- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU) Shows Resilience With Net Income Doubling Despite Market Challenges

Reviewed by Simply Wall St

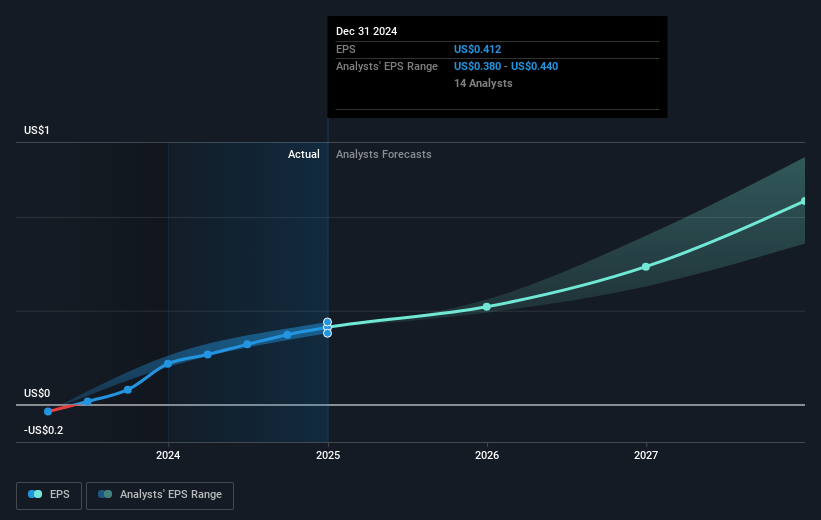

Nu Holdings (NYSE:NU) recently reported its full-year 2024 earnings, showcasing significant growth with net interest income increasing by approximately $2.4 billion, and net income more than doubling from the previous year. The company's basic and diluted EPS also saw substantial improvements, reflecting a strong enhancement in shareholder value. Despite a broadly challenging market, with major indices experiencing declines amid geopolitical uncertainties and new tariffs announced on automobile imports, Nu’s stock remained relatively stable. This resilience aligns with the company's robust earnings, which likely supported its performance during this period.

Buy, Hold or Sell Nu Holdings? View our complete analysis and fair value estimate and you decide.

Over the last three years, Nu Holdings has achieved a total return of 28.41%, reflecting its effective strategies and robust operational growth, despite recently underperforming the US Banks industry over the past year. The company's expansion into secured lending and new services has been a pivotal factor in this success, diversifying revenue streams and enhancing financial resilience. Significant increases in net interest income and net income, as demonstrated in its 2024 results where net income reached nearly $2 billion, have also played a crucial role in supporting its long-term performance.

Additionally, while recent removal from indices like the S&P Global BMI Index may pose challenges, the company's inclusion in indices like the FTSE All-World Index in 2023 highlights its growing global presence. Furthermore, the continued expansion in key markets such as Mexico and Colombia has contributed to its financial stability, supported by strong deposit growth, which boosts liquidity and net interest margins. Nu Holdings' focus on technology and cost-efficiency remains integral to sustaining profitability and shareholder returns.

Jump into the full analysis health report here for a deeper understanding of Nu Holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, Cayman Islands, Germany, Argentina, the United States, and Uruguay.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives