- United States

- /

- Oil and Gas

- /

- NYSE:DHT

3 Dividend Stocks In US With Yields Up To 8.3%

Reviewed by Simply Wall St

As major U.S. stock indexes hover near record highs, driven by a rally in chipmakers like Nvidia and Broadcom, investors are increasingly looking for stable income sources amidst the market's volatility and geopolitical developments. Dividend stocks, known for providing regular income through payouts, can be an attractive option in such an environment, offering potential yields that can complement capital gains from rising markets.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.07% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.72% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.81% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.46% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.48% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.28% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.48% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.69% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.62% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.47% | ★★★★★★ |

Click here to see the full list of 133 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

Peoples Bancorp (NasdaqGS:PEBO)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Peoples Bancorp Inc., with a market cap of approximately $1.15 billion, operates as the holding company for Peoples Bank, offering a range of commercial and consumer banking products and services.

Operations: Peoples Bancorp Inc. generates $423.28 million in revenue through its Community Banking segment.

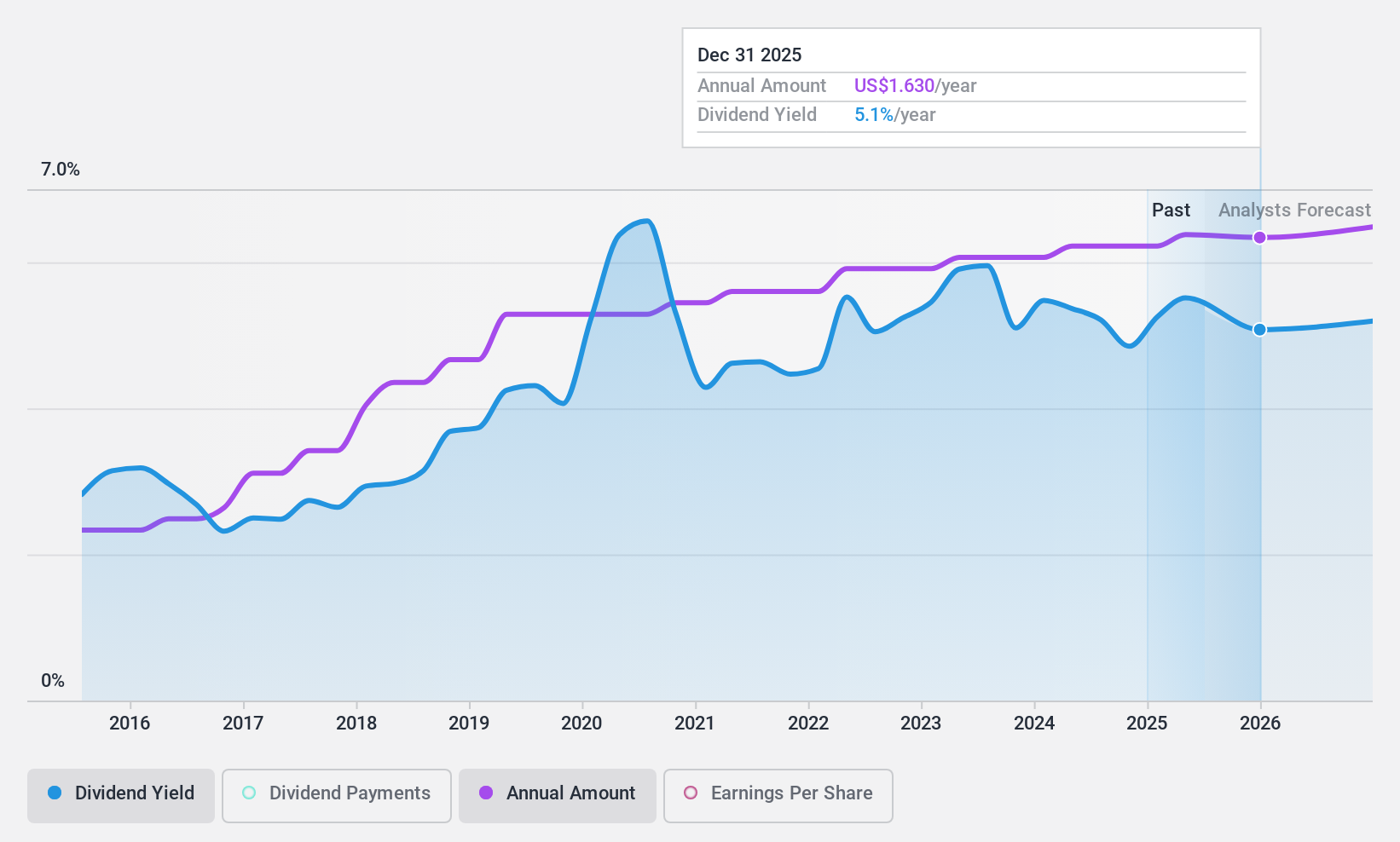

Dividend Yield: 4.8%

Peoples Bancorp recently affirmed a quarterly dividend of US$0.40 per share, maintaining a stable and reliable dividend history over the past decade. Despite a slight decline in fourth-quarter earnings, with net income at US$26.93 million compared to US$33.83 million the previous year, dividends remain well-covered by earnings with a 47.9% payout ratio. The stock offers an attractive yield of 4.81%, placing it in the top quartile among U.S. dividend payers, while trading below estimated fair value suggests potential for capital appreciation alongside income generation.

- Dive into the specifics of Peoples Bancorp here with our thorough dividend report.

- Our valuation report here indicates Peoples Bancorp may be undervalued.

DHT Holdings (NYSE:DHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DHT Holdings, Inc. owns and operates crude oil tankers through its subsidiaries in Monaco, Singapore, and Norway, with a market cap of approximately $1.91 billion.

Operations: DHT Holdings generates its revenue primarily from its fleet of crude oil tankers, amounting to $583.76 million.

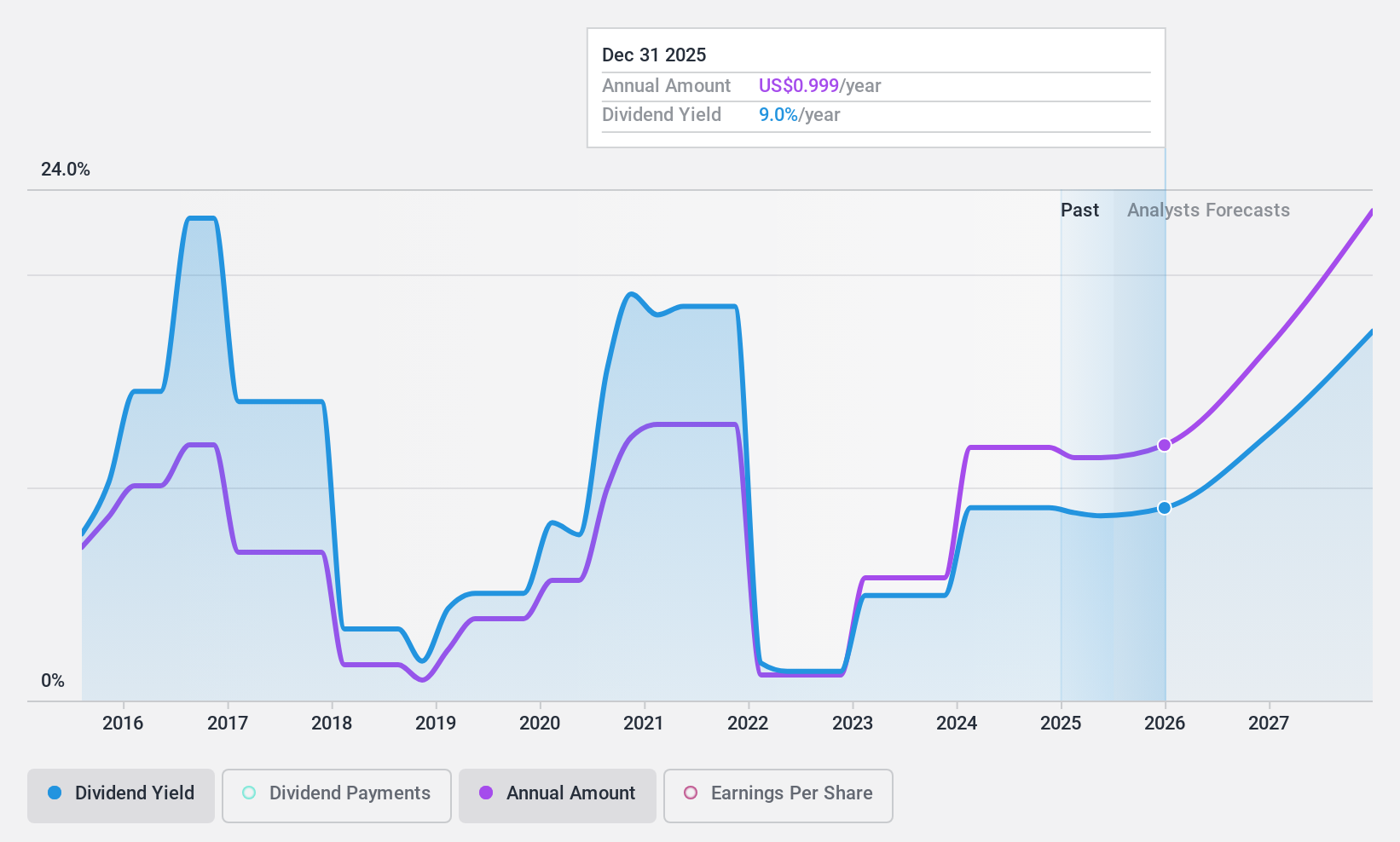

Dividend Yield: 8.4%

DHT Holdings offers an attractive dividend yield of 8.39%, ranking in the top 25% among U.S. dividend payers, yet its dividends have been volatile and are not well-covered by earnings, with a high payout ratio of 99.7%. Despite this, cash flow coverage is better at an 84.6% cash payout ratio. The company reported improved earnings for 2024, with net income rising to US$181.38 million from US$161.35 million in the prior year.

- Take a closer look at DHT Holdings' potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of DHT Holdings shares in the market.

Provident Financial Services (NYSE:PFS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Provident Financial Services, Inc. is a bank holding company for Provident Bank, offering a range of banking products and services to individuals, families, and businesses in the United States with a market cap of approximately $2.46 billion.

Operations: Provident Financial Services, Inc. generates revenue of $607.16 million from its Traditional Banking and Other Financial Services segment.

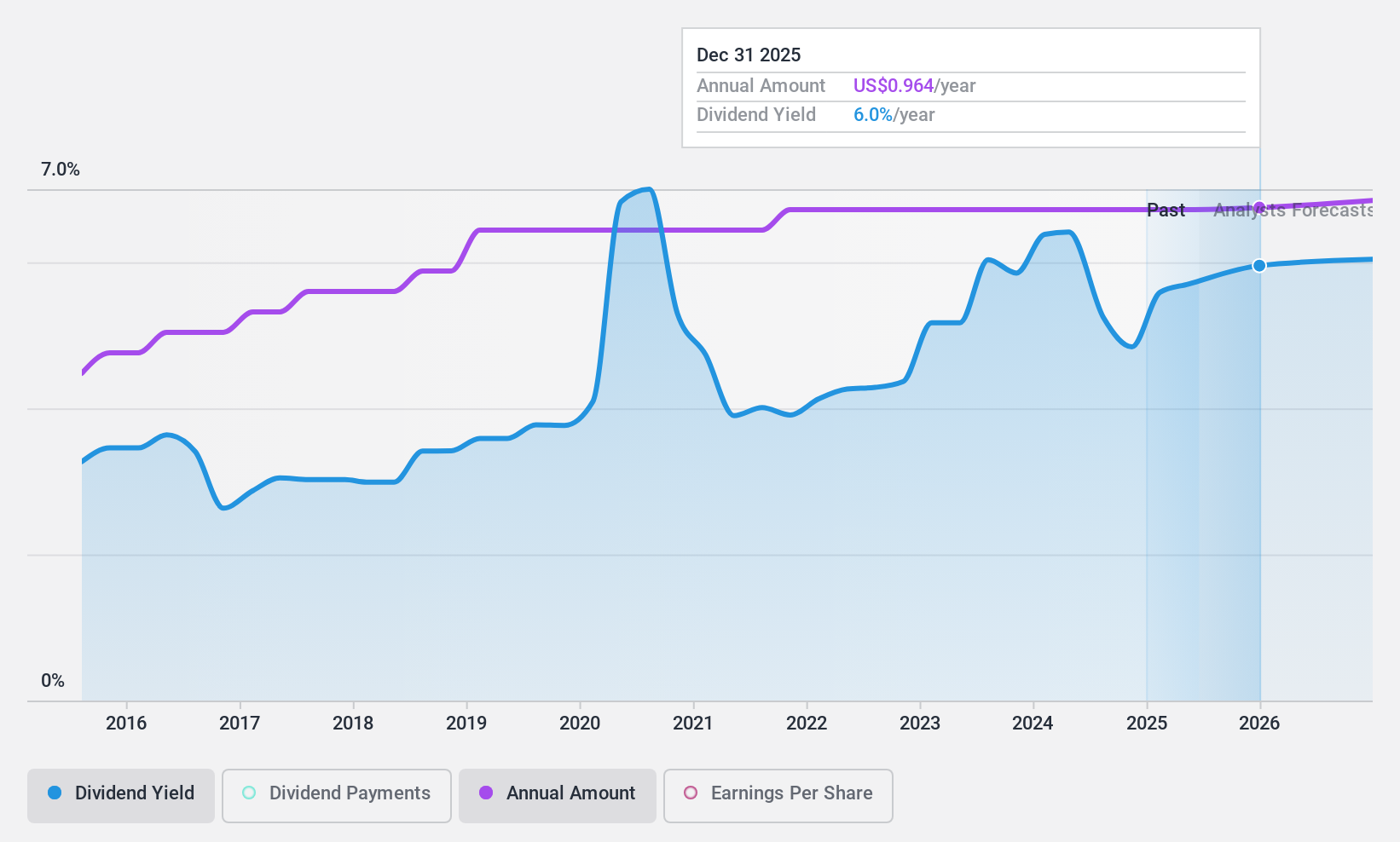

Dividend Yield: 5%

Provident Financial Services offers a dividend yield of 5.03%, placing it in the top 25% of U.S. dividend payers, though its high payout ratio of 91.1% raises sustainability concerns. Despite stable dividends over the past decade, recent earnings have declined, with net income dropping to US$115.53 million from US$128.4 million last year, partly due to significant one-off items and shareholder dilution. Analysts expect future earnings growth and improved dividend coverage in three years.

- Get an in-depth perspective on Provident Financial Services' performance by reading our dividend report here.

- Our expertly prepared valuation report Provident Financial Services implies its share price may be lower than expected.

Seize The Opportunity

- Reveal the 133 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHT

DHT Holdings

Through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, Norway, and India.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives