- United States

- /

- Banks

- /

- NYSE:KEY

KeyCorp (NYSE:KEY) Stock Slips 11% Amid Market Volatility

Reviewed by Simply Wall St

Last week, KeyCorp (NYSE:KEY) experienced a 11% decline in its share price. This price movement unfolded against the backdrop of broader market volatility, where stocks slipped as investors absorbed tariff developments and escalating economic concerns including talk from former President Trump on tariffs impacting sectors that KeyCorp operates in. The Dow Jones and S&P 500 experienced declines of 1.2% and 0.8% respectively, and the overall market fell by 4.6%. This downward pressure impacted banks and financial institutions like KeyCorp, likely exacerbating the sell-off. Additionally, the uncertain economic environment and lagging investor confidence might have placed further stress on financial stocks. Such market conditions, characterized by reactions to tariffs and economic uncertainties, played into KeyCorp's recent on-market performance.

Click here to discover the nuances of KeyCorp with our detailed analytical report.

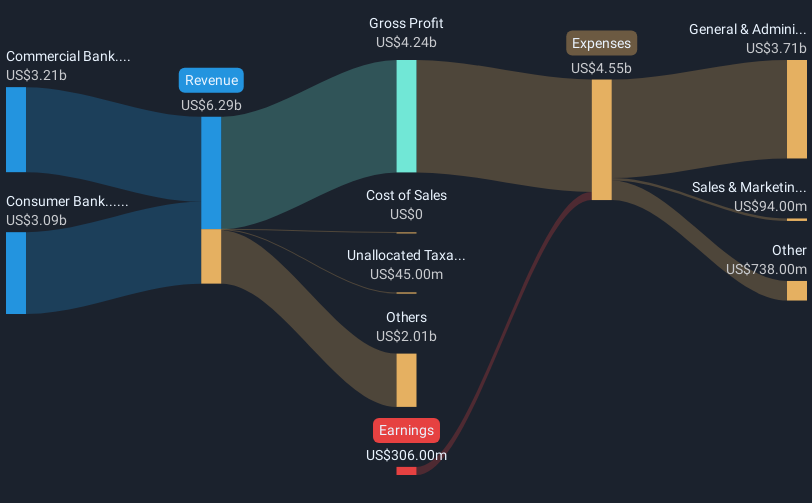

Over the past five years, KeyCorp has seen a total shareholder return of 94.31%. This performance reflects various strategic maneuvers and challenges. Notably, the company has faced a consistent decline in net income, culminating in a net loss of US$161 million for the year ending December 2024. Despite these setbacks, KeyCorp has maintained a commitment to shareholder value through dividends, declaring a cash dividend of US$0.205 per share on common shares in early 2025. During this period, the company also experienced leadership changes, with Christopher M. Gorman taking over as CEO after Beth E. Mooney's retirement.

In seeking growth amid financial pressures, KeyCorp initiated strategic moves such as pursuing bolt-on acquisitions to expand its business and launched new products like KeyVAM for treasury management clients. However, legal challenges surfaced late in 2023, with a class action lawsuit alleging non-disclosure of liquidity concerns. These factors reveal a complex interplay contributing to KeyCorp's share performance over the five-year span.

- Understand the fair market value of KeyCorp with insights from our valuation analysis—click here to learn more.

- Discover the key vulnerabilities in KeyCorp's business with our detailed risk assessment.

- Is KeyCorp part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives