- United States

- /

- Banks

- /

- NYSE:CBU

Analysts Are Updating Their Community Bank System, Inc. (NYSE:CBU) Estimates After Its Full-Year Results

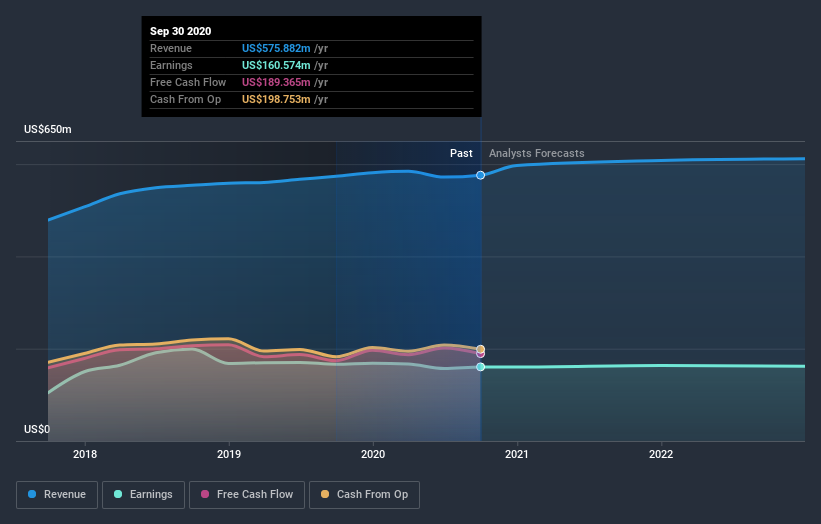

Last week saw the newest yearly earnings release from Community Bank System, Inc. (NYSE:CBU), an important milestone in the company's journey to build a stronger business. Community Bank System missed revenue estimates by 3.6%, with sales of US$576m, although statutory earnings per share (EPS) of US$3.08 beat expectations, coming in 2.8% ahead of analyst estimates. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for Community Bank System

Taking into account the latest results, the most recent consensus for Community Bank System from six analysts is for revenues of US$607.9m in 2021 which, if met, would be a modest 5.6% increase on its sales over the past 12 months. Statutory per share are forecast to be US$3.01, approximately in line with the last 12 months. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$604.0m and earnings per share (EPS) of US$2.91 in 2021. So the consensus seems to have become somewhat more optimistic on Community Bank System's earnings potential following these results.

The consensus price target was unchanged at US$67.25, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Community Bank System, with the most bullish analyst valuing it at US$72.00 and the most bearish at US$60.00 per share. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's pretty clear that there is an expectation that Community Bank System's revenue growth will slow down substantially, with revenues next year expected to grow 5.6%, compared to a historical growth rate of 9.9% over the past five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 6.3% next year. Factoring in the forecast slowdown in growth, it looks like Community Bank System is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Community Bank System's earnings potential next year. Happily, there were no real changes to sales forecasts, with the business still expected to grow in line with the overall industry. The consensus price target held steady at US$67.25, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Community Bank System. Long-term earnings power is much more important than next year's profits. We have forecasts for Community Bank System going out to 2022, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with Community Bank System .

If you’re looking to trade Community Bank System, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:CBU

Community Financial System

Operates as the bank holding company for Community Bank, N.A.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives