- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (NYSE:JPM) Unveils Center For Geopolitics To Guide Clients On Global Trends

Reviewed by Simply Wall St

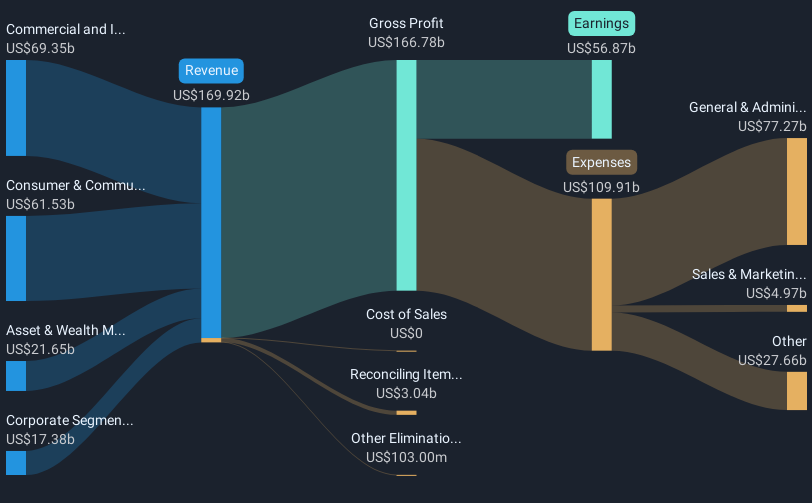

JPMorgan Chase (NYSE:JPM) recently saw a 14% gain in its share price over the last month, highlighting a period of positivity for the firm amidst several strategic developments. The company's launch of the JPMorganChase Center for Geopolitics could offer clients vital insights into evolving global business landscapes. Additionally, the recent dividend affirmation may enhance investor sentiment, reinforcing a welcoming environment for income-focused investors. In the broader market, stock momentum was sluggish, with a 1.1% drop, suggesting that JPMorgan's positive movement diverges from broader market trends, potentially amplified by its product innovations and business expansions.

Find companies with promising cash flow potential yet trading below their fair value.

JPMorgan Chase's recent developments, such as the launch of the JPMorganChase Center for Geopolitics and the reaffirmation of its dividend, could enhance investor confidence and potentially influence future earnings positively. The company's strategic initiatives might also support revenue growth by providing deeper insights to clients, although increased credit loss allowances and expenses could pose challenges. Over the past five years, the company's total returns, including dividends, reached 195.94%, reflecting a substantial gain over this long-term period.

Compared to the broader market, JPMorgan Chase's share price movement over the past year has been remarkable, outperforming the sluggish market which experienced a 9.1% return. These gains indicate that the company's recent strategic moves may have played a role in boosting investor sentiment and stock performance. In the context of the consensus analyst price target of US$266.19, the company's current share price shows a minor discount, suggesting a relatively aligned market perception of its fair value, despite underlying bearish narratives about potential revenue and earnings pressures.

Assess JPMorgan Chase's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives