- United States

- /

- Banks

- /

- NYSE:OBK

Will Mixed Q2 Results Reshape Origin Bancorp's (OBK) Capital Allocation Story?

Reviewed by Simply Wall St

- Origin Bancorp, Inc. recently announced its second quarter 2025 results, reporting higher net interest income of US$82.14 million but a year-over-year decline in net income to US$14.65 million.

- Alongside the earnings report, the company affirmed its quarterly cash dividend, completed a share repurchase, and saw net charge-offs decrease compared to the prior year.

- With net interest income rising yet overall profits declining, we assess what these mixed results mean for Origin Bancorp’s broader investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Origin Bancorp Investment Narrative Recap

To be a shareholder in Origin Bancorp, you need to believe in its ability to grow its loan book and maintain healthy net interest margins, especially as it optimizes its operations and looks for efficiencies. The Q2 results, with higher net interest income but a decline in net income, do not materially change the main short-term catalyst, which is the expected improvement in profitability from operational initiatives, but also leave the key risk of margin compression from rising deposit costs firmly on the table.

The recent affirmation of a consistent US$0.15 per share quarterly dividend is particularly relevant in the context of these results, as it reflects the company’s continued focus on shareholder returns even as quarterly net income fell. Dividend consistency may provide some reassurance for income-focused investors, especially while the company’s margins and costs remain important watchpoints.

In contrast, what investors should also be aware of is the ongoing risk from rising deposit competition, where higher funding costs could quickly...

Read the full narrative on Origin Bancorp (it's free!)

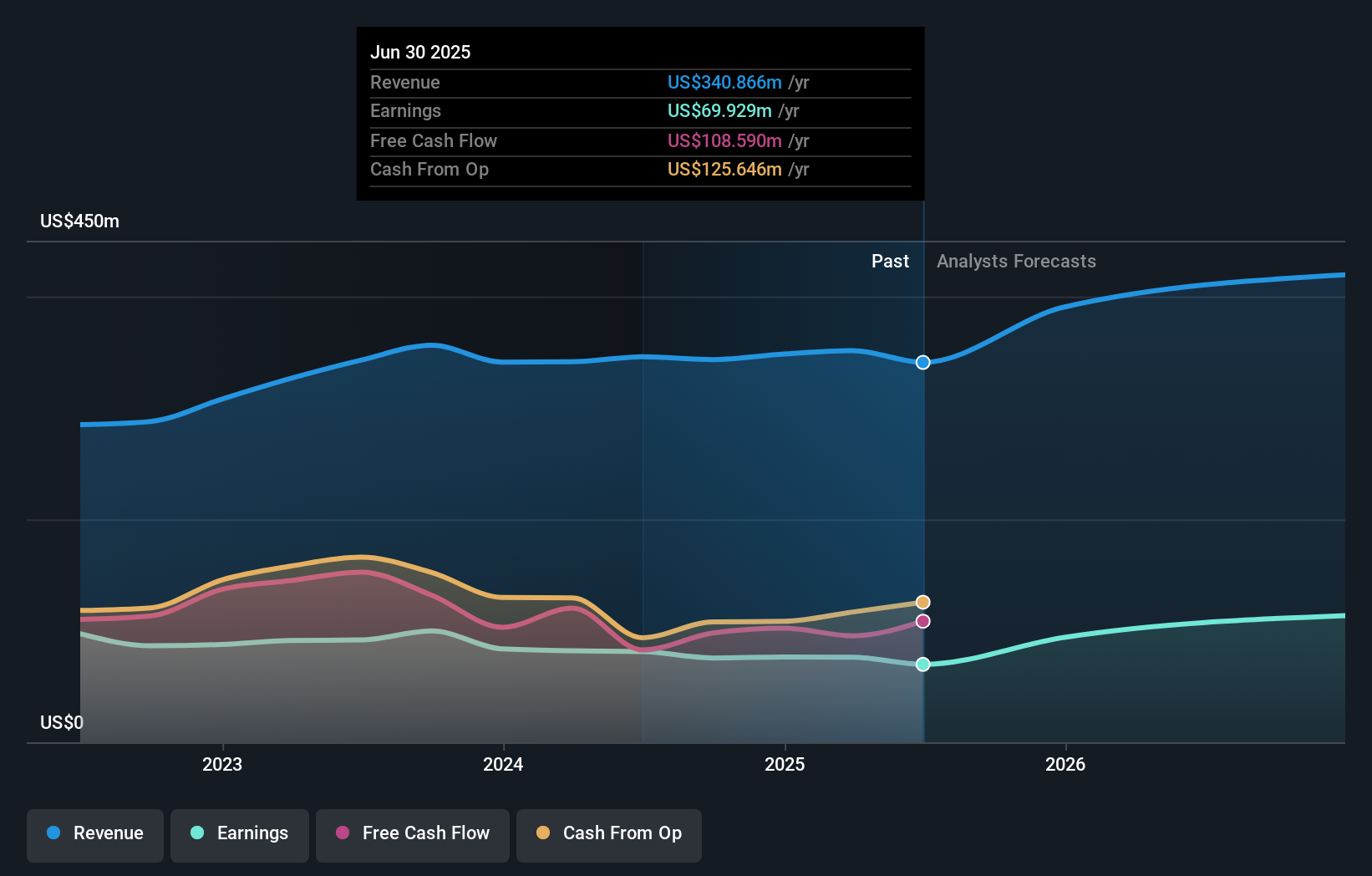

Origin Bancorp's outlook anticipates $471.7 million in revenue and $142.9 million in earnings by 2028. This implies a 10.3% annual revenue growth rate and an earnings increase of $66.6 million from the current $76.3 million.

Uncover how Origin Bancorp's forecasts yield a $41.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

From the Simply Wall St Community, one fair value estimate for Origin Bancorp stands at US$67.01 per share. While optimism around operational improvements remains a key theme, market participants highlight that rising funding costs could still weigh on margins and future earning power.

Explore another fair value estimate on Origin Bancorp - why the stock might be worth as much as 76% more than the current price!

Build Your Own Origin Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Origin Bancorp research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Origin Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Origin Bancorp's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OBK

Origin Bancorp

Operates as a bank holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, and retail clients in Texas, Louisiana, and Mississippi.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives