- United States

- /

- Banks

- /

- NYSE:JPM

Is JPMorgan (JPM) Still Undervalued After Its Strong Year-to-Date Share Price Rally?

Reviewed by Simply Wall St

JPMorgan Chase (JPM) keeps grinding higher, and with shares up around 31 % this year, investors are starting to ask a simple question: is there still enough upside left to matter?

See our latest analysis for JPMorgan Chase.

That move has come alongside a steady stream of solid earnings and resilience through rate uncertainty. With the share price now around 315.55 dollars, JPMorgan Chase’s strong year to date share price return and hefty multi year total shareholder returns suggest momentum is still very much intact rather than fading.

If JPMorgan Chase’s run has you rethinking your financials exposure, this is a good moment to explore other leading solid balance sheet and fundamentals stocks screener (None results) that could complement or diversify your bank holdings.

With JPMorgan Chase now trading close to analyst targets but still showing a modest intrinsic discount, investors face a key question: is this banking giant quietly undervalued, or is the market already baking in years of growth?

Most Popular Narrative: 3.8% Undervalued

With JPMorgan Chase closing at 315.55 dollars against a narrative fair value near 328 dollars, the story leans toward modest upside built on resilient profitability.

The analysts have a consensus price target of $306.174 for JPMorgan Chase based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $350.0, and the most bearish reporting a price target of just $235.0.

Want to see how steady revenue growth, margin compression, and a richer future earnings multiple can still justify higher value for a mature bank giant? The full narrative unpacks the precise growth path, profitability assumptions, and valuation bridge that turn today’s price into a long term upside case.

Result: Fair Value of $328.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster fintech disruption and tighter capital rules could pressure JPMorgan’s fee income and margins and challenge the earnings and valuation assumptions behind this upside case.

Find out about the key risks to this JPMorgan Chase narrative.

Another Angle on Valuation

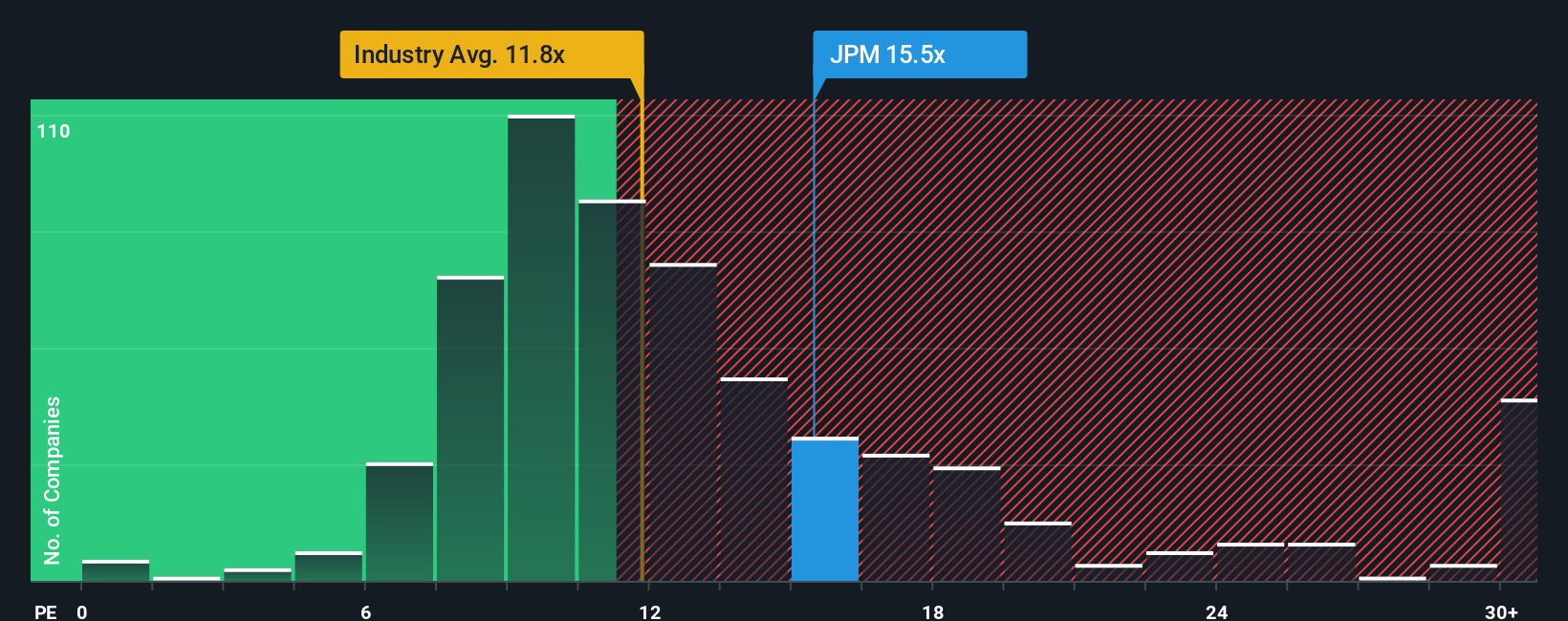

On earnings multiples, JPMorgan looks richer than many rivals, trading on a 15.2 times price to earnings ratio versus 13.9 times for peers and 12 times for the wider US banks industry. Yet that sits close to a 15.5 times fair ratio, so is this really froth, or just a premium that sticks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JPMorgan Chase Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a fresh narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding JPMorgan Chase.

Ready for your next investing moves?

Before you stop at JPMorgan, broaden your edge with fresh ideas from our Simply Wall St Screener so you do not miss tomorrow’s most compelling opportunities.

- Capture potential multi baggers early by scanning these 3632 penny stocks with strong financials that already back their tiny share prices with real, improving fundamentals.

- Ride structural growth trends by zeroing in on these 30 healthcare AI stocks harnessing data, diagnostics, and automation to reshape global healthcare.

- Strengthen your portfolio’s income engine by targeting these 13 dividend stocks with yields > 3% that combine attractive yields with underlying business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)