- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (NYSE:JPM) Posts Strong Q1 Earnings With US$14,643 Million Net Income

Reviewed by Simply Wall St

JPMorgan Chase (NYSE:JPM) announced a strong first-quarter earnings report for 2025, revealing impressive growth in net income and earnings per share compared to the previous year. These positive results likely added weight to the stock's 12% price increase over the past week. During this period, the market itself rose by 5%, indicating that broader market trends may also have contributed to JPM's performance. The solid financial performance underscored the company's resilience, amplifying investor confidence alongside general market optimism, even though no specific market news was reported during the week.

The recent positive earnings announcement from JPMorgan Chase, coupled with a 12% share price increase within a week, underscores the potential for enhanced investor sentiment. However, when analyzing the company over a longer period, JPMorgan Chase has delivered total returns of 185.19% over the past five years. This strong performance sets a robust context compared to the broader US Banks industry, which saw a return of 10.3% in the past year. Such historical performance reflects the company's resilience and its capacity to provide shareholder value despite existing challenges.

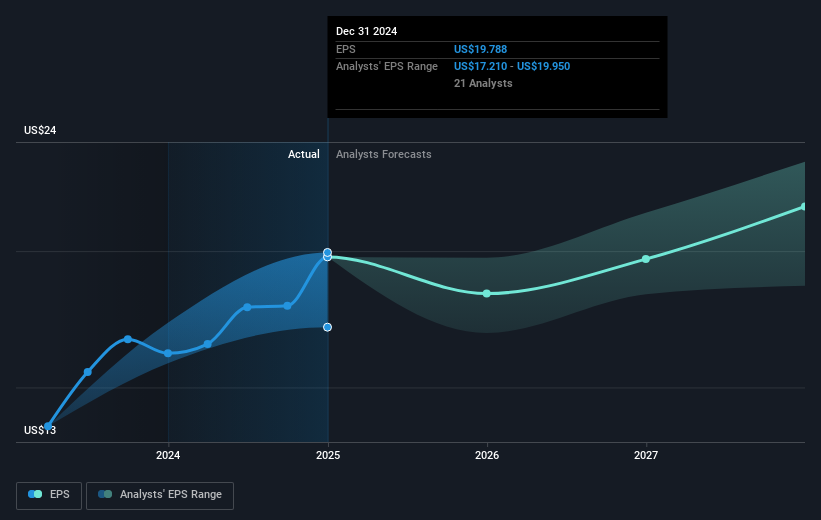

In regards to the company's revenue and earnings forecasts, the recent earnings report may bolster expectations, although concerns about rising expenses and margin compression remain pertinent. JPMorgan anticipates rising costs due to investments in diverse areas, which could potentially affect profitability if revenue fails to keep up. The share price, now at US$234.34, is lower than the consensus price target of US$258.88 but close to the bearish target of US$227.84, hinting at varied market perceptions about its valuation relative to future earnings pressures and regulatory hurdles. As such, the financial community may observe these developments closely to gauge the impact on the bank's fiscal projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives