- United States

- /

- Banks

- /

- NYSE:JPM

Should Anticipated Strong Q3 Results Prompt Action From JPMorgan Chase (JPM) Investors?

Reviewed by Sasha Jovanovic

- JPMorgan Chase is set to report third-quarter earnings this week, with analysts widely anticipating strong year-over-year growth in both revenue and profits amidst favorable lending and improved investment banking activity.

- This reporting milestone comes as positive sentiment and upward earnings estimate revisions put the spotlight on banks’ profitability, with JPMorgan’s results expected to influence broader perceptions of the sector’s resilience.

- We'll explore how the market's optimism for robust quarterly results could shape JPMorgan's investment narrative and future outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

JPMorgan Chase Investment Narrative Recap

To own shares of JPMorgan Chase, an investor needs to believe the firm's global scale, diversified earnings, and ongoing investment in technology can keep it resilient through changing markets and competitive threats, while regulatory burdens and macro risks remain persistent challenges. The appointment of new EMEA leadership is not expected to materially alter the main near-term catalyst, upcoming earnings driven by lending and investment banking strength, or shift the current biggest risk of tighter regulation and digital disruption.

This leadership change is most relevant to JPMorgan's ongoing international expansion and its push across Europe, the Middle East, and Africa. While the new co-CEOs bring deep banking expertise, their appointments reinforce management’s efforts to grow fee-based and cross-border businesses, aligning with expected positive momentum in lending and dealmaking highlighted as short-term catalysts.

But investors should also keep in mind the risk that, despite market optimism, regulatory and technology shifts could reshape profitability faster than anticipated, especially if...

Read the full narrative on JPMorgan Chase (it's free!)

JPMorgan Chase's outlook anticipates $186.7 billion in revenue and $55.5 billion in earnings by 2028. This reflects an annual revenue growth rate of 4.5%, and a modest earnings increase of $0.3 billion from the current earnings of $55.2 billion.

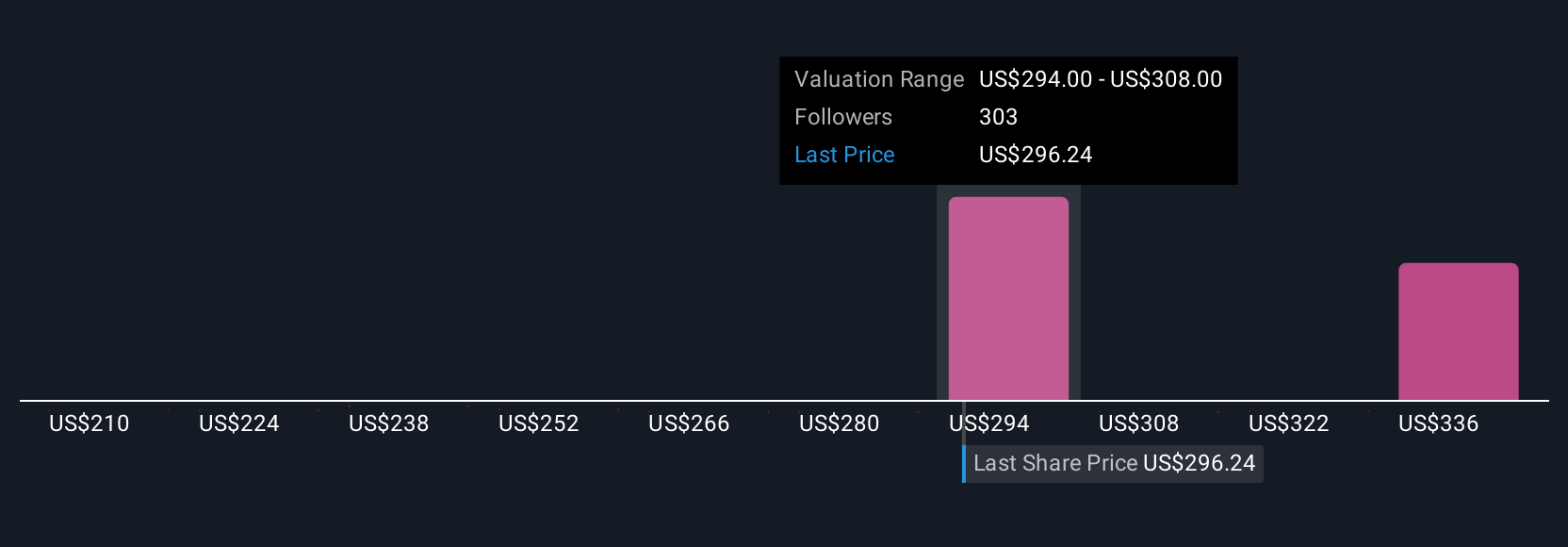

Uncover how JPMorgan Chase's forecasts yield a $320.96 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Some of the most pessimistic analysts were concerned about higher credit losses and rising expenses eating into future earnings, with forecasts for 2028 net income as low as US$53.2 billion. If you’re considering JPMorgan Chase, it’s worth understanding how events like executive changes and global challenges could shift these views and why opinions can vary so widely within the same set of numbers.

Explore 25 other fair value estimates on JPMorgan Chase - why the stock might be worth as much as 14% more than the current price!

Build Your Own JPMorgan Chase Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JPMorgan Chase research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JPMorgan Chase's overall financial health at a glance.

No Opportunity In JPMorgan Chase?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives