The company consistently generates a gross profit margin of 100%, indicating all revenue effectively contributes to gross profit, as COGS are not applicable. Over recent periods, net income margins have shown variability but remained robust, peaking at 35.57% in Q1 2019 and adjusting to lower levels around 27.19% by Q3 2024.

PE: 11.1x

Provident Financial Services, with earnings forecasted to grow 54.74% annually, recently bolstered its strategic positioning by filing a $40.78 million Shelf Registration for common stock and reshuffling its board—indicative of a dynamic governance approach aimed at enhancing oversight and strategic execution. Insider confidence is evident as they recently purchased shares, signaling belief in the firm’s growth trajectory amidst these developments. This aligns with their $225 million fixed-income offering completion, underscoring financial fortitude and market trust.

Summing It All Up

- Access the full spectrum of 70 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Provident Financial Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFS

Provident Financial Services

Operates as the bank holding company for Provident Bank that provides various banking products and services to individuals, families, and businesses in the United States.

Flawless balance sheet, undervalued and pays a dividend.