- United States

- /

- Banks

- /

- NYSE:CMA

Comerica (CMA): Exploring Current Valuation Following Recent Share Price Surge

Reviewed by Kshitija Bhandaru

See our latest analysis for Comerica.

This latest stretch of momentum follows a year where Comerica’s total shareholder return hit 32%, a clear sign that investors are warming up to the stock. With a recent uptick in the 3-month share price return, interest seems to be building as the market reassesses Comerica’s longer-term prospects in a shifting banking landscape.

If Comerica’s rebound has you rethinking your watchlist, now is the perfect opportunity to discover fast growing stocks with high insider ownership.

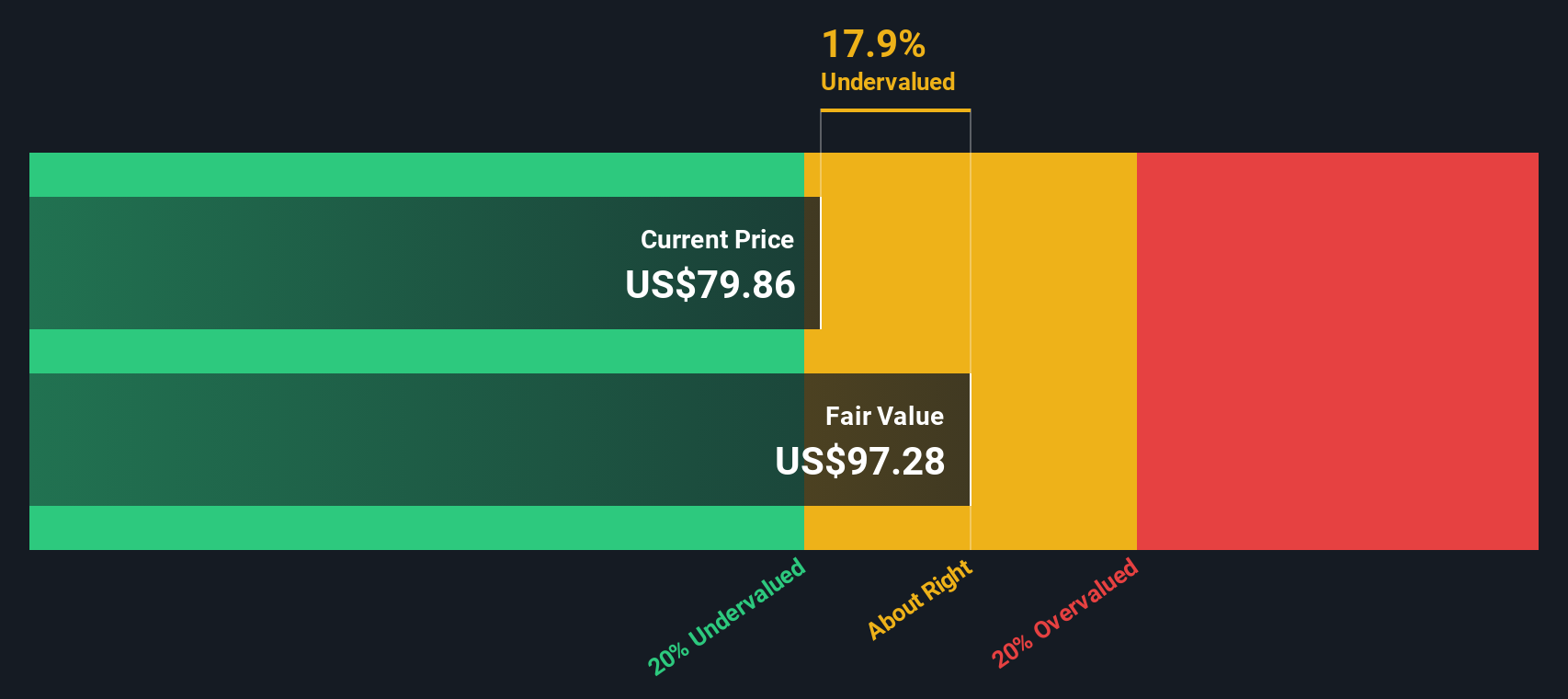

With Comerica’s shares surging and total returns hitting new highs, investors now face a crucial question: are further gains already priced in, or does the stock still offer a genuine buying opportunity?

Most Popular Narrative: 13.9% Overvalued

Comerica’s widely followed narrative pegs its fair value well below the last close, with many expecting more muted upside for the shares from here. The market seems to have moved ahead of these consensus projections, raising questions about whether current valuations fully reflect the challenges ahead.

Comerica's significant presence in economically vibrant Sunbelt and growth markets is fueling robust loan origination and stable deposit growth as local businesses and demographic shifts drive increased financial services demand. This supports long-term revenue expansion. Strategic investments in digital capabilities (such as new real-time payment solutions and embedded finance products) are enabling Comerica to enhance operational efficiency, reduce costs, and access new customer segments. This positions the bank to improve net margins over time.

How bullish are these projections really? The full narrative relies on aggressive growth, margin resilience, and valuation multiples that outpace industry norms. Want to know the key factors driving this ambitious price target? The details might surprise you.

Result: Fair Value of $69 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competitive pressures and Comerica’s lagging technology adoption could quickly challenge these upbeat projections if not addressed soon.

Find out about the key risks to this Comerica narrative.

Another View: SWS DCF Model Suggests Undervaluation

Looking at Comerica through the lens of our DCF model offers a different perspective. The SWS DCF model estimates the fair value at $95.86, which is well above the current share price. This suggests potential upside if the underlying cash flows are realized. Which outlook will prove more accurate as the market digests new data?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Comerica for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Comerica Narrative

If you have your own take on Comerica’s story or want to back up your view with the numbers, you can easily build a custom narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Comerica.

Seeking Even Smarter Investment Opportunities?

Your next great move could be one decision away. Sharpen your portfolio strategy by targeting stocks with huge growth potential, untapped trends, and the staying power to outperform the crowd.

- Boost your income potential and find reliable payout stocks by tapping into these 18 dividend stocks with yields > 3%, which offers attractive yields above market averages.

- Ride the future of technology with these 26 quantum computing stocks, unlocking opportunities in quantum innovation and groundbreaking computational speed.

- Tap into the AI healthcare wave as these 33 healthcare AI stocks reveals companies transforming patient care through next-generation artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMA

Comerica

Provides financial services in the United States, Canada, and Mexico.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives