- United States

- /

- Software

- /

- NasdaqGS:NTNX

3 Stocks That May Be Undervalued By Up To 49.7%

Reviewed by Simply Wall St

The United States market has shown positive momentum, with a 2.8% increase over the last week and a 9.3% rise in the past year, while earnings are anticipated to grow by 14% annually in the coming years. In this environment, identifying stocks that may be undervalued can offer potential opportunities for investors seeking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $24.56 | $48.87 | 49.7% |

| FB Financial (NYSE:FBK) | $44.69 | $89.12 | 49.9% |

| Quaker Chemical (NYSE:KWR) | $103.46 | $206.46 | 49.9% |

| KeyCorp (NYSE:KEY) | $15.49 | $30.81 | 49.7% |

| Amerant Bancorp (NYSE:AMTB) | $17.55 | $34.97 | 49.8% |

| HealthEquity (NasdaqGS:HQY) | $90.58 | $179.14 | 49.4% |

| Granite Ridge Resources (NYSE:GRNT) | $5.10 | $10.09 | 49.5% |

| BigCommerce Holdings (NasdaqGM:BIGC) | $5.15 | $10.22 | 49.6% |

| Expand Energy (NasdaqGS:EXE) | $105.88 | $211.08 | 49.8% |

| Nutanix (NasdaqGS:NTNX) | $72.54 | $143.63 | 49.5% |

Let's uncover some gems from our specialized screener.

Nutanix (NasdaqGS:NTNX)

Overview: Nutanix, Inc. offers an enterprise cloud platform across various global regions, with a market cap of approximately $19.34 billion.

Operations: The company's revenue segment is derived entirely from Internet Software & Services, amounting to $2.32 billion.

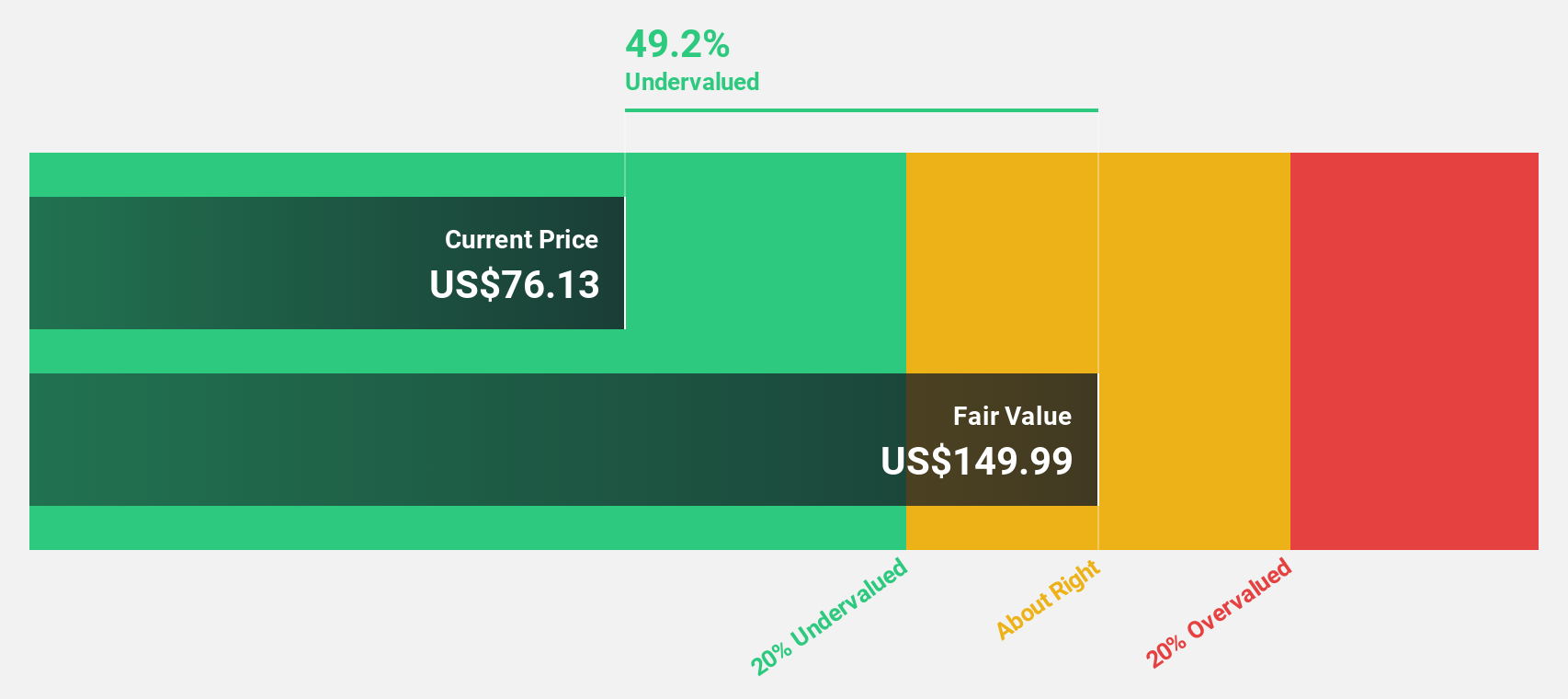

Estimated Discount To Fair Value: 49.5%

Nutanix is trading at US$72.54, significantly below its estimated fair value of US$143.63, indicating it may be undervalued based on cash flows. Recent earnings showed substantial revenue and net income growth, with revenue reaching US$654.72 million in Q2 2025. The company plans to continue share buybacks and pursue tuck-in acquisitions to enhance its offerings, supported by a new $500 million credit facility for strategic flexibility and growth initiatives.

- According our earnings growth report, there's an indication that Nutanix might be ready to expand.

- Get an in-depth perspective on Nutanix's balance sheet by reading our health report here.

KeyCorp (NYSE:KEY)

Overview: KeyCorp is the holding company for KeyBank National Association, offering a range of retail and commercial banking products and services in the United States, with a market cap of approximately $17.22 billion.

Operations: KeyBank National Association's revenue is primarily derived from its Consumer Bank segment, which generated $3.16 billion, and its Commercial Bank segment, which contributed $3.38 billion.

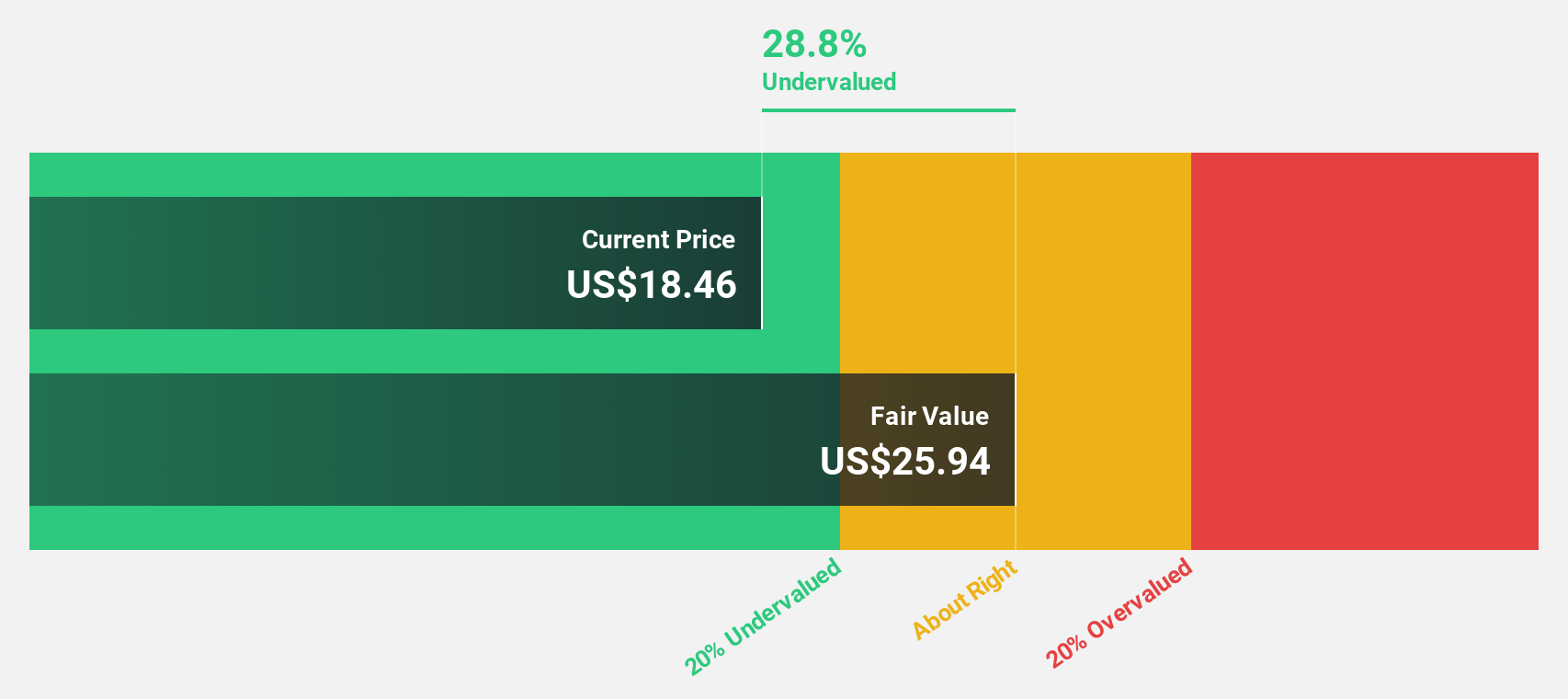

Estimated Discount To Fair Value: 49.7%

KeyCorp is trading at US$15.49, significantly below its estimated fair value of US$30.81, suggesting it is undervalued based on cash flows. Recent earnings show net interest income increased to US$1.10 billion in Q1 2025, with net income rising to US$405 million. The company announced a share repurchase program up to $1 billion and completed a $750 million fixed-income offering, indicating strategic financial management despite past shareholder dilution and low forecasted return on equity.

- Upon reviewing our latest growth report, KeyCorp's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of KeyCorp stock in this financial health report.

Pure Storage (NYSE:PSTG)

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services both in the United States and internationally, with a market cap of approximately $15.60 billion.

Operations: The company generates revenue of $3.17 billion from its computer storage devices segment.

Estimated Discount To Fair Value: 49.4%

Pure Storage is trading at US$47.84, significantly below its estimated fair value of US$94.58, highlighting potential undervaluation based on cash flows. The company's earnings grew 73.5% last year and are forecasted to grow at 32.8% annually over the next three years, outpacing the broader U.S. market's growth rate of 13.9%. Recent strategic moves include a partnership with Varonis Systems for enhanced data security and a share repurchase program worth up to $250 million.

- Insights from our recent growth report point to a promising forecast for Pure Storage's business outlook.

- Click here to discover the nuances of Pure Storage with our detailed financial health report.

Key Takeaways

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 182 more companies for you to explore.Click here to unveil our expertly curated list of 185 Undervalued US Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives