- United States

- /

- Banks

- /

- NYSE:PFS

Can New Retail Leadership at Provident (PFS) Shift the Balance on Profitability and Competitive Strength?

Reviewed by Sasha Jovanovic

- Provident Bank recently appointed Renee Altomonte as Executive Vice President, Retail Banking Director, placing her in charge of branch operations and retail strategy across the network.

- This leadership change coincides with investor concerns about weak unit economics and challenges in improving profitability and tangible book value at Provident Financial Services.

- We’ll explore how the new leadership’s focus on retail growth could impact Provident’s future earnings and competitive positioning.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Provident Financial Services Investment Narrative Recap

For someone considering shares of Provident Financial Services, the key conviction centers on improved branch efficiency and retail banking innovation driving stronger profitability. The new appointment of Renee Altomonte as Executive Vice President in charge of retail operations signals a push to address challenges in unit economics and weak tangible book value, but whether this leadership change meaningfully shifts near-term results or mitigates the biggest risk, deposit outflows from increased competition, remains unclear for now.

Among recent developments, the company’s entry into multiple Russell indices stands out as a potential catalyst for share demand and liquidity, but it does not directly impact immediate concerns regarding retail growth, deposit stability, or profitability improvement following the leadership change.

By contrast, investors should be alert to continued pressure from rising funding costs...

Read the full narrative on Provident Financial Services (it's free!)

Provident Financial Services' outlook anticipates $1.1 billion in revenue and $411.2 million in earnings by 2028. This is based on an annual revenue growth rate of 8.9% and an increase in earnings of $180.3 million from the current $230.9 million.

Uncover how Provident Financial Services' forecasts yield a $22.08 fair value, a 13% upside to its current price.

Exploring Other Perspectives

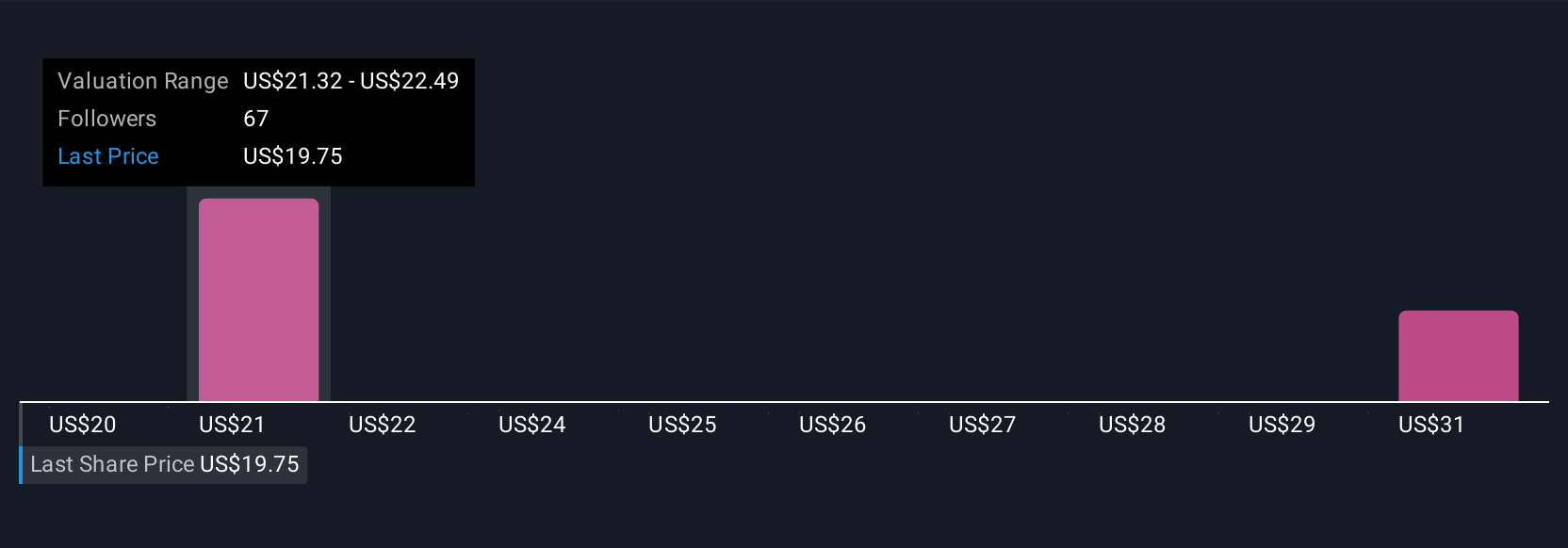

Five private investors in the Simply Wall St Community estimated fair value for Provident shares from US$20.16 to US$32.11, with several placing value well above current market pricing. In light of persistent competition for consumer deposits, your outlook on future earnings and balance sheet strength can lead to very different views among market participants.

Explore 5 other fair value estimates on Provident Financial Services - why the stock might be worth as much as 65% more than the current price!

Build Your Own Provident Financial Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Provident Financial Services research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Provident Financial Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Provident Financial Services' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFS

Provident Financial Services

Operates as the bank holding company for Provident Bank that provides various banking products and services to individuals, families, and businesses in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives