- United States

- /

- Banks

- /

- NYSE:FHN

First Horizon (FHN): Valuation in Focus After Michael Moehn Joins Board, Signaling Strategic Changes

Reviewed by Simply Wall St

If you’ve been watching First Horizon (FHN) lately, there’s a fresh storyline worth your attention. The company just added Michael Moehn, a seasoned executive from Ameren, to its Board of Directors. This move could have meaningful implications for First Horizon’s approach to strategy and governance. For investors, welcoming someone with Moehn’s background in finance, strategic planning, and risk management to the boardroom might be more than just a routine leadership shuffle. It signals a broader intent to enhance oversight and focus on future growth potential.

This board appointment comes at an interesting time for First Horizon. The stock has climbed 42% over the past year and is up 12% so far this year, a pace that outpaces many peers in the sector. There has also been momentum in recent months, with shares up 12% for the past quarter despite some minor dips in the past month. Alongside this, First Horizon has continued to evolve by bringing in new leadership for consumer banking and making operational moves in key markets, which suggests an ongoing push for transformation and scale.

With shares pushing higher and a new director known for tech-savvy leadership, investors are left weighing a familiar question: Is First Horizon undervalued at current levels, or is the market already reflecting all of its future growth prospects?

Most Popular Narrative: 8.2% Undervalued

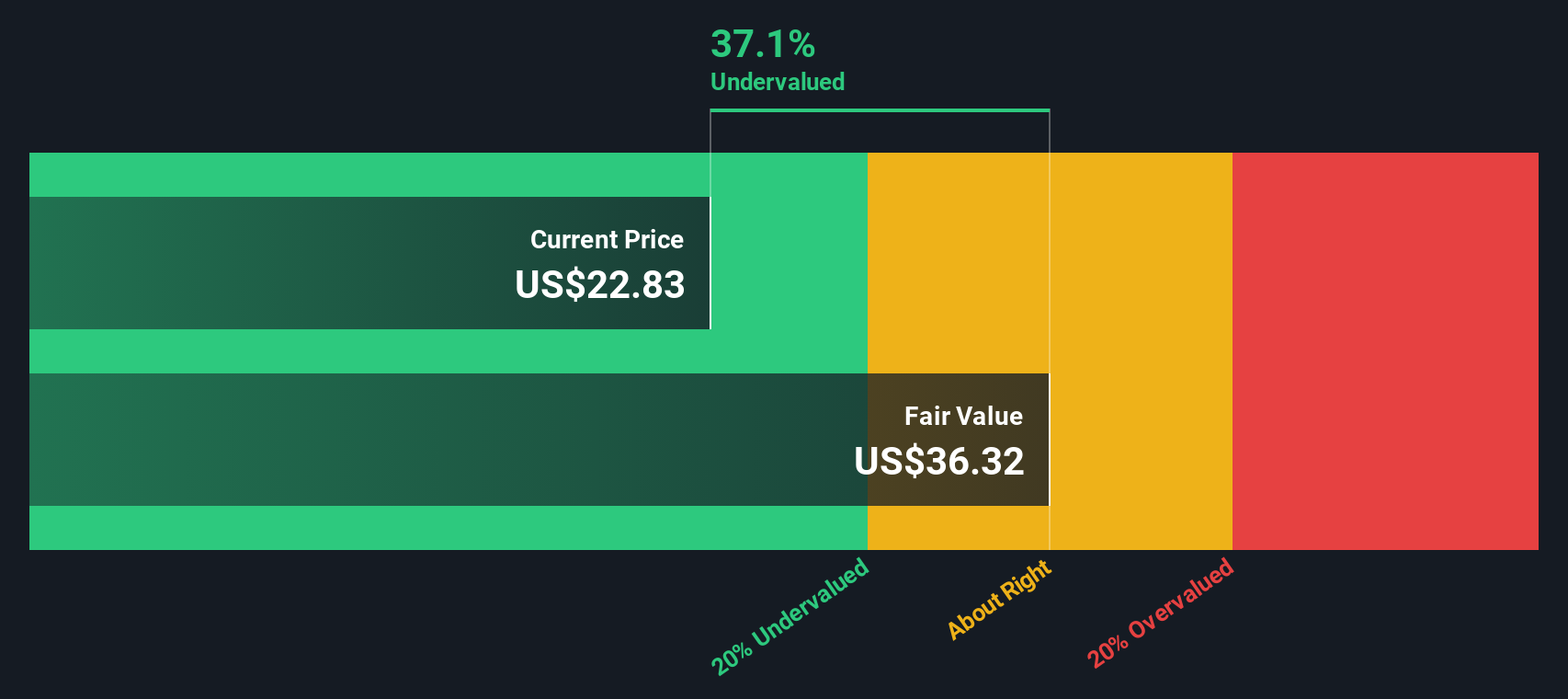

According to community narrative, First Horizon is considered undervalued, with a fair value estimate notably above its recent trading price.

*The analysts have a consensus price target of $24.516 for First Horizon based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $22.0.*

What is fueling the optimism? Analysts are making bold assumptions about future earnings, margins, and how highly this bank deserves to be valued. Want to know if these projections are rooted in realism or just blue-sky thinking? The narrative suggests there is more to this valuation than meets the eye. It is not just about steady banking profits. Find out what makes this target price so intriguing.

Result: Fair Value of $24.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing macroeconomic uncertainty and rising credit risks could disrupt First Horizon’s growth trajectory. These factors may also challenge analysts’ optimistic assumptions.

Find out about the key risks to this First Horizon narrative.Another View: Putting It to the Test

While the first valuation method points to a discount, our DCF model tells a similar story, suggesting the market could be underestimating First Horizon’s intrinsic worth. Are both approaches seeing the same picture, or missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Horizon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Horizon Narrative

If the current analysis does not align with your own perspective or if you prefer to dig into the figures yourself, you can craft your own take on First Horizon using your own research in just a few minutes. do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding First Horizon.

Looking for Your Next Great Opportunity?

Stay ahead of the game by exploring new investment angles beyond First Horizon. The Simply Wall Street Screener can help you find stocks with growth potential, unique themes, or smart income strategies. Missing out could mean overlooking some of the market’s brightest opportunities right now:

- Discover high-potential companies in the artificial intelligence sector by starting your search among AI penny stocks.

- Find alternative value by checking out undervalued stocks based on cash flows with healthy cash flows at attractive prices.

- Strengthen your portfolio with reliable income from dividend stocks with yields > 3%, featuring yields above 3% and steady financial performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FHN

First Horizon

Operates as the bank holding company for First Horizon Bank that provides various financial services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives