- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU) Surges 16% After Strong Earnings Report

Reviewed by Simply Wall St

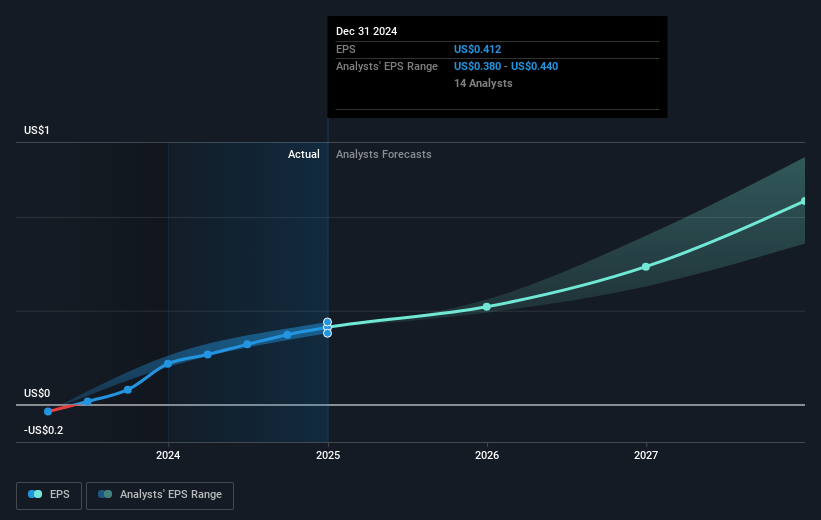

Nu Holdings (NYSE:NU) recently announced its earnings for the year ending December 31, 2024, showcasing a robust financial performance with increases in net interest income, net income, and earnings per share. The company's impressive growth metrics coincide with a 16% price surge over the last week, a period that also witnessed significant fluctuations in major stock indices. The broader market has grappled with mixed performances, as reflected by a general struggle to rebound from recent sell-offs, though it ended the past week on a high note. While the Dow Jones and S&P 500 ticked upwards marginally, the Nasdaq Composite faced declines, particularly from tech giants like Tesla and Nvidia. Amid these market dynamics, Nu Holdings's strong earnings announcement appears to resonate well with investors amid contrasting signals from key indexes and sectors.

Over the last three years, Nu Holdings achieved a total shareholder return of 55.16%, reflecting a compelling appreciation in shareholder value. This period of growth is marked by several key developments. Notably, the company shifted from a net loss in 2022 to a net income of US$1.03 billion for 2023, underpinned by a significant rise in net interest income. Earnings growth over the past five years averaged nearly 80% annually, indicating consistent profitability improvement. The high return on equity, reaching 25.8%, further underscores financial efficiency and investor appeal.

In the past year, despite the broader US market's 9% return and the US Banks industry's 17% return, Nu Holdings underperformed with its lower return. However, it continued to showcase robust revenue performance, with an impressive earnings growth rate of 91.4% that outpaced its industry peers. This consistent revenue and earnings momentum likely contributed to the positive three-year return, despite challenging market conditions more recently.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, Cayman Islands, Germany, Argentina, the United States, and Uruguay.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives