- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (JPM) Profit Margins Hit 33.9%, Challenging Bearish Slower-Growth Narratives

Reviewed by Simply Wall St

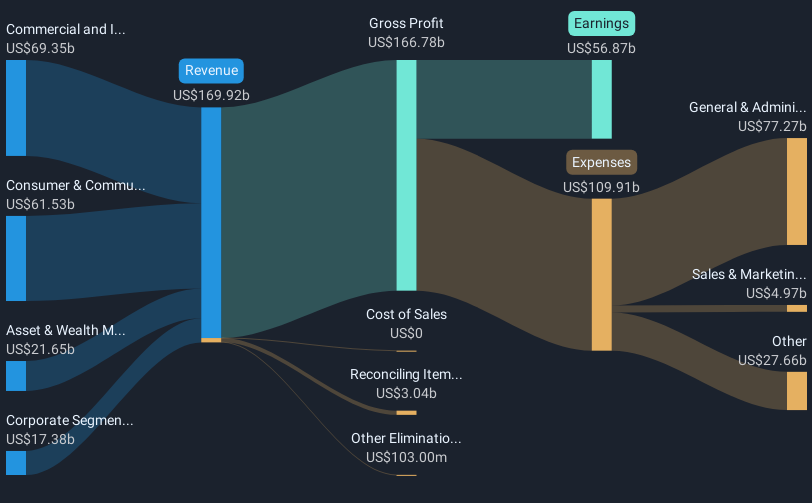

JPMorgan Chase (JPM) reported a net profit margin of 33.9%, up from 32.1% last year, while earnings have grown at an average rate of 11.1% per year over the last five years. Most recently, annual earnings growth was 8.8%, which is below trend, with forecasts now pointing to just 0.7% expected per year, well behind the US market’s 15.5% outlook. Despite these muted projections, investors are weighing a combination of strong historical profitability, a current share price below estimated fair value, and a premium price-to-earnings ratio in the context of slower growth ahead.

See our full analysis for JPMorgan Chase.Now, let's see how the latest results stack up against the dominant market narratives. This comparison highlights where expectations align and where the numbers could challenge the consensus.

See what the community is saying about JPMorgan Chase

Tech Investments Drive Cost Growth

- Total expenses rose by 4% over the previous year to $23.6 billion, as highlighted in the latest filing. Major increases were attributed to rising technology investment and compensation costs.

- Bulls say these investments signal JPMorgan's commitment to long-term tech leadership, not just cost inflation.

- The bullish case argues that accelerating spending on digital banking and blockchain will fuel transformative productivity gains and provide an edge in global payments and wealth management, likely offsetting near-term hits to net margins.

- What is striking is that despite these heavier costs, net profit margins remained high at 33.9%. This heavily supports the bullish view that scale and tech integration are driving sustainable efficiency.

Credit Loss Allowances Signal Caution

- The allowance for credit losses climbed to $27.6 billion, reflecting increased downside risks and higher unemployment projections factored into JPMorgan’s credit models.

- Bears highlight the risk that this build-up points to mounting economic uncertainty, threatening to squeeze future profits if charge-offs rise.

- Rising reserves, particularly in consumer lending, give weight to bearish concerns that JPMorgan is proactively bracing for tougher times. Worsening credit quality would directly restrain net income growth.

- At the same time, bears warn that elevated expense growth could eat further into operating margins should revenue not accelerate. This is core to their skepticism on sustained profitability.

Premium Valuation Versus Peers Holds Firm

- JPMorgan trades at a price-to-earnings ratio of 14.7x, above both the US Banks industry average (11.5x) and the peer average (13.3x), even as its current share price of $302.08 remains nearly 11% below its DCF fair value of $340.99.

- Analysts' consensus view notes that this premium pricing reflects investor confidence in JPMorgan’s historical earnings quality and resilience.

- The consensus narrative suggests that, while future annual earnings growth is expected to slow to just 0.7% per year (well below the US market’s 15.5%), sustained leadership across wealth management, digital banking, and payments supports the case for a stable, blue-chip rerating above the sector.

- However, the modest upside from current share price to the $322.61 analyst price target underscores a belief that much of this resilience is already reflected. This limits the scope for outsized gains without a positive shift in growth expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for JPMorgan Chase on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different view on the figures above? Share your take and craft your own narrative in just a few minutes. Do it your way

A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

With JPMorgan’s outlook dampened by slowing earnings growth and rising credit costs, which could restrict future profitability, some investors may want more consistent performance.

If you want steadier, more reliable expansion, check out stable growth stocks screener (2090 results) to target companies delivering strong, sustainable growth regardless of economic uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives