- United States

- /

- Banks

- /

- NYSE:NU

Assessing Nubank’s Current Valuation After Recent 5.5% Drop Amid 2025 Market Shifts

Reviewed by Bailey Pemberton

Trying to figure out what to do with Nu Holdings stock right now? You are definitely not alone. The Brazilian fintech has been on quite a ride, with plenty of investors wondering whether the run-up has more room to go or if it is time to lock in gains. Just last week, Nu Holdings dipped 5.5%, even as its year-to-date gain sits at a commanding 42.3%. In the past three years, it has surged an eye-popping 269.0%, surpassing many peers. While these returns might catch your eye, the most recent moves suggest shifting investor appetite, possibly reflecting broader market changes or evolving views on emerging market risk.

With numbers like these, it makes sense to ask whether the current price really reflects what Nu Holdings is worth. After all, high flyers can get expensive and quick corrections are never out of the question. If you are hoping for a bargain, the company's valuation score tells a clear story: Nu Holdings is undervalued on 0 out of 6 standard checks for value, giving it a value score of 0. That might raise some eyebrows, but scores rarely tell the whole story on their own.

Let us dig into how analysts typically size up valuation and what these methods reveal about Nu Holdings. Stay tuned, because there is a more insightful way to think about value that is often overlooked, and we will get to that by the end of our article.

Nu Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nu Holdings Excess Returns Analysis

The Excess Returns model evaluates a stock’s value by comparing the returns a company generates on its equity to the opportunity cost of capital. In other words, it measures how much more or less Nu Holdings is earning on its invested capital than what investors might expect from similar-risk alternatives.

For Nu Holdings, the latest figures show a Book Value of $1.98 per share and a Stable EPS (earnings per share) of $0.91, based on future Return on Equity estimates from 10 analysts. The cost of equity stands at $0.36 per share. Crucially, Nu Holdings produces an Excess Return of $0.55 per share, reflecting how much it is generating above the cost of capital. The average Return on Equity is a robust 30.03%. Looking ahead, analysts expect the Stable Book Value to reach $3.03 per share, according to projections from 6 analysts.

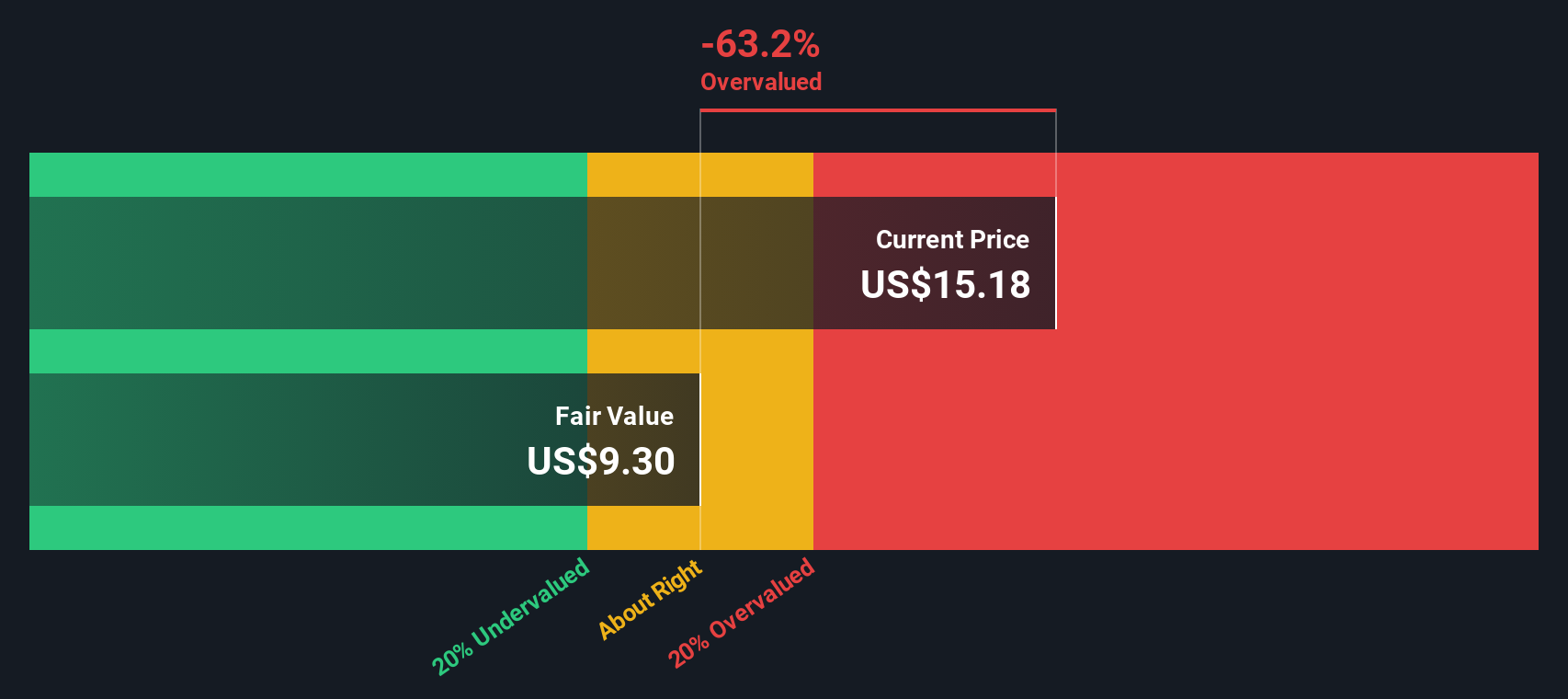

After factoring in these growth and return assumptions, the Excess Returns model suggests Nu Holdings shares are trading at a substantial premium. The intrinsic discount implies the stock is 62.6% overvalued relative to its fair value.

Result: OVERVALUED

Our Excess Returns analysis suggests Nu Holdings may be overvalued by 62.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nu Holdings Price vs Earnings

For profitable companies like Nu Holdings, the price-to-earnings (PE) ratio is a widely used metric. It helps investors put the company’s current price in the context of its actual earnings, making it easier to compare against competitors and industry trends. Because earnings reflect both growth prospects and risk, a “normal” or “fair” PE ratio shifts depending on how fast the company is expected to grow and how reliably it can maintain that trajectory compared to its peers.

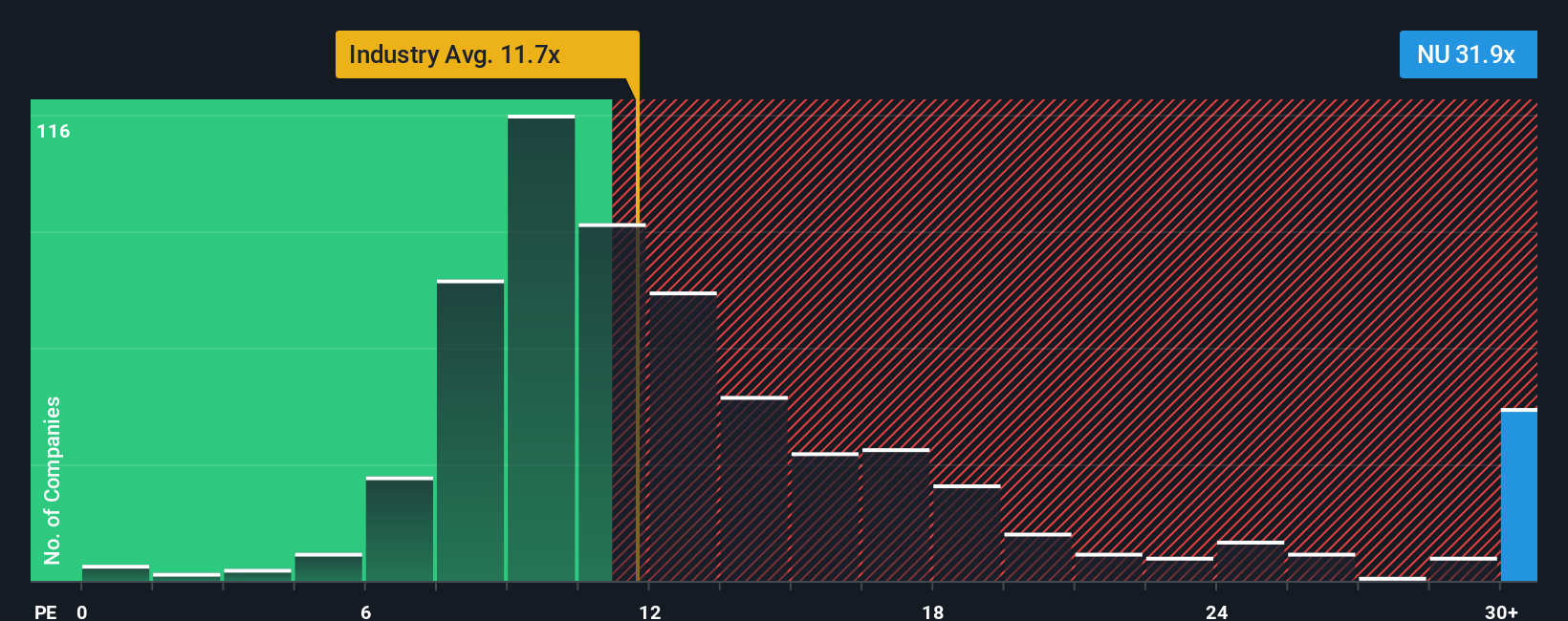

Nu Holdings is currently trading at a PE ratio of 31.8x. This is substantially higher than the average PE for banks, which stands at just 11.7x, and also above its peer group’s average of 12.0x. On the surface, this premium might seem significant, but it is important to dig deeper and look at the reasons behind such a valuation.

This is where the Simply Wall St Fair Ratio comes in. Unlike a simple comparison to peers or the broader industry, the Fair Ratio takes into account Nu’s unique mix of earnings growth, profit margins, risk profile, size, and the competitive landscape. For Nu Holdings, the Fair Ratio is 22.7x, reflecting its above-average growth and market potential, but also weighing in its company-specific risks and recent performance.

Comparing the current PE of 31.8x to the Fair Ratio of 22.7x shows that Nu Holdings is priced above what the fundamentals suggest is fair. This points to the stock being overvalued at current levels, even after accounting for its notable growth story.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nu Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your own story or perspective about a company, which brings together your personal assumptions about fair value, future revenue and earnings growth, profit margins, and the reasons behind your outlook. This approach makes the numbers more meaningful by linking them to your beliefs and insights.

With Narratives, you can clearly connect Nu Holdings’ business story to a financial forecast and, ultimately, to a fair value estimate. It is a simple and accessible tool available on Simply Wall St's Community page, trusted by millions of investors. Narratives empower you to see how your view compares to the market and other users, so you can decide whether to buy or sell based on the difference between your calculated fair value and the current share price.

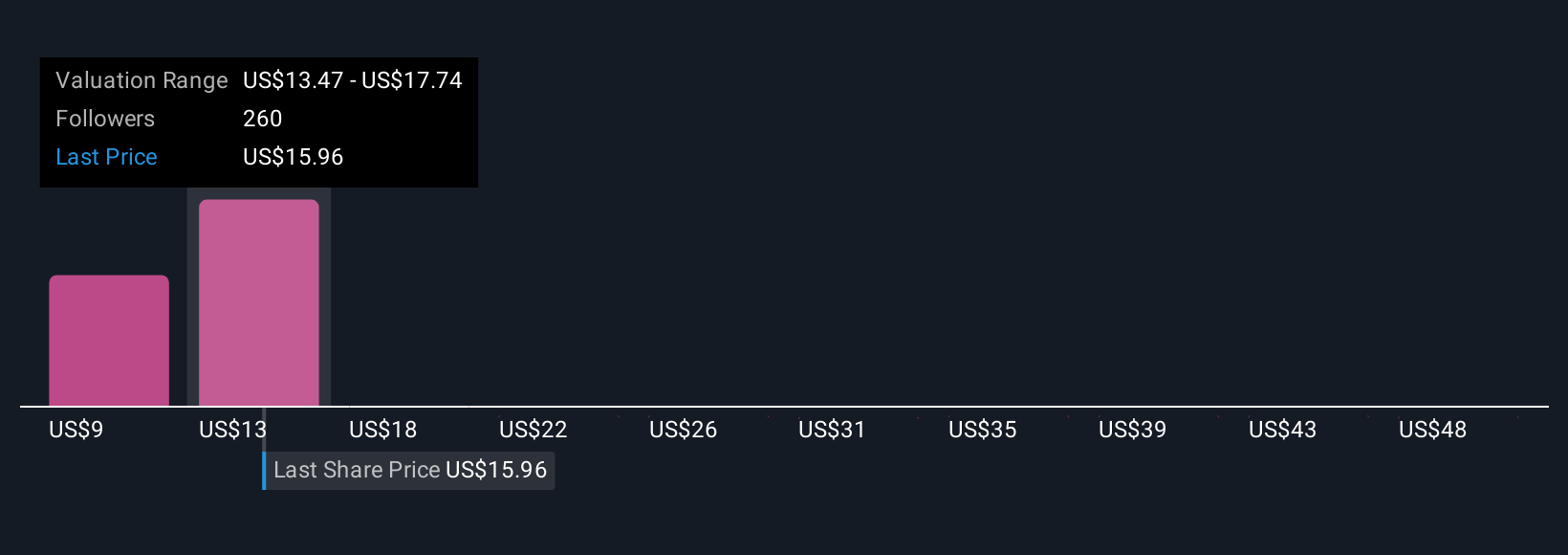

What sets Narratives apart is that they update dynamically. Whenever important news or financial results are released, your fair value and assumptions refresh automatically, helping you stay ahead in a fast-changing market. For example, some investors might use optimistic growth assumptions and assign Nu Holdings a fair value as high as $20.00 per share, while more cautious users might set it closer to $14.00, based on differing expectations for digital adoption, competition, or credit risk.

Do you think there's more to the story for Nu Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives