- United States

- /

- Banks

- /

- NYSE:CBU

Community Bank System (CBU) Net Profit Margin Jump Reinforces Bullish Narrative

Reviewed by Simply Wall St

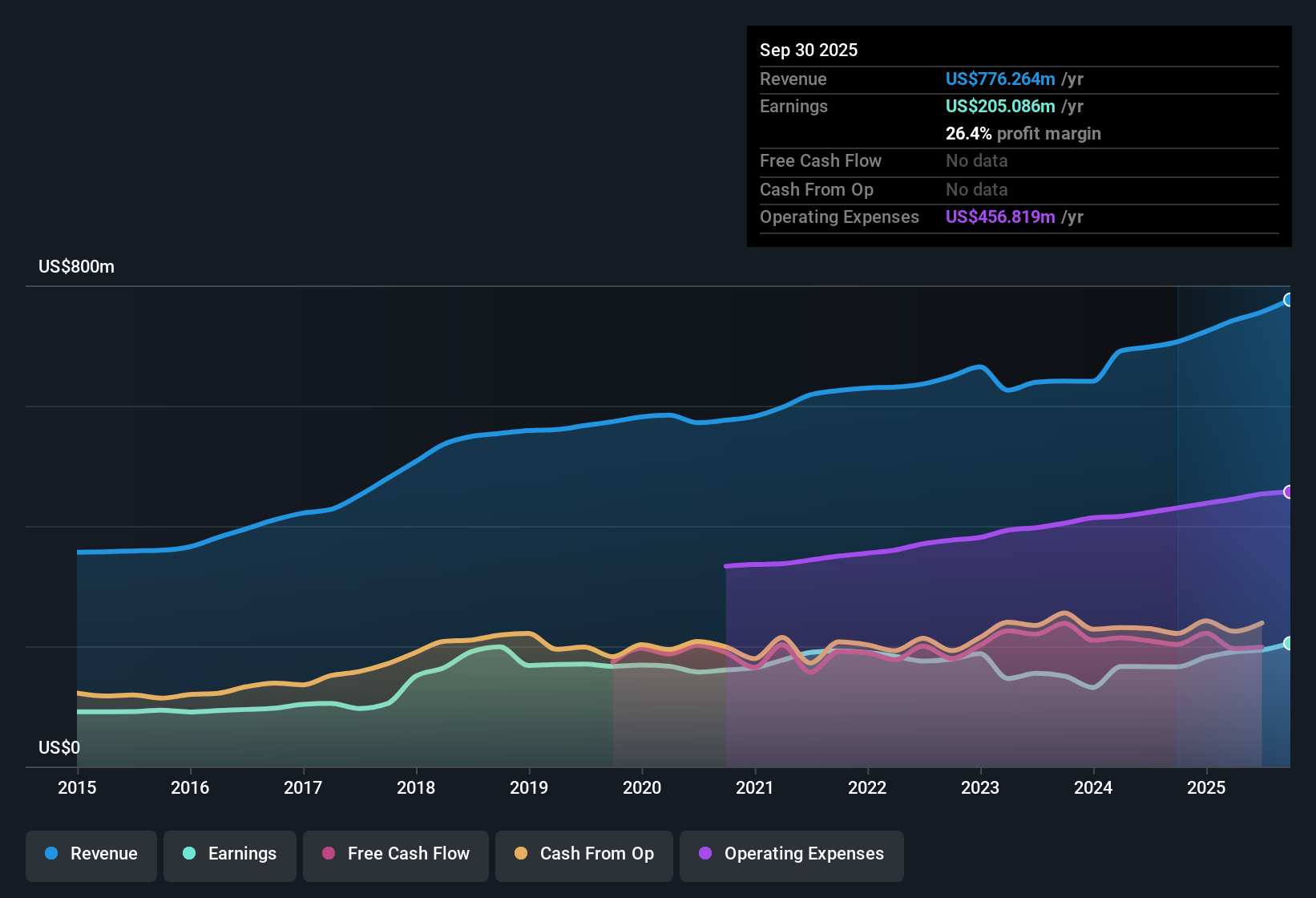

Community Financial System (CBU) posted a current net profit margin of 26.4%, up from last year’s 23.5%, while earnings growth for the year hit 23.7%. Over the past five years, the company’s earnings averaged 0.6% annual growth, and forecasts now call for earnings to rise 18.31% per year, ahead of the broader US market. Running a Price-To-Earnings ratio of 14.5x, CBU trades at a premium to the US Banks industry but still sits below its peer average. With no identified risks and ongoing profit and revenue growth, these results are likely fueling upbeat sentiment around the stock’s outlook.

See our full analysis for Community Financial System.Up next, we’ll see how this earnings snapshot measures up against the broader narrative among investors and analysts. We will consider which story gets strengthened and which takes a hit.

See what the community is saying about Community Financial System

Profit Margin Expansion Supports Resilience

- Net profit margin sits at 26.4%, up from 23.5% last year, making it one of the stronger performers among regional banks for core profitability.

- Analysts' consensus view is that strategic expansion, especially the branch acquisition in Pennsylvania and new branch openings in high-growth markets, should reinforce revenue and lending resilience.

- Double-digit fee revenues from insurance and wealth management diversify growth drivers, adding stability to income streams beyond lending.

- Digital banking and automation investments are flagged as structural cost reducers, which may further improve margins and overall earnings quality.

- Consensus narrative notes that, with a forecast for profit margins to rise from 25.6% to 31.4% in three years, core profitability is expected to stay robust and trends above the US market average.

- Branch and market expansion, paired with digital upgrades, are seen as the main levers for margin improvement.

- Analysts expect earnings per share to climb to $6.11 by September 2028, in part due to operational efficiencies as well as top-line gains.

Branch Expansion and Execution Risks

- Community Financial System plans an ambitious expansion: 19 new branches (de novo openings plus Pennsylvania acquisition) but simultaneously is closing 17 locations, which creates near-term operational complexity.

- Consensus narrative warns that if execution stumbles, higher noninterest costs and integration hiccups could offset the benefits of scale, despite long-term growth goals.

- Bears argue that branch expansion, coming with rising competition and shifting digital preferences, may heighten credit risk and limit noninterest income progress if targets and cost synergies are not achieved.

- Flat or weak results in fee businesses like wealth management and employee benefits, as noted in segment commentary, underscore the challenge of growing noninterest income beyond banking.

Valuation: Trading Below Fair Value Despite Premium PE

- Shares trade at $56.18, which is a premium to the US Banks industry’s PE (14.5x vs. 11.3x), yet still falls below both the peer average PE (16.5x) and the discounted cash flow (DCF) fair value estimate of $71.65.

- Analysts' consensus view: trading premium reflects the “high quality” label and steady profit growth, but the current price still lags the analyst target ($68.25) by nearly 21%, suggesting the market is cautious, yet open to upside as targets are met.

- Compared to the forecasted earnings growth of 18.31% per year (vs. US market’s 15.5%) and revenue growth of 11.4% per year (vs. 10.1%), the valuation gap could narrow if growth continues at this pace.

- Assumptions behind the price target include EPS rising to $6.11 by 2028 and a lower future PE (13.2x vs. current 14.5x), reflecting analyst expectations for durable value creation even as the broader sector evolves.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Community Financial System on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Does the data paint a different picture for you? Share your take in just a few minutes and add your voice to the discussion. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Community Financial System.

See What Else Is Out There

Operational complexity from simultaneous branch openings and closures, along with integration risks, could threaten Community Financial System’s ability to deliver consistent and stable growth.

Seeking steadier performance? Use stable growth stocks screener (2087 results) to discover companies that demonstrate reliable earnings and revenue expansion, minimizing surprises from execution setbacks or market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBU

Community Financial System

Operates as the bank holding company for Community Bank, N.A.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)