Stock Analysis

- United States

- /

- Banks

- /

- NasdaqCM:SBFG

SB Financial Group Leads Three Key US Dividend Stocks

Reviewed by Simply Wall St

Recent fluctuations in major U.S. stock indexes, marked by a downturn in technology stocks and broader market declines, underscore the volatile nature of today’s investment landscape. In such an environment, dividend stocks like SB Financial Group may offer investors a measure of stability through regular income generation, making them particularly appealing amidst current market uncertainties.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.14% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.27% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.10% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.24% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.48% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.97% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.55% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.39% | ★★★★★☆ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.68% | ★★★★★☆ |

| Franklin Financial Services (NasdaqCM:FRAF) | 4.42% | ★★★★★☆ |

Click here to see the full list of 185 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

SB Financial Group (NasdaqCM:SBFG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SB Financial Group, Inc., with a market cap of approximately $107.20 million, operates as the financial holding company for the State Bank and Trust Company, offering commercial banking and wealth management services mainly in Ohio, Indiana, and Michigan.

Operations: SB Financial Group, Inc. specializes in commercial banking and wealth management services, catering to both individuals and corporate clients across Ohio, Indiana, and Michigan.

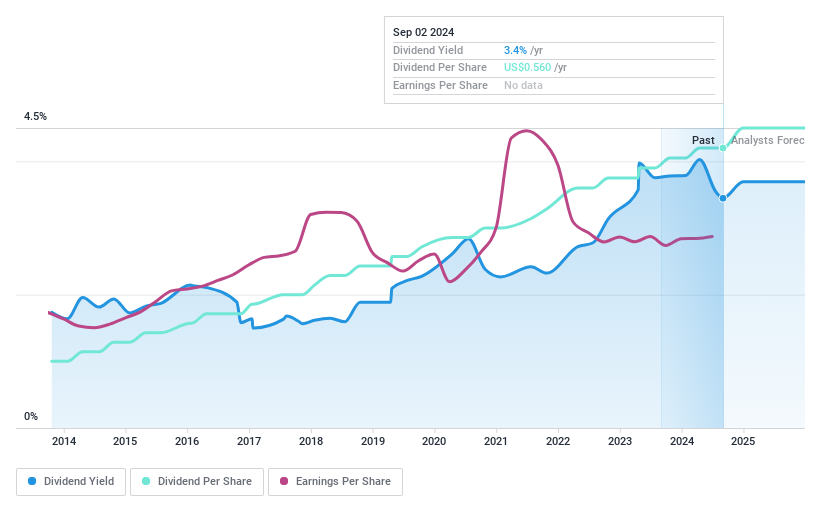

Dividend Yield: 3.6%

SB Financial Group offers a stable and reliable dividend, with a 3.62% yield, which is lower than the top US dividend payers. Dividends have shown growth over the past decade and are well-covered by earnings due to a low payout ratio of 30%. However, earnings are expected to decline annually by 11.2% over the next three years. Recent financial performance shows slight fluctuations in net income and interest income, alongside minor changes in EPS.

- Click here to discover the nuances of SB Financial Group with our detailed analytical dividend report.

- Our expertly prepared valuation report SB Financial Group implies its share price may be lower than expected.

Union Bankshares (NasdaqGM:UNB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Union Bankshares, Inc., serving as the bank holding company for Union Bank, offers retail, commercial, and municipal banking products and services in northern Vermont and New Hampshire with a market capitalization of approximately $115.79 million.

Operations: Union Bankshares, Inc. generates its revenue primarily through its Community Bank segment, which reported earnings of $47.75 million.

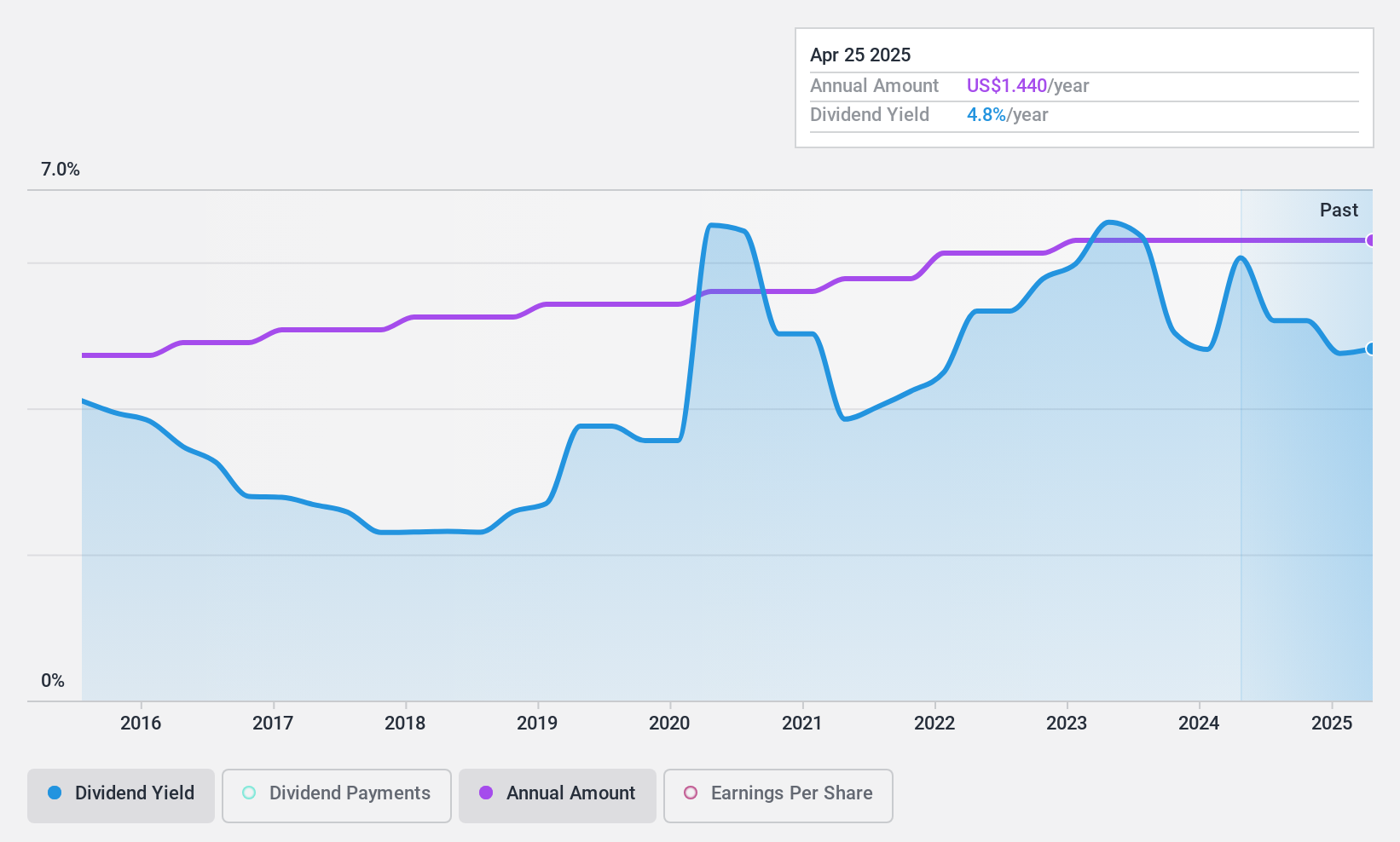

Dividend Yield: 5.6%

Union Bankshares recently affirmed a quarterly dividend of US$0.36 per share, maintaining its decade-long record of stable payouts. Despite a slight dip in net interest income and net income as reported in the first quarter of 2024, the company's dividends remain well-covered with a payout ratio of 60.7%. The stock is currently undervalued, trading at 47.8% below estimated fair value, and offers an attractive yield of 5.62%, placing it in the top quartile of US dividend payers.

- Click to explore a detailed breakdown of our findings in Union Bankshares' dividend report.

- The analysis detailed in our Union Bankshares valuation report hints at an deflated share price compared to its estimated value.

Independent Bank (NasdaqGS:IBCP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Independent Bank Corporation, serving as the holding company for Independent Bank, offers commercial banking services to individuals and businesses in rural and suburban Michigan communities, with a market capitalization of approximately $666.37 million.

Operations: Independent Bank Corporation generates its revenue primarily through its subsidiary, Independent Bank, which contributed $205.98 million.

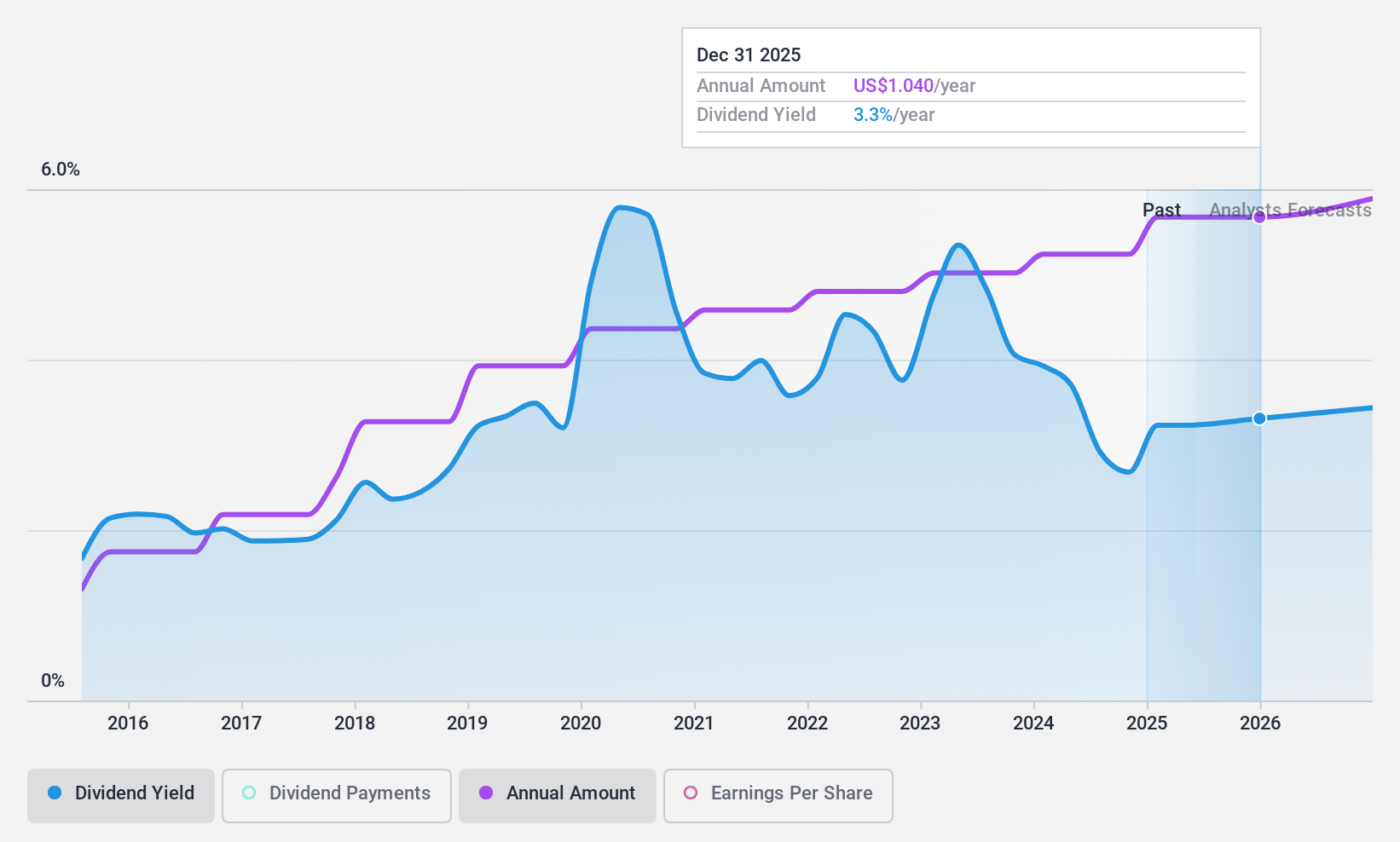

Dividend Yield: 3.1%

Independent Bank Corporation, despite forecasting a slight earnings decline of 0.3% annually over the next three years, has maintained a stable dividend for the past decade. Its current dividend yield stands at 3.05%, which is lower than the top quartile of US dividend stocks at 4.41%. However, with a payout ratio of 31.3%, its dividends are well-covered by earnings. The stock is also trading at an attractive valuation, being 56.2% below its estimated fair value as per recent assessments.

- Navigate through the intricacies of Independent Bank with our comprehensive dividend report here.

- According our valuation report, there's an indication that Independent Bank's share price might be on the cheaper side.

Where To Now?

- Reveal the 185 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether SB Financial Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SBFG

SB Financial Group

Operates as the financial holding company for the State Bank and Trust Company that provides a range of commercial banking and wealth management services to individual and corporate customers primarily in Ohio, Indiana, and Michigan.

Flawless balance sheet, good value and pays a dividend.