- United States

- /

- Professional Services

- /

- NasdaqGS:CNDT

US Market's Hidden Gems: 3 Promising Small Caps

Reviewed by Simply Wall St

As the U.S. market grapples with a contraction in GDP and investors await major tech earnings, small-cap stocks have been navigating a landscape marked by economic uncertainty and fluctuating indices like the S&P 600. Amid these challenges, identifying promising small-cap companies can offer unique opportunities for growth, particularly those that demonstrate resilience and adaptability in dynamic market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Tiptree (NasdaqCM:TIPT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tiptree Inc. operates through its subsidiaries to offer specialty insurance products and related services across the United States and Europe, with a market capitalization of approximately $830.86 million.

Operations: Tiptree generates the majority of its revenue from its insurance segment, amounting to $1.97 billion. The company also derives income from Tiptree Capital's mortgage operations, contributing $65.91 million.

Tiptree, a smaller player in the financial sector, has shown impressive growth with earnings surging by 282% over the past year, outpacing the broader insurance industry. The company's net debt to equity ratio stands at a satisfactory 24.5%, indicating prudent financial management. Interest payments are well-covered by EBIT at 5.7 times, showcasing solid operational performance. Despite significant insider selling recently, Tiptree's price-to-earnings ratio of 15.9x suggests it offers good value compared to the US market average of 16.9x. Additionally, their free cash flow remains positive, further supporting its robust financial health and potential appeal as an investment prospect.

- Click here and access our complete health analysis report to understand the dynamics of Tiptree.

Gain insights into Tiptree's historical performance by reviewing our past performance report.

Conduent (NasdaqGS:CNDT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Conduent Incorporated delivers digital business solutions and services across commercial, government, and transportation sectors globally, with a market capitalization of approximately $344.70 million.

Operations: Conduent generates revenue from three primary segments: Commercial ($1.61 billion), Government ($984 million), and Transportation ($586 million).

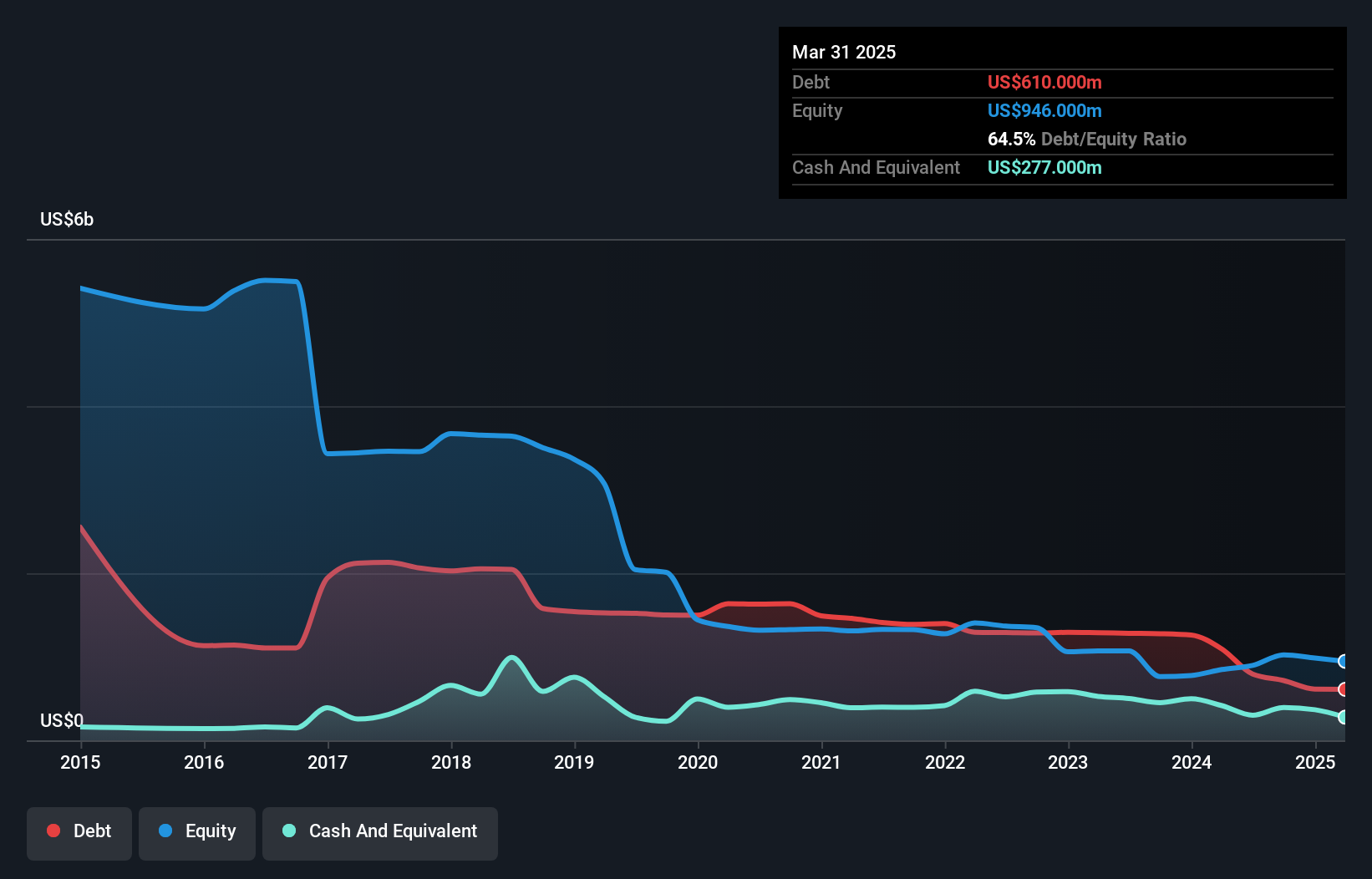

Conduent, a business processing outsourcing firm, recently turned profitable and is trading at a substantial discount to its estimated fair value. With a satisfactory net debt to equity ratio of 25.1%, the company has reduced its debt from 103.8% to 62.2% over five years, indicating improved financial health. Despite a reported $28 million goodwill impairment in Q4 2024 and an annual sales decline from $3.72 billion to $3.36 billion, Conduent's strategic focus on government contracts and innovative solutions like GenAI could enhance future prospects, as seen with recent deals such as NJ TRANSIT's contract for advanced fare gates installation.

Northpointe Bancshares (NYSE:NPB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Northpointe Bancshares, Inc. is the bank holding company for Northpointe Bank, offering a range of banking products and services in the United States with a market capitalization of $478.70 million.

Operations: Northpointe Bancshares generates revenue through its banking products and services offered by Northpointe Bank in the United States. The company has a market capitalization of $478.70 million, reflecting its valuation in the financial market.

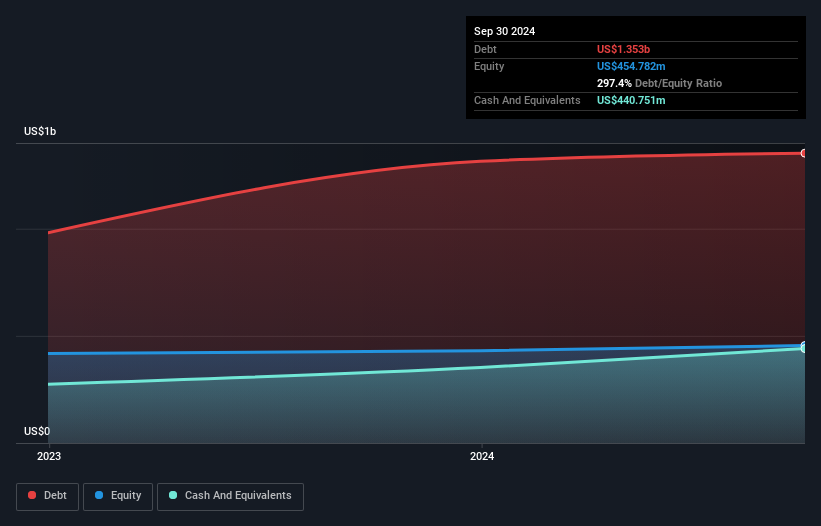

Northpointe Bancshares, with total assets of US$5.9 billion and equity of US$586.5 million, showcases a robust financial profile despite its small size. The bank's earnings surged by 83% over the past year, outpacing the industry average of 3%. However, it has an insufficient allowance for bad loans at 1.7% of total loans. Trading at nearly 36% below estimated fair value highlights potential upside for investors. Recent leadership changes aim to strengthen its mortgage warehouse lending division, signaling strategic growth initiatives in this area while maintaining primarily low-risk funding sources through customer deposits (72%).

- Get an in-depth perspective on Northpointe Bancshares' performance by reading our health report here.

Evaluate Northpointe Bancshares' historical performance by accessing our past performance report.

Key Takeaways

- Dive into all 291 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNDT

Conduent

Provides digital business solutions and services for the commercial, government, and transportation spectrum in the United States, Europe, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives