- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (NYSE:JPM) Drops 13% Following Trade Tension Impact

Reviewed by Simply Wall St

JPMorgan Chase (NYSE:JPM) recently experienced a 13% price decline amid a turbulent week for global markets. While initiatives such as launching the Money Smart Financial Coaching Program and appointing Carl Torrillo as Managing Director underline its strategic focus on expansion and leadership, the broader market's response to escalating trade tensions played a pivotal role in this downturn. With major indices like the S&P 500 and Nasdaq dropping significantly due to tariff concerns, JPM's financial position aligned with the broader financial sector's fall, highlighting the shared impact of the market climate on its performance.

JPMorgan Chase has delivered significant long-term returns, with a 135.17% increase over the last five years. Despite a challenging recent period, the company's performance reflects robust financial management and strategic initiatives. The share price appreciation, combined with dividends, underscores the company's growth despite market volatility. Shareholder returns over the past year also surpassed both the overall US market and the banking industry, demonstrating resilience amidst economic pressures.

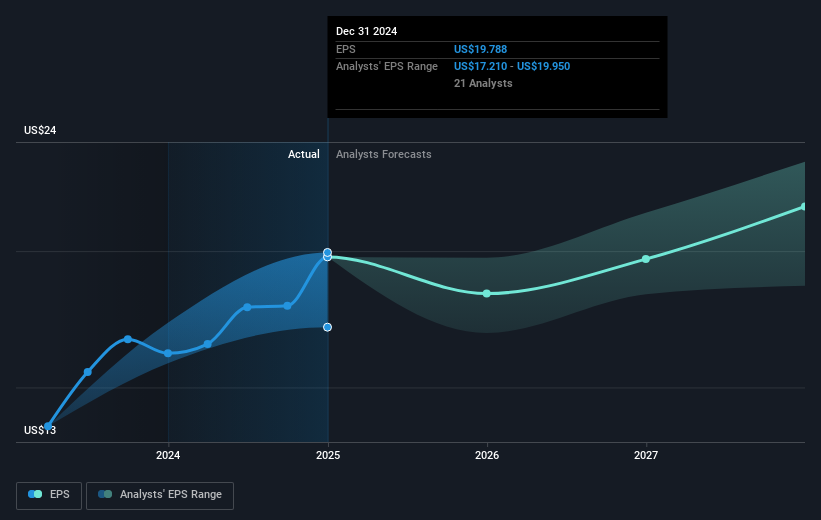

A few key factors have contributed to this performance. Technological investments and strategic hiring have bolstered the bank's operational efficiency and revenue potential. Record net inflows in asset management and investment banking momentum have further fueled financial growth. Additionally, strong earnings performance reported for the full year in January 2025, with net income reaching US$58.5 billion, highlights successful financial execution. Dividend declarations, such as the quarterly US$1.40 per share, reinforce the firm's commitment to rewarding shareholders, enhancing total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade JPMorgan Chase, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives