- United States

- /

- Banks

- /

- NYSE:HTH

Hilltop Holdings (HTH): Evaluating Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

Hilltop Holdings (HTH) shares have seen some movement lately, which prompts a closer look at the company’s recent performance and how its stock is holding up. Investors may be weighing the implications of its returns and underlying fundamentals.

See our latest analysis for Hilltop Holdings.

After a solid stretch of upward momentum this year, Hilltop Holdings’ share price has cooled off a bit lately, pulling back 7.5% over the last month after climbing more than 15% year-to-date. Still, long-term investors have enjoyed notable gains, with a total shareholder return of over 67% in the past five years. This demonstrates the stock's ability to generate value even during short-term dips.

If this shift in sentiment has you looking for the next standout, now could be the perfect time to discover fast growing stocks with high insider ownership

With shares pulling back and fundamentals presenting a mixed picture, investors must now consider whether Hilltop Holdings is trading at an attractive valuation, or if the market has already accounted for the company’s future potential. Could this be a buying opportunity, or is growth already priced in?

Most Popular Narrative: 2.2% Undervalued

Hilltop Holdings trades at $32.60, just below the narrative's fair value estimate of $33.33. This minimal gap reflects nuanced expectations embedded in the numbers and future outlook.

The ongoing shift toward digital financial services allows Hilltop to gain operational efficiencies and lower operating costs, as management focuses on further digital investments and improving customer analytics. This leads to better efficiency ratios and expanded net margins over time.

Curious how digital upgrades and efficiency bets fuel this slim valuation edge? The narrative hinges on a dramatic shift in profitability, driven by bold assumptions about future growth and margin resilience. Want to see what makes analysts confident in this premium? Dive into the full story to decode the math that underpins this valuation.

Result: Fair Value of $33.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent mortgage headwinds and intensifying competition in Texas could quickly offset recent gains and present challenges to Hilltop Holdings' long-term profit outlook.

Find out about the key risks to this Hilltop Holdings narrative.

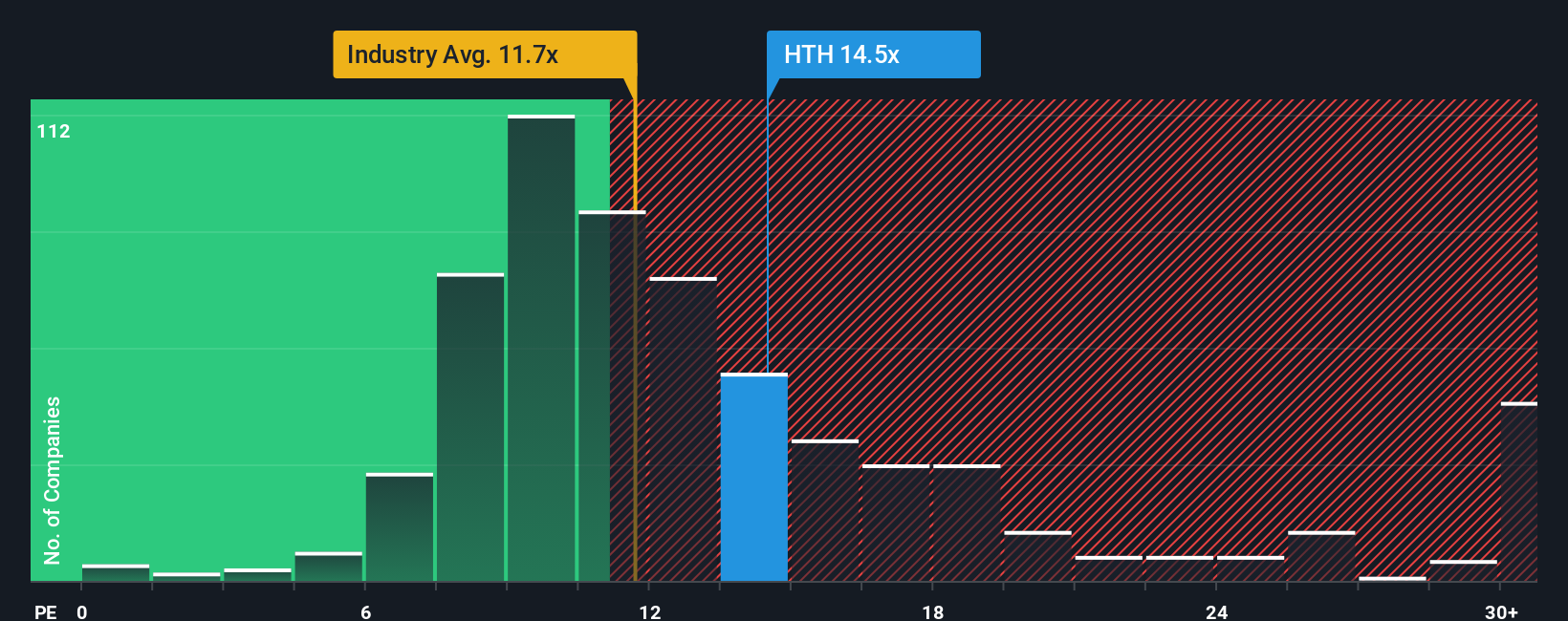

Another View: Market Ratios Signal Mixed Messages

Looking at Hilltop Holdings through the lens of its price-to-earnings ratio, we find a more skeptical story. The stock is trading at 14.3 times earnings, which makes it more expensive than typical U.S. banks (11.8x) but still cheaper than its closest peers (18.9x). However, compared to its fair ratio of 8.8x, the current valuation looks stretched, suggesting less margin for safety if earnings waiver. Does the market expect growth that the numbers do not guarantee, or does this reflect hidden optimism about the business?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hilltop Holdings Narrative

If you see the numbers differently or want to dig deeper on your terms, you can analyze the facts and shape your own story in just a few minutes. Do it your way.

A great starting point for your Hilltop Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity? Open up your investing playbook with unique stocks filtered by the features that matter most to your strategy.

- Unlock potential with high-yield picks and steady cash flow by checking out these 19 dividend stocks with yields > 3% to see where reliable income meets real returns.

- Fuel your search for tomorrow’s tech leaders by scouting these 25 AI penny stocks filled with companies positioned at the forefront of artificial intelligence innovation.

- Spot bargains others might overlook by zeroing in on undervalued opportunities right now with these 894 undervalued stocks based on cash flows and make your next investment count.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilltop Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HTH

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives