- United States

- /

- Oil and Gas

- /

- NYSE:TRGP

3 Noteworthy Stocks Estimated To Be Trading At Discounts Of Up To 32.5%

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 2.2%, contributing to a 13% increase over the past year, with earnings forecasted to grow by 15% annually. In this environment of robust growth, identifying stocks that are potentially undervalued can offer investors opportunities to capitalize on companies trading at discounts relative to their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $25.53 | $51.03 | 50% |

| SharkNinja (SN) | $106.36 | $209.63 | 49.3% |

| Privia Health Group (PRVA) | $21.92 | $43.37 | 49.5% |

| Mid Penn Bancorp (MPB) | $29.49 | $57.45 | 48.7% |

| MAC Copper (MTAL) | $12.09 | $23.93 | 49.5% |

| Lyft (LYFT) | $15.71 | $31.22 | 49.7% |

| Insteel Industries (IIIN) | $39.03 | $76.82 | 49.2% |

| Carter Bankshares (CARE) | $17.88 | $35.50 | 49.6% |

| Camden National (CAC) | $42.59 | $83.04 | 48.7% |

| Acadia Realty Trust (AKR) | $18.51 | $36.55 | 49.4% |

Let's review some notable picks from our screened stocks.

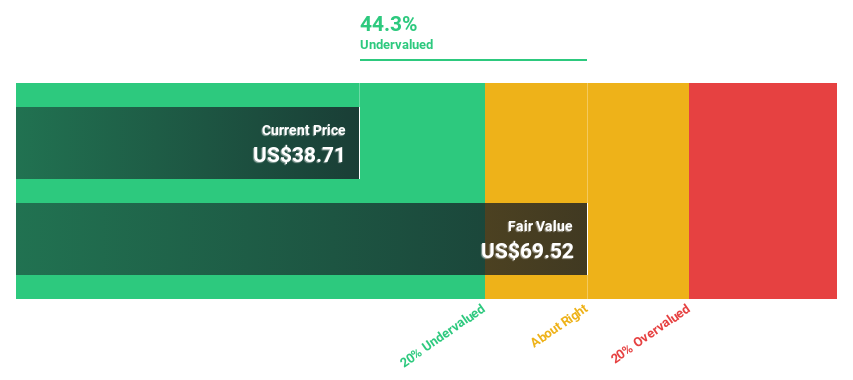

Citizens Financial Group (CFG)

Overview: Citizens Financial Group, Inc. is a bank holding company offering a range of retail and commercial banking products and services across the United States with a market cap of approximately $19.99 billion.

Operations: The company's revenue segments include Consumer Banking, generating $5.50 billion, and Commercial Banking, contributing $2.42 billion.

Estimated Discount To Fair Value: 27.7%

Citizens Financial Group is trading at US$47.03, significantly below its estimated fair value of US$65.06, indicating potential undervaluation based on discounted cash flow analysis. The company forecasts robust earnings growth of 20.6% annually, surpassing the US market average of 14.6%. Recent strategic moves include an expanded equity buyback plan and innovative credit card offerings with Mastercard, reflecting a commitment to enhancing shareholder value and customer engagement amid evolving market dynamics.

- Upon reviewing our latest growth report, Citizens Financial Group's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Citizens Financial Group.

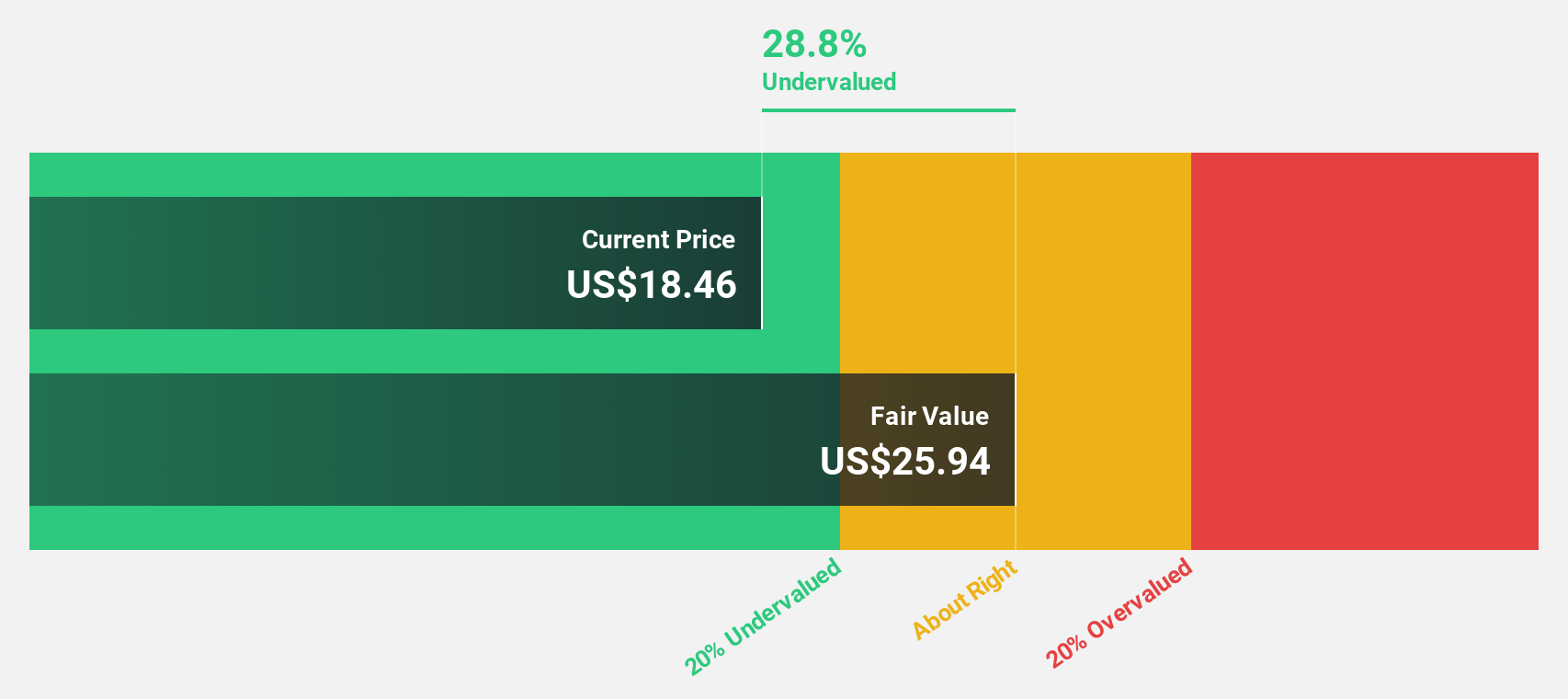

KeyCorp (KEY)

Overview: KeyCorp, with a market cap of approximately $19.58 billion, operates as the holding company for KeyBank National Association, offering a range of retail and commercial banking products and services across the United States.

Operations: KeyBank National Association generates revenue through its Consumer Bank segment, contributing $3.16 billion, and its Commercial Bank segment, contributing $3.38 billion.

Estimated Discount To Fair Value: 28.5%

KeyCorp is trading at US$18.2, below its fair value estimate of US$25.47, highlighting potential undervaluation based on cash flows. Despite a 28.5% discount to its fair value, the dividend coverage remains weak with earnings not fully supporting it. Revenue growth is projected at 14.4% annually, exceeding the US market average of 8.7%. Recent strategic partnerships with fintech firms aim to enhance cash management solutions and drive innovation in financial services delivery.

- Insights from our recent growth report point to a promising forecast for KeyCorp's business outlook.

- Navigate through the intricacies of KeyCorp with our comprehensive financial health report here.

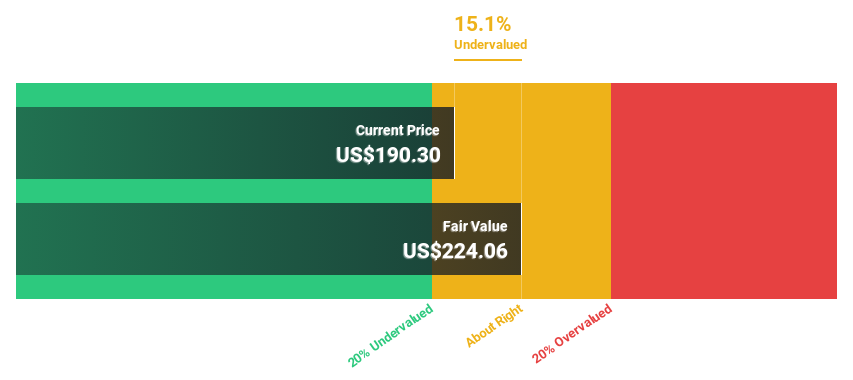

Targa Resources (TRGP)

Overview: Targa Resources Corp., along with its subsidiary Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary infrastructure assets in North America, with a market cap of approximately $37.31 billion.

Operations: Targa Resources generates revenue through its Gathering and Processing segment, which accounts for $7.19 billion, and its Logistics and Transportation segment, contributing $14.28 billion.

Estimated Discount To Fair Value: 32.5%

Targa Resources, trading at US$173.78, is undervalued with a fair value estimate of US$257.37. Despite high debt levels and weak dividend coverage by free cash flows, earnings are projected to grow 16.45% annually, surpassing the US market average of 14.6%. Recent fixed-income offerings totaling nearly $1.5 billion support financial flexibility while involvement in the Traverse Pipeline project indicates strategic growth initiatives in natural gas transportation infrastructure.

- In light of our recent growth report, it seems possible that Targa Resources' financial performance will exceed current levels.

- Get an in-depth perspective on Targa Resources' balance sheet by reading our health report here.

Taking Advantage

- Discover the full array of 178 Undervalued US Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Targa Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRGP

Targa Resources

Together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic infrastructure assets in North America.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives