- United States

- /

- Banks

- /

- NYSE:LOB

Live Oak Bancshares (LOB): Valuation Check After New CRO Appointment and $10 Billion Asset Milestone

Reviewed by Simply Wall St

Live Oak Bancshares (LOB) just passed a key milestone, crossing $10 billion in assets and appointing seasoned risk executive Ewa M. Stasiowska as its dedicated Chief Risk Officer. This move separates the role from general counsel.

See our latest analysis for Live Oak Bancshares.

The leadership reshuffle and the $10 billion asset milestone come after a choppy stretch, with a 30 day share price return of 5.35% but a 1 year total shareholder return of minus 28.94%, suggesting sentiment is stabilizing rather than surging.

If this shift in risk oversight has you rethinking your bank exposure, it might be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With the shares still down sharply over 12 months but trading at a steep discount to analyst targets, investors now face a crucial question: is Live Oak Bancshares a quietly undervalued turnaround story, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 20.8% Undervalued

With Live Oak Bancshares last closing at $33.28 versus a narrative fair value near $42, the story framing this gap leans heavily on future growth and profitability.

The rapid scaling of new digital products, such as Live Oak Express and checking account offerings (both essentially at zero in 2023 and now meaningfully contributing to loan and deposit growth), positions the company to capture increased demand from the ongoing shift toward tech enabled banking and digital native small business owners supporting sustained revenue and margin growth.

Want to see what kind of revenue trajectory and margin expansion could justify this valuation reset? The narrative quietly bakes in transformation level earnings power and a future earnings multiple that looks more like a growth franchise than a typical regional bank. Curious how those assumptions stack up against today’s compressed returns and mixed recent performance? Dive in to unpack the full playbook behind that projected fair value.

Result: Fair Value of $42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on continued policy support and flawless tech execution. Regulatory shifts or missteps in AI investments could quickly erode profitability.

Find out about the key risks to this Live Oak Bancshares narrative.

Another View: Multiples Paint a Tougher Picture

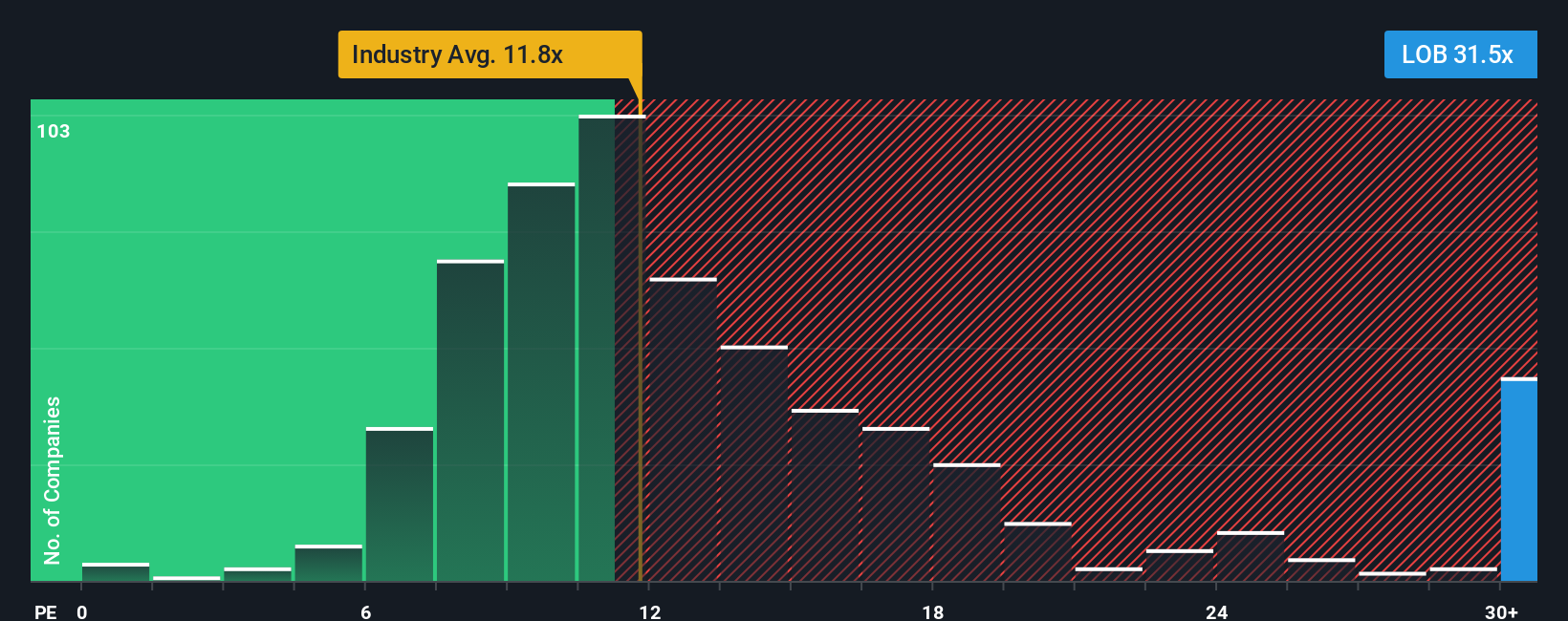

On earnings, the story is less generous. Live Oak trades at about 22.2 times earnings, nearly double the US banks average of 11.5 times and above its fair ratio of 20.4 times. This suggests limited margin for error if the growth narrative stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Oak Bancshares Narrative

If the story so far does not quite match your own view, you can dig into the numbers yourself and build a custom narrative in minutes: Do it your way.

A great starting point for your Live Oak Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one compelling story when the market is full of others; let the Simply Wall Street Screener surface candidates you would otherwise miss.

- Capture high potential growth by scanning these 3573 penny stocks with strong financials that pair tiny market caps with surprisingly solid fundamentals and momentum.

- Ride the next wave of innovation by targeting these 25 AI penny stocks that are poised to benefit from accelerating adoption of intelligent automation and data driven services.

- Consider steadier cash returns through these 14 dividend stocks with yields > 3% that combine attractive yields with balance sheet strength to keep paying shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026