- United States

- /

- Banks

- /

- NYSE:FCF

Exploring First Commonwealth Financial’s (FCF) Valuation Following Sector Optimism and Easing Liquidity Concerns

Reviewed by Kshitija Bhandaru

First Commonwealth Financial (FCF) shares moved alongside regional banks as upbeat earnings from major financial institutions sparked renewed optimism. Recent signals from Fed Chair Jerome Powell about liquidity have helped improve sentiment across the sector.

See our latest analysis for First Commonwealth Financial.

The latest momentum in First Commonwealth Financial’s share price has been shaped by sector-wide optimism, with upbeat results at bigger banks and liquidity signals from the Fed drawing attention. Still, after a rapid rally with a standout 5-year total shareholder return of 103.5%, the share price has pulled back by 6.2% year-to-date and 10% over the last month. This reminds investors that even regional banking surges can be short-lived if market winds shift.

If you’re watching the currents shift in financial stocks, it could be a great moment to broaden your search and uncover fast growing stocks with high insider ownership.

With shares pulling back despite strong recent growth and the stock trading below analyst price targets, investors must now decide if First Commonwealth Financial is undervalued or if the market is already anticipating the next stage of growth.

Most Popular Narrative: 19% Undervalued

The widely followed narrative suggests First Commonwealth Financial has room to run. Its analyst fair value estimate sits meaningfully above the last close of $15.52. With the share price lagging behind what analysts believe the company is worth, the discussion centers on what could spark a re-rating.

Continued investment in scalable digital banking platforms and treasury management solutions is enabling the bank to acquire new customers at lower incremental cost, improve customer experience, and deepen client relationships. This is leading to enhanced operational efficiency and the potential for higher net margins over time.

Curious what future benchmarks must be met to achieve this upside? The full narrative hinges on ambitious projections and a bet on margin expansion tied to digital transformation. Ready to see the numbers and hidden levers behind this valuation call?

Result: Fair Value of $19.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from national banks and the risk of slower digital upgrades could quickly erode margins and create challenges for First Commonwealth Financial’s earnings outlook.

Find out about the key risks to this First Commonwealth Financial narrative.

Another View: Comparing the Numbers

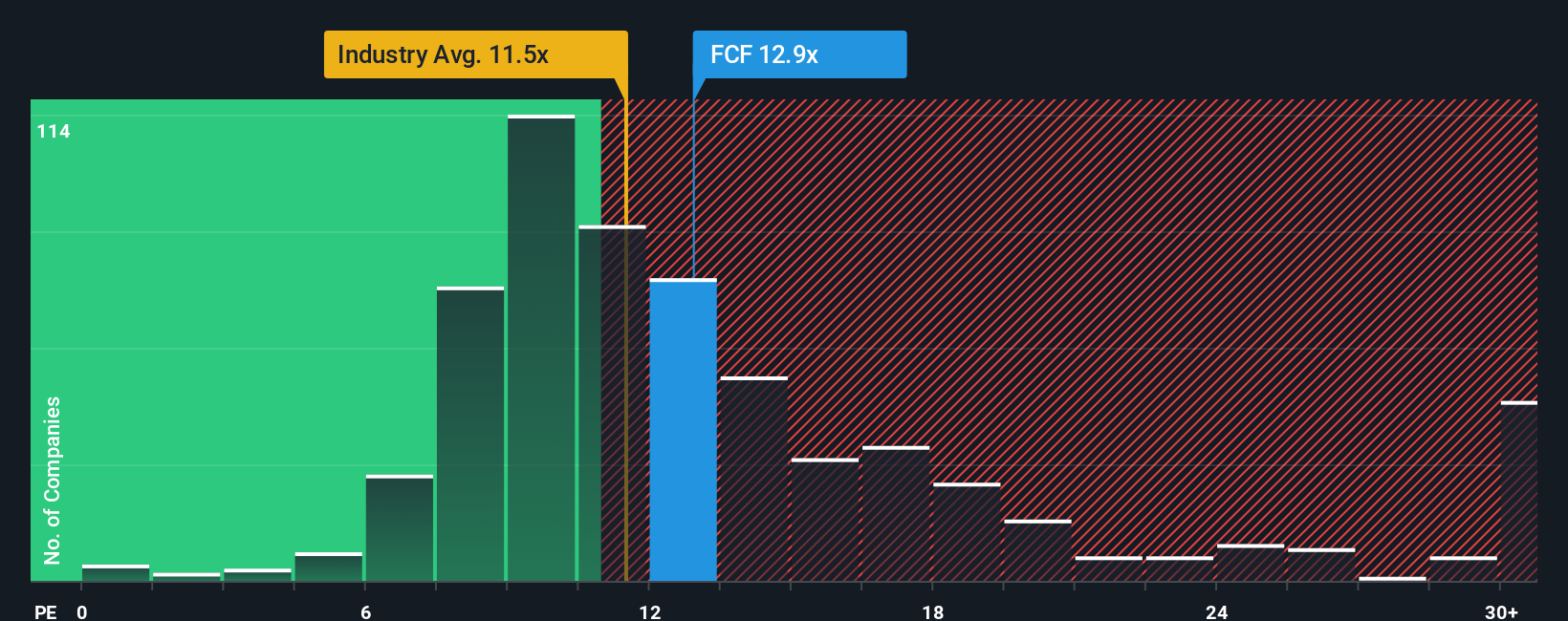

While some see upside in First Commonwealth Financial’s analyst fair value, a look at its price-to-earnings ratio raises questions. The company trades at 12.1x, which is slightly higher than both the peer average (11.8x) and the US industry average (11.6x). The fair ratio for FCF could be closer to 14.2x, suggesting possible opportunity but also emphasizing near-term valuation risk if market preferences change. Should investors trust the multiples, or lean on the growth narrative?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Commonwealth Financial Narrative

If you see things differently or want to bring your own perspective to the table, take a few minutes to build your own view. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding First Commonwealth Financial.

Looking for more investment ideas?

Don’t settle for the ordinary when the next standout opportunity could be just a click away. Use the Simply Wall Street Screener to pinpoint stocks with breakout potential others might miss.

- Capitalize on tomorrow’s tech trends by checking out these 24 AI penny stocks, which are making waves in AI and automation.

- Target strong income with these 20 dividend stocks with yields > 3%, offering reliable yields above 3% for the benefit of your portfolio.

- Ride the next wave of finance by exploring these 79 cryptocurrency and blockchain stocks, featuring companies that are transforming blockchain and digital currencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCF

First Commonwealth Financial

A financial holding company, provides various consumer and commercial banking products and services in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives