- United States

- /

- Pharma

- /

- NYSE:LLY

Citizens Financial Group And 2 Other Stocks That May Be Priced Below Their Estimated Worth

Reviewed by Simply Wall St

As the U.S. stock market kicks off a holiday-shortened trading week with significant gains, investors are buoyed by optimism around a potential Federal Reserve interest rate cut in December. In this environment of heightened confidence, identifying stocks that may be undervalued compared to their estimated worth can be particularly appealing, as they offer opportunities for growth amidst broader market enthusiasm.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WEBTOON Entertainment (WBTN) | $14.28 | $28.22 | 49.4% |

| Sotera Health (SHC) | $16.78 | $33.29 | 49.6% |

| Peraso (PRSO) | $0.8763 | $1.72 | 48.9% |

| Nicolet Bankshares (NIC) | $122.61 | $242.17 | 49.4% |

| Huntington Bancshares (HBAN) | $15.91 | $31.35 | 49.3% |

| Freshworks (FRSH) | $12.06 | $23.98 | 49.7% |

| First Busey (BUSE) | $23.21 | $45.34 | 48.8% |

| Fifth Third Bancorp (FITB) | $42.33 | $83.68 | 49.4% |

| Elastic (ESTC) | $69.07 | $135.32 | 49% |

| Crocs (CROX) | $80.33 | $157.15 | 48.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Citizens Financial Group (CFG)

Overview: Citizens Financial Group, Inc. is a bank holding company offering retail and commercial banking services across various customer segments in the United States, with a market cap of approximately $22.46 billion.

Operations: The company's revenue is primarily generated from two segments: Consumer Banking, which accounts for $5.79 billion, and Commercial Banking, contributing $2.43 billion.

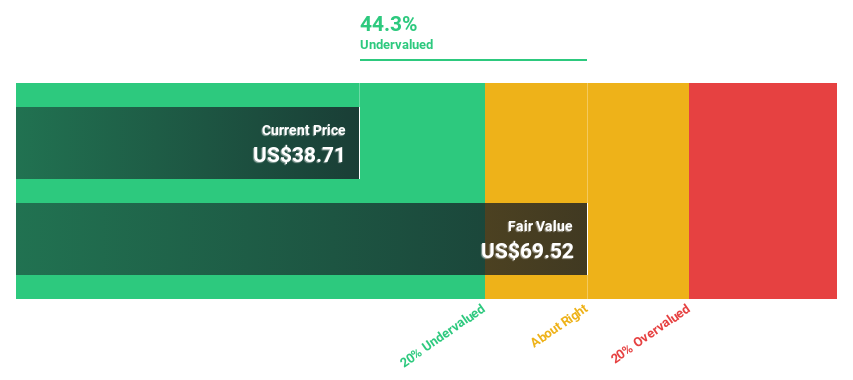

Estimated Discount To Fair Value: 34.7%

Citizens Financial Group is trading at US$52.79, significantly below its estimated fair value of US$80.84, indicating potential undervaluation based on cash flows. The company reported robust earnings growth of 34.5% over the past year and forecasts a continued annual earnings growth rate of 21.36%, outpacing the broader U.S. market's expected growth rate of 15.8%. Recent strategic initiatives, including dividend increases and share buybacks, further enhance its financial profile amidst ongoing expansion efforts.

- Our expertly prepared growth report on Citizens Financial Group implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Citizens Financial Group's balance sheet by reading our health report here.

Eli Lilly (LLY)

Overview: Eli Lilly and Company discovers, develops, and markets human pharmaceuticals globally, with a market cap of approximately $948.84 billion.

Operations: The company's revenue primarily comes from the discovery, development, manufacturing, marketing, and sales of pharmaceutical products totaling $59.42 billion.

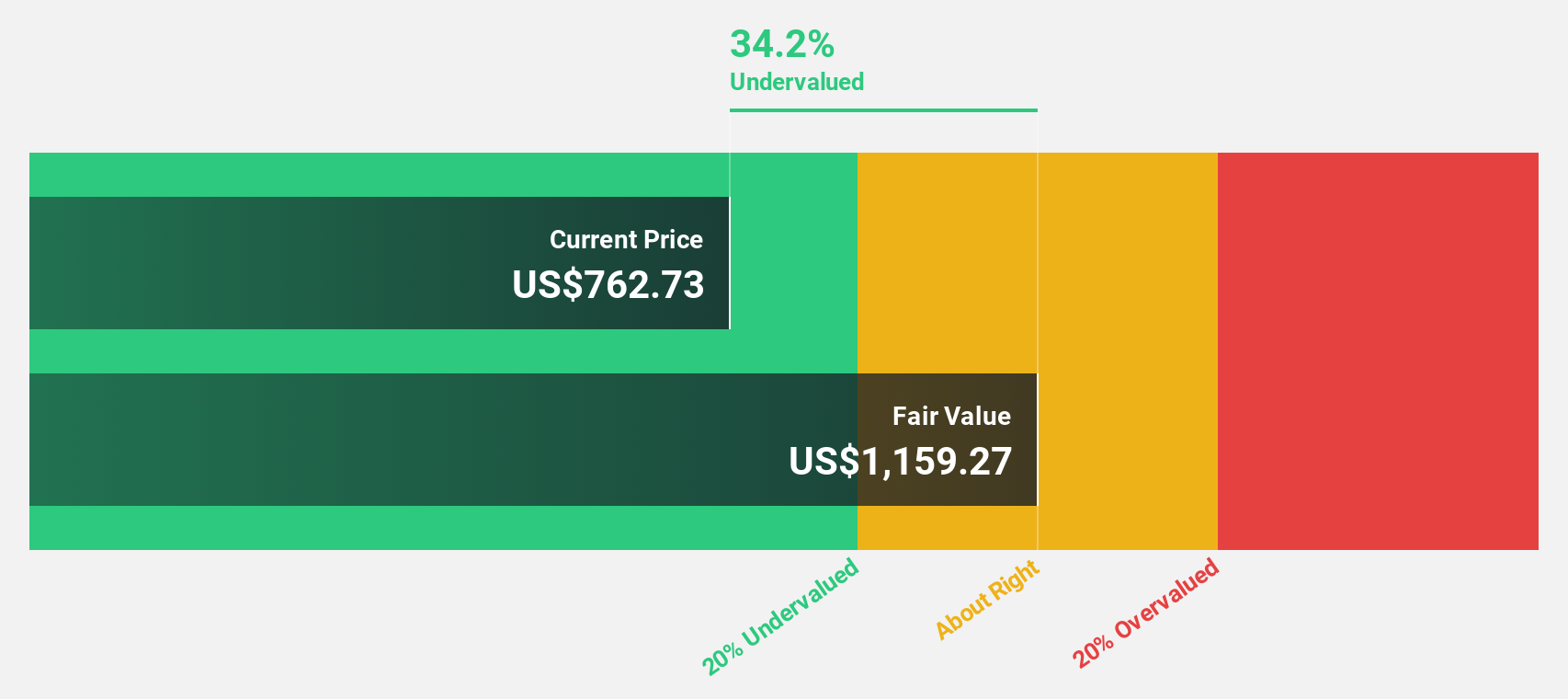

Estimated Discount To Fair Value: 15.8%

Eli Lilly, trading at US$1070.16, is priced 15.8% below its estimated fair value of US$1270.28, suggesting potential undervaluation based on cash flows despite a high debt level. Earnings have grown significantly by 120% in the past year and are forecasted to grow annually by over 21%, surpassing the U.S. market's growth expectations of 15.9%. Recent product advancements and strategic partnerships highlight ongoing innovation across therapeutic areas like oncology and diabetes care.

- Insights from our recent growth report point to a promising forecast for Eli Lilly's business outlook.

- Click to explore a detailed breakdown of our findings in Eli Lilly's balance sheet health report.

Vertiv Holdings Co (VRT)

Overview: Vertiv Holdings Co specializes in designing, manufacturing, and servicing critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments worldwide, with a market cap of approximately $64.58 billion.

Operations: The company's revenue segments consist of $5.82 billion from the Americas, $2.29 billion from the Asia Pacific, and $2.43 billion from Europe, the Middle East, and Africa.

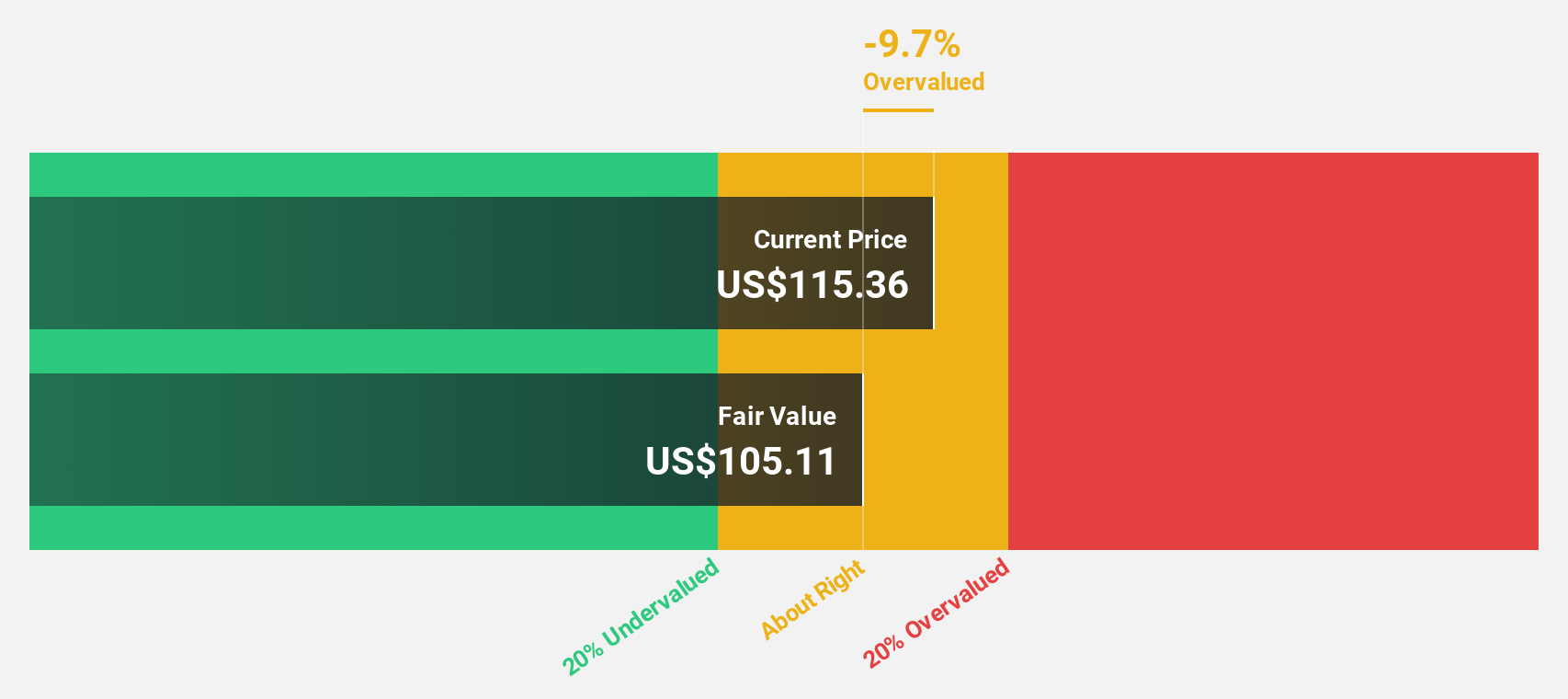

Estimated Discount To Fair Value: 22.1%

Vertiv Holdings Co, trading at US$168.91, is undervalued by over 20% relative to its estimated fair value of US$216.86, highlighting potential based on cash flows. Despite insider selling in recent months, strong financial performance includes a 77.9% earnings growth last year and forecasts exceeding market expectations with annual profit growth of 23.6%. Strategic alliances with Caterpillar and product innovations in AI infrastructure further bolster Vertiv's position for future growth.

- Upon reviewing our latest growth report, Vertiv Holdings Co's projected financial performance appears quite optimistic.

- Take a closer look at Vertiv Holdings Co's balance sheet health here in our report.

Where To Now?

- Dive into all 211 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success