- United States

- /

- Banks

- /

- NYSE:KEY

KeyCorp (KEY): Assessing Valuation Following Strong Earnings Beat and Upgraded Profitability Outlook

Reviewed by Simply Wall St

If you've been following KeyCorp (KEY), the latest quarterly report probably caught your eye. The company not only posted earnings per share that beat expectations, but also lifted its outlook for net interest margin and income through to the end of 2026. A combination of rising net interest and fee income helped push results past estimates. Management’s new, higher guidance suggests confidence in how profitability is shaping up for the rest of the year and beyond. That is an encouraging signal for anyone weighing whether to hold, buy, or adjust their exposure to the stock.

Looking at the broader picture, KeyCorp's shares have gained roughly 18% over the past year. Recent upward momentum has continued over the past month with even more pronounced gains during the last three months. The stronger guidance arrived after a period where the company already showed improving revenue and bottom-line growth, despite some softness in average loan balances. While other banks have faced margin pressure, KeyCorp’s focus on commercial lending and fee income is reflected in its performance. This suggests it may be rebounding faster than its peers.

However, with this run-up and positive guidance, questions remain. Is the market underestimating KeyCorp’s earnings potential, or is the stock simply reflecting the improved outlook? Is there still value to be unlocked, or has the easiest opportunity already passed?

Most Popular Narrative: 10.3% Undervalued

According to community narrative, KeyCorp is currently viewed as undervalued by 10.3% compared to its estimated fair value. Analysts are optimistic about future profitability and are forecasting significant improvements in both revenue and margins over the next several years.

The anticipated shift from net interest income (NII) headwinds to tailwinds is expected due to a pivot in fixed asset repricing and the structure of swap and treasury maturities. This change is projected to significantly enhance NII in the forthcoming quarters, having a positive impact on revenue growth.

Curious about what is fueling this optimistic outlook? One pillar of the thesis is a set of forward-looking financial assumptions rarely seen at this bank. Interested in seeing which profit forecasts and margin expectations underpin this valuation? The underlying numbers might surprise you.

Result: Fair Value of $21.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising nonperforming loans or sustained sluggish loan demand could quickly challenge even the most optimistic outlook for KeyCorp’s future growth and margins.

Find out about the key risks to this KeyCorp narrative.Another View: A Different Way to Value KeyCorp

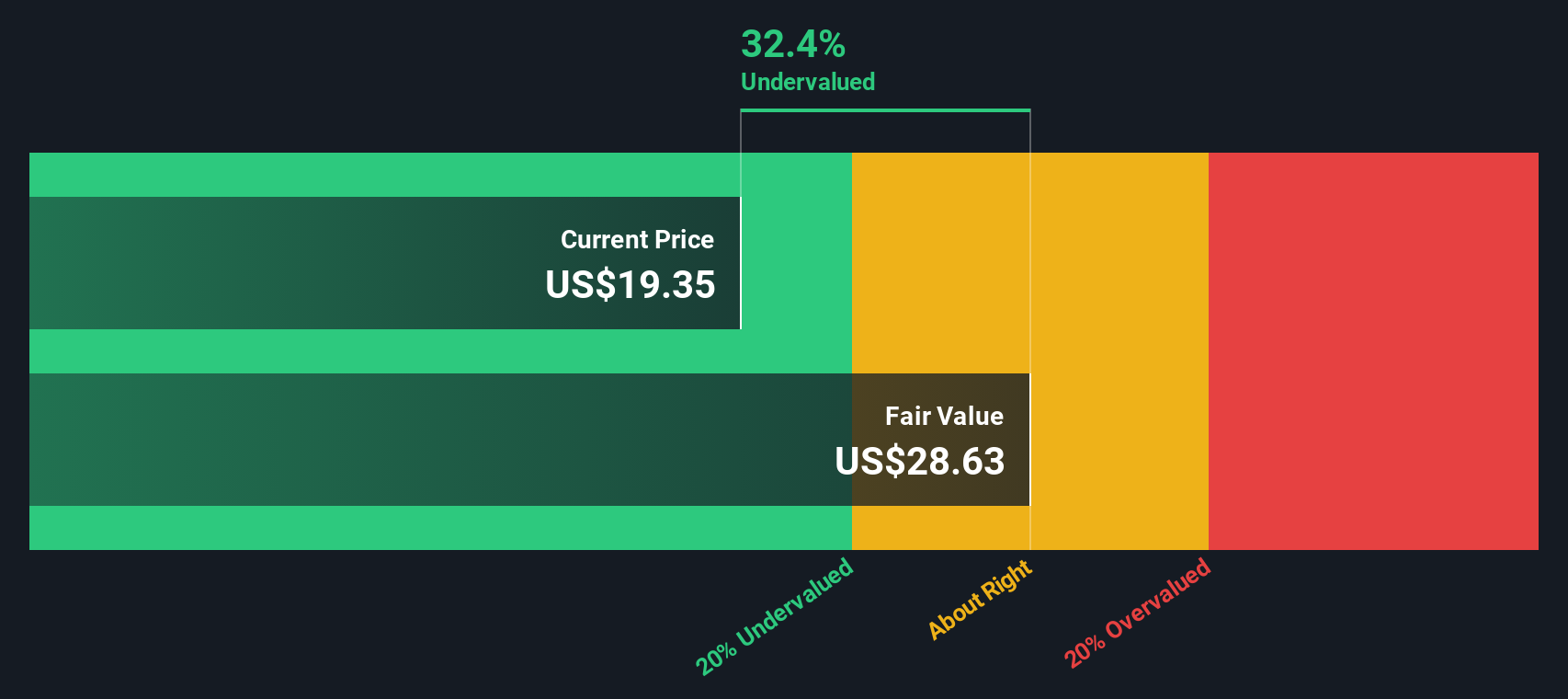

While the fair value estimate points to KeyCorp being undervalued, our DCF model also suggests the stock is currently trading below its intrinsic worth. Could this support the case for its growth potential, or is there more to consider?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KeyCorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KeyCorp Narrative

If you have another angle or want to dig deeper into the numbers yourself, it is easy to put together your own analysis in just a few minutes. This allows you to do it your way.

A great starting point for your KeyCorp research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for even more investment ideas?

Unlock new opportunities and take your investing strategy to the next level. The market is full of standout stocks waiting to be noticed. Why let great ideas slip by? Here are a few dynamic paths to consider, tailored for investors hungry for performance, value, and innovation:

- Target consistent income by checking out companies offering dividend stocks with yields > 3%, and see which stocks are rewarding shareholders with strong and steady yields above 3%.

- Zero in on the future of healthcare by tapping into the growth and disruption coming from healthcare AI stocks, where AI-driven breakthroughs could reshape the industry.

- Capitalize on value with a focus on undervalued stocks based on cash flows, uncovering stocks trading below their intrinsic worth and primed for upside based on cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives