- United States

- /

- Banks

- /

- NYSE:JPM

Tech Mahindra Joins JPMorgan Chase (JPM) To Enhance Global Payment Solutions For Enterprises

Reviewed by Simply Wall St

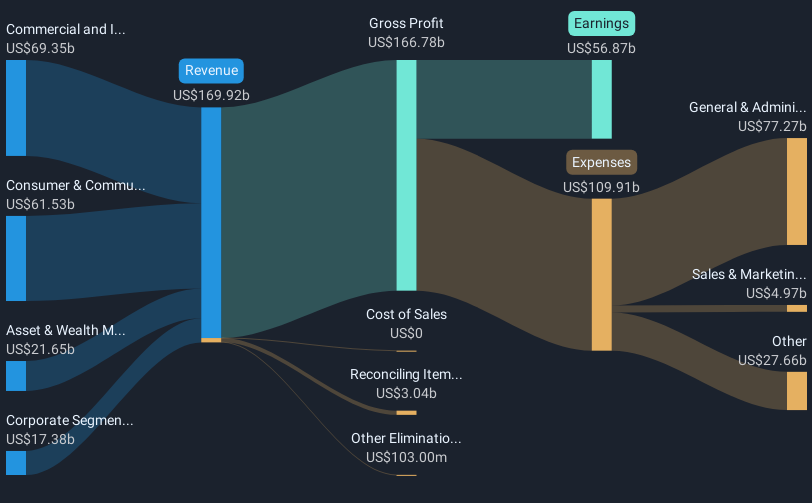

Recent developments at Tech Mahindra include joining the J.P. Morgan Payments System Integrator Program to enhance global enterprises' payment infrastructure. This move comes as JPMorgan Chase (JPM) saw its share price increase 21% over the last quarter. The company's performance aligns with broader market optimism, reflected by record highs in the S&P 500 driven by positive economic data and a favorable trade deal. J.P. Morgan's recent product launches and share buyback programs may have further supported this upward movement, suggesting strength in the company's response to market trends, in conjunction with other robust market segments.

You should learn about the 1 risk we've spotted with JPMorgan Chase.

Tech Mahindra's alliance with J.P. Morgan Payments System Integrator Program highlights its commitment to enhancing infrastructure. While the broader optimism in the market may boost sentiment around Tech Mahindra, the narrative warns of increased credit losses and higher expenses, which could impact future profitability. JPMorgan Chase's challenges with credit loss allowances and expenses underscore a cautious forward-looking approach. The narrative suggests constraints on net margins and a slow pace of revenue growth without significant changes.

Over the past five years, Tech Mahindra's total shareholder return, including share price and dividends, reached a substantial 242.46%. This impressive long-term performance contrasts with the shorter-term movements and market dynamics. While the company exceeded the US market's 14.6% return over the past year, it's essential to contextualize recent performance against industry and market benchmarks. Tech Mahindra's current share price of US$291.43 remains just below the analyst price target of US$300.54, posing a slight discount of 0.03% to its fair value consensus. This proximity to the price target reinforces the nuanced sentiment among analysts and stakeholders regarding future revenue and earnings trajectories.

Our valuation report unveils the possibility JPMorgan Chase's shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives