- United States

- /

- Banks

- /

- NYSE:CADE

Cadence Bank (CADE) Earnings Surge Reinforces Bullish Narratives on Profitability and Margins

Reviewed by Simply Wall St

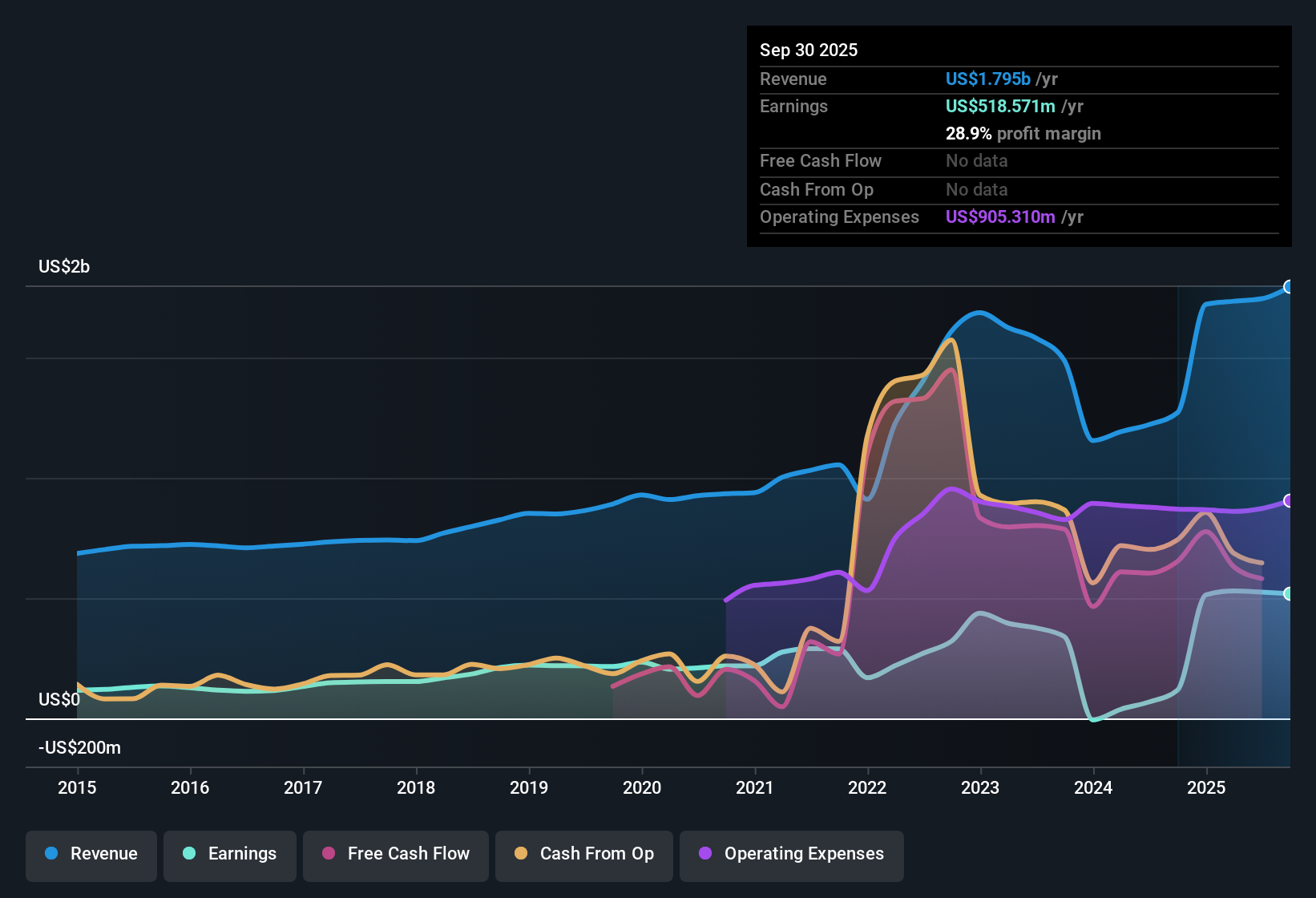

Cadence Bank (CADE) delivered robust results, growing earnings by 340.7% in the most recent year, far outpacing its five-year average annual rate of 11.1%. Net profit margins jumped to 28.9% from last year’s 9.3%, and with earnings expected to expand at 15.14% per year along with a forecasted 10.1% annual revenue growth, investors have reason for optimism. Consistent profit growth, strengthening margins, and an attractive dividend point to substantive rewards. However, a price-to-earnings ratio of 12.8x, which is above both peers and industry averages, keeps the spotlight on whether the premium valuation matches up to these financial gains.

See our full analysis for Cadence Bank.Next, we’ll see how these headline results compare to the key narratives shaping sentiment around Cadence Bank, pinpointing where consensus meets reality and where expectations might get tested.

See what the community is saying about Cadence Bank

Sunbelt Market Expansion Boosts Diversification

- Cadence Bank’s ongoing growth in high-potential Sunbelt regions such as Texas and Georgia continues to drive organic loan and deposit increases. Texas now accounts for 37% of deposits and an even higher share of loans.

- According to analysts' consensus view, the company’s geographic reach and diverse client base are seen as key catalysts because entry into these rapidly growing markets is fueling scalable earnings.

- The efficiency ratio has improved alongside investments in digital capabilities and treasury management, which gives analysts confidence in continued margin expansion.

- However, the growing concentration in Texas means any slowdown or local shock could pose outsized risks to future growth, as nearly two-fifths of all deposits now come from a single region.

Consensus estimates suggest that this balance of upside and regional risk is shaping expectations about how far Cadence Bank can stretch its current growth story. 📊 Read the full Cadence Bank Consensus Narrative.

Acquisition Integration Powers Scalable Earnings

- Recent mergers with Industry Bancshares and First Chatham Bank are broadening Cadence Bank’s footprint and have accelerated scalable earnings improvement and return on assets.

- Analysts' consensus narrative highlights that successful M&A integration allows Cadence Bank to capture M&A synergies, expand its client base, and realize cost efficiencies.

- Growing deposit and loan volumes from these acquisitions provide new cross-selling opportunities and help underpin future revenue growth of an expected 12.4% per year through 2028.

- Yet, integration risks remain. Critics point out that assimilating acquired loan books and portfolios could inflate provisions or challenge efficiency ratios, especially if inherited credit quality issues emerge.

Premium Valuation Faces Market Scrutiny

- With a price-to-earnings ratio of 12.8x, Cadence Bank trades above peers (11.6x) and the US Banks industry average (11.3x). Its share price at $35.63 remains below the analyst price target of $42.36.

- Consensus narrative notes that this premium is only justifiable if projected earnings and margin expansion keep pace. Any failure to realize forecasted EPS of $4.22 by September 2028 could pressure the stock’s multiple.

- Although analysts remain confident that the company’s fair value aligns closely with its current valuation, the narrow 7.3% upside to target reflects little room for disappointment if uncertainties around costs, competition, or credit risks materialize.

- On the other hand, a drop in the future PE to industry levels (11.9x by 2028) would reinforce the consensus that Cadence Bank is fairly priced based on today’s growth assumptions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cadence Bank on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something others might have missed? In just a few minutes, you can put your perspective into a narrative and share your outlook. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cadence Bank.

See What Else Is Out There

Cadence Bank’s premium valuation leaves little room for error if earnings or margin expansion falter. This situation exposes investors to the risk of overpaying for uncertain growth.

Want more upside and less worry? Discover value-driven ideas and potential bargains among these 877 undervalued stocks based on cash flows that sidestep the risks of paying too high a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CADE

Cadence Bank

Provides commercial banking and financial services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives