- United States

- /

- Banks

- /

- NYSE:FNB

Does FNB Present Opportunity After Strong 21% Yearly Rise in 2025?

Reviewed by Bailey Pemberton

If you have been eyeing F.N.B stock and wondering whether now might be the time to make a move, you are not alone. This regional bank has quietly outperformed many of its peers over the past five years, growing over 161.0% during that period. Even after a modest dip of 1.4% in the past month, F.N.B’s share price remains up 11.8% for the year and has gained a remarkable 21.1% over the last twelve months. In the last week, movement has been relatively flat at 0.1%, which may indicate that investors are pausing to reassess as broader market dynamics shift.

Some of this growth stems from positive developments in the banking sector and trends favoring larger regionals. It also reflects shifting risk perceptions as investors respond to the company’s stability and expansion efforts. As you consider your options regarding F.N.B, a closer look is warranted. The company’s valuation score stands at 3 out of 6, indicating it is undervalued in half of the metrics commonly used to price bank stocks.

But what do those valuation methods actually mean for you as an investor? In the next sections, we will break down the traditional ways to measure F.N.B’s value and explore how the company performs in each category. Before making a final decision, we will also examine a more comprehensive approach to evaluating whether F.N.B could be a suitable addition to your portfolio.

Why F.N.B is lagging behind its peers

Approach 1: F.N.B Excess Returns Analysis

The Excess Returns valuation method measures how effectively a company generates returns above its cost of equity. Essentially, this approach evaluates whether F.N.B’s investments are creating true value for shareholders. This model focuses on return on invested capital, future profitability, and the sustainability of those returns.

According to the latest analysis, F.N.B has a Book Value of $18.17 per share and a Stable EPS of $1.65 per share, based on projections from five analysts. The Cost of Equity is $1.45 per share. This means the company generates an Excess Return of $0.20 per share. F.N.B’s average Return on Equity is a healthy 8.47%. Looking ahead, the company’s Stable Book Value is forecasted to rise to $19.46 per share, using data collected from six analysts.

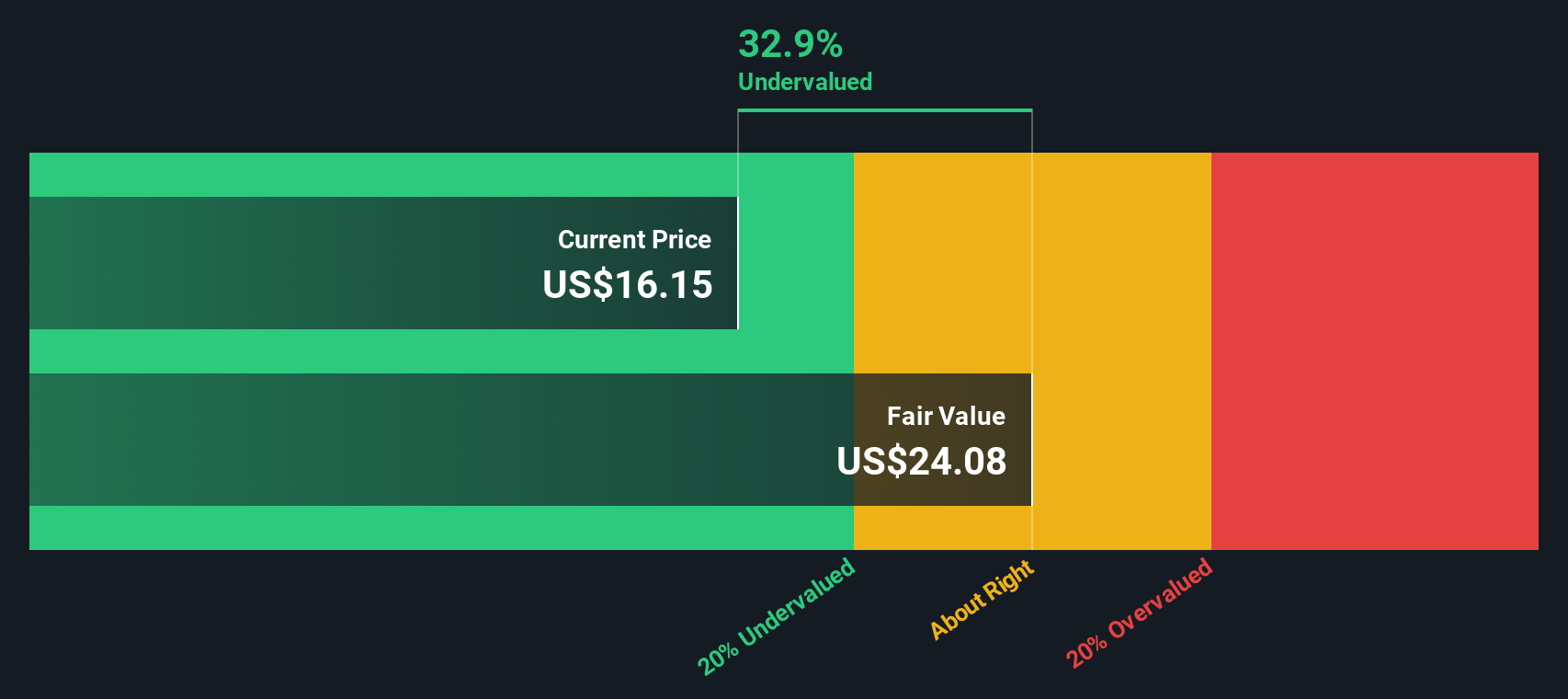

Based on these factors, the intrinsic value per share using the Excess Returns Model is estimated at $24.06. With the stock’s current price reflecting a 32.5% discount to this valuation, F.N.B appears significantly undervalued by this measure.

Result: UNDERVALUED

Our Excess Returns analysis suggests F.N.B is undervalued by 32.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: F.N.B Price vs Earnings

The Price-to-Earnings (PE) ratio is often the preferred valuation tool for established, profitable companies like F.N.B. It gives investors quick insight into how much they are paying for each dollar of a company’s earnings, making it a straightforward way to compare value across similar businesses.

Growth expectations and risk profile play a key role in determining what a “normal” or “fair” PE ratio should look like. Companies with strong earnings growth or lower risk typically command higher PE ratios. Those facing growth challenges or greater risks often trade at a discount.

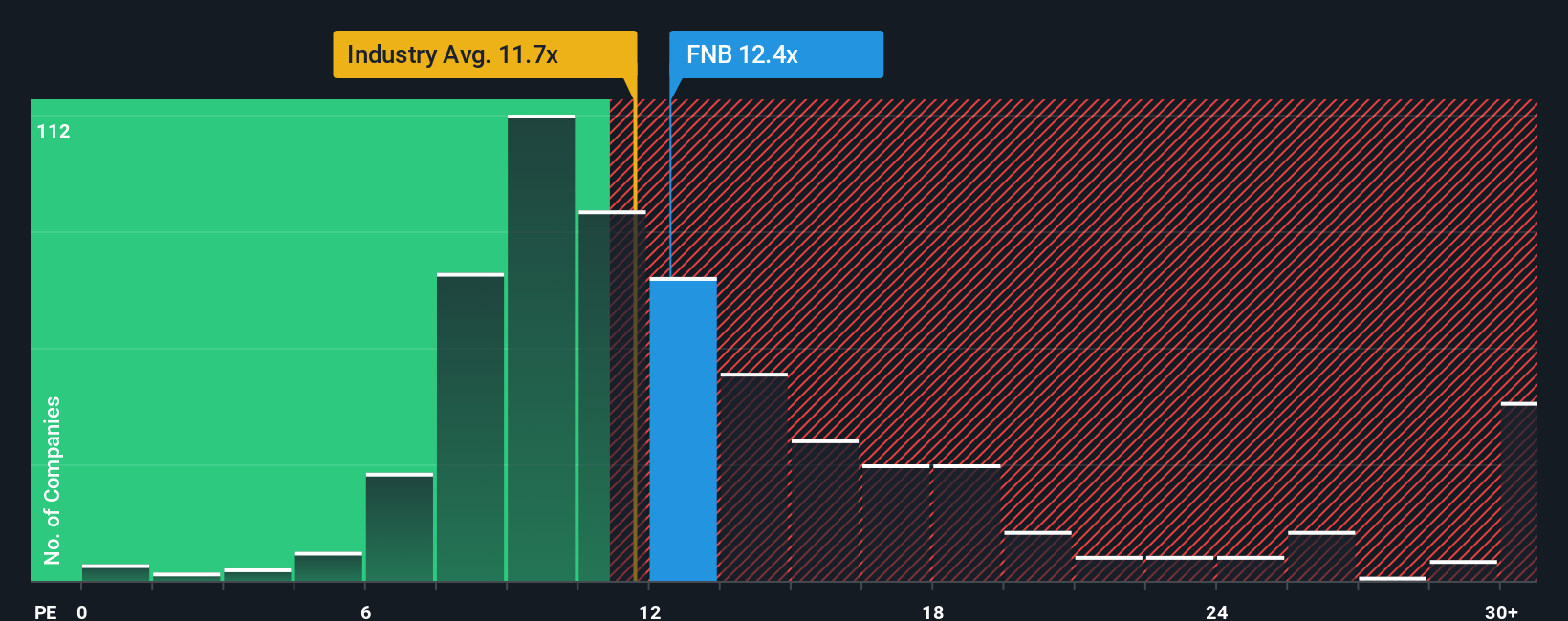

Currently, F.N.B trades at a PE ratio of 12.50x. This is slightly above the industry average of 11.80x and the peer average of 11.45x. This suggests the market values F.N.B’s profitability and growth prospects at a modest premium. However, Simply Wall St calculates its proprietary Fair Ratio for F.N.B to be 14.70x. The Fair Ratio differs from a simple industry or peer comparison because it is tailored to the company’s unique earnings growth outlook, risk profile, profit margins, and size within its industry and market.

By comparing F.N.B’s current PE to its Fair Ratio, the stock appears to be undervalued, since it is trading below the level justified by its fundamentals and expected performance.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your F.N.B Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story about a company like F.N.B, combining your views on its prospects with numbers such as fair value and future estimates for revenue, earnings, and margins.

Rather than just relying on static ratios, Narratives directly link F.N.B’s business story, such as its digital investments and market expansion, to financial forecasts and a calculated fair value. This approach makes your investment thesis clear and actionable. Narratives are designed to be intuitive and are readily available on the Simply Wall St Community page, where millions of investors compare their ideas and see different perspectives in real time.

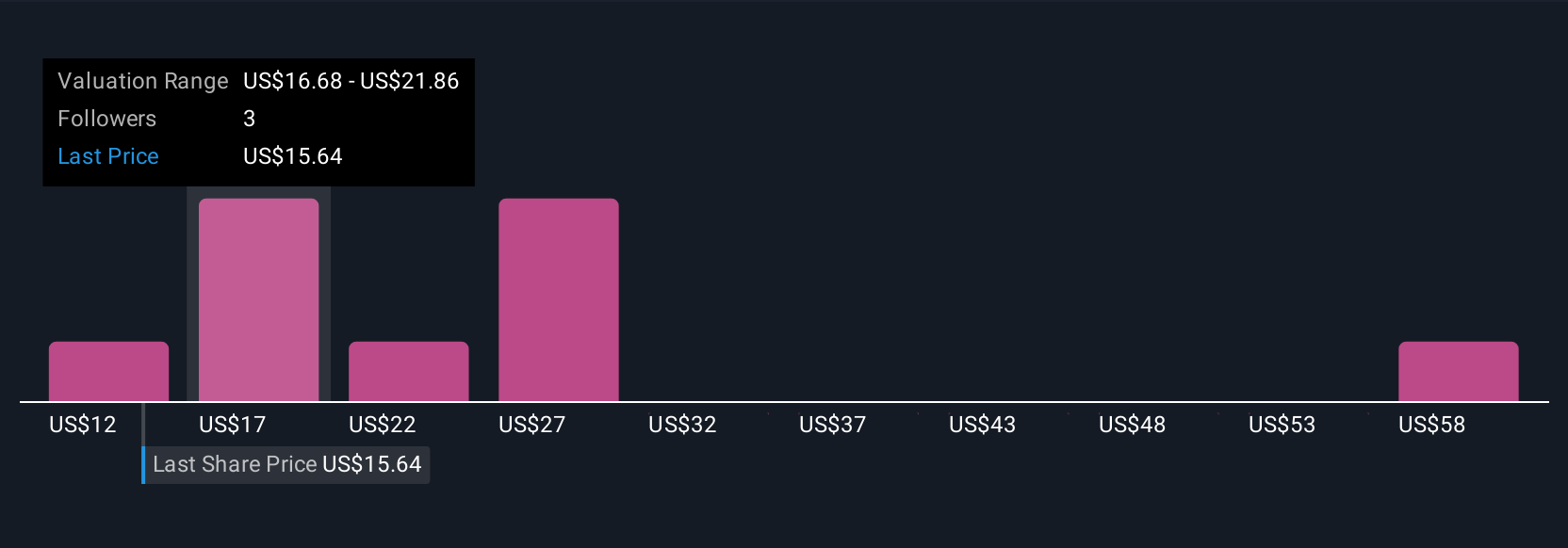

Narratives help you decide when to buy or sell by directly showing how your view of Fair Value compares to the current price. They update automatically when new developments, like earnings results or major news, are released. For example, one F.N.B Narrative sees strong digital innovation and growth potential, setting a fair value at $18.56 per share. Another, more conservative view, puts fair value closer to $16.36 per share. This highlights how different stories can lead to different, but equally valid, judgments on what F.N.B is really worth.

Do you think there's more to the story for F.N.B? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FNB

F.N.B

A bank and financial holding company, provides a range of financial products and services primarily to consumers, corporations, governments, and small- to medium-sized businesses in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives