- United States

- /

- Banks

- /

- NYSE:C

Examining Citigroup Shares After Recent 60% Surge and Positive Q1 2025 Earnings Report

Reviewed by Bailey Pemberton

If you own Citigroup stock or are eyeing it on your watchlist, you are definitely not alone. Lately, Citigroup has been on quite the ride, and investors everywhere are weighing whether its next move is up, down, or simply sideways. Over the last year, Citigroup’s share price has jumped an impressive 60.8%, and if you go back five years, the stock is up well over 160%. Even with the recent dip of -5.5% over the past week, the year-to-date gain of nearly 40% is a clear sign that something has shifted in how the market views Citigroup’s prospects.

A confluence of factors such as changing interest rates, shifting economic outlooks, and renewed optimism around the financial sector has played into Citigroup’s latest moves. When traditional financial stocks start to trend like this, it gets people talking about growth stories and risk perceptions, not just dividends and book values. But does the stock still have room to run, or is it starting to look a little stretched?

Here’s where things get interesting for the value-minded crowd: on a valuation scoring system that checks for signs a company is undervalued across six different measures, Citigroup scores a 2. That means it’s undervalued in only two out of six categories. Depending on your optimism, that leaves some room for debate about where fair value truly lies.

Let’s break down what this valuation score really means and how different methods stack up against each other to uncover whether Citigroup is genuinely a bargain. Stick around, there’s an even smarter way to think about valuation that might just surprise you at the end.

Citigroup scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Citigroup Excess Returns Analysis

The Excess Returns valuation model takes a closer look at how efficiently Citigroup is putting its capital to work for shareholders, measuring the company’s ability to generate returns above its cost of capital. In this case, the focus is on return on invested equity and the value that can be created when a company earns more than what it costs to raise funds.

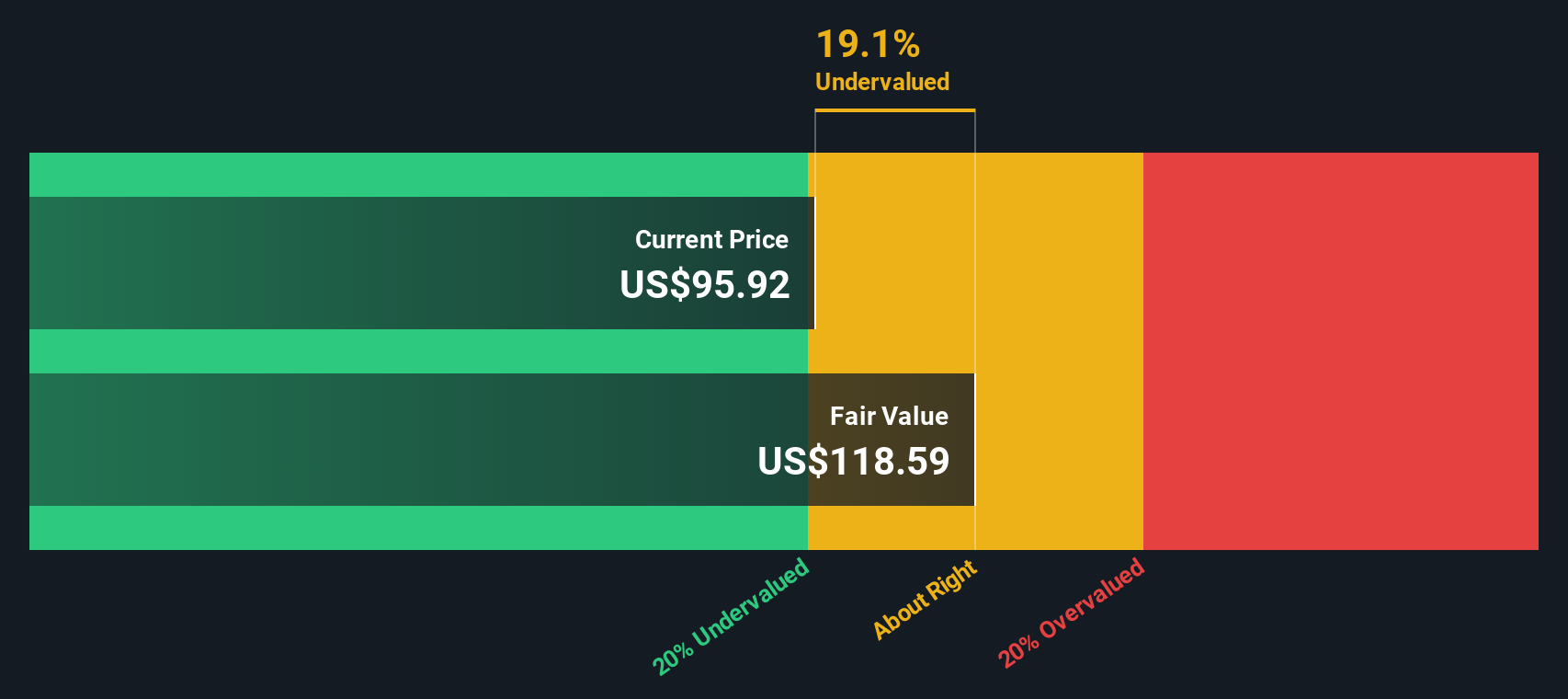

For Citigroup, the numbers are telling. The book value stands at $106.94 per share, while stable Earnings Per Share (EPS), based on projections from 12 analysts, sit at $9.69. The average return on equity is 8.18%, but the cost of equity is nearly identical at $9.71 per share. That leaves the excess return at a slight negative: -$0.03 per share. This means that Citigroup is just about breaking even in terms of creating additional value for shareholders through its investments. Looking ahead, the stable book value is estimated to rise to $118.37 per share, according to projections from 11 analysts.

Despite these mixed signals, the intrinsic value per share derived from the Excess Returns approach lands at $117.86, which is about 17.1% higher than Citigroup’s current share price. This suggests the stock is trading at a notable discount to its underlying value based on this methodology.

Result: UNDERVALUED

Our Excess Returns analysis suggests Citigroup is undervalued by 17.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Citigroup Price vs Earnings

For profitable companies like Citigroup, the price-to-earnings (PE) ratio is a tried-and-true valuation metric. It reflects what investors are willing to pay for each dollar of the company's earnings, making it a direct gauge of both value and market sentiment. A company's PE ratio can be influenced by expectations for future growth and the perceived risk of those earnings. Firms with solid outlooks and low risks usually command higher ratios, while inconsistent or riskier businesses tend to trade at a discount.

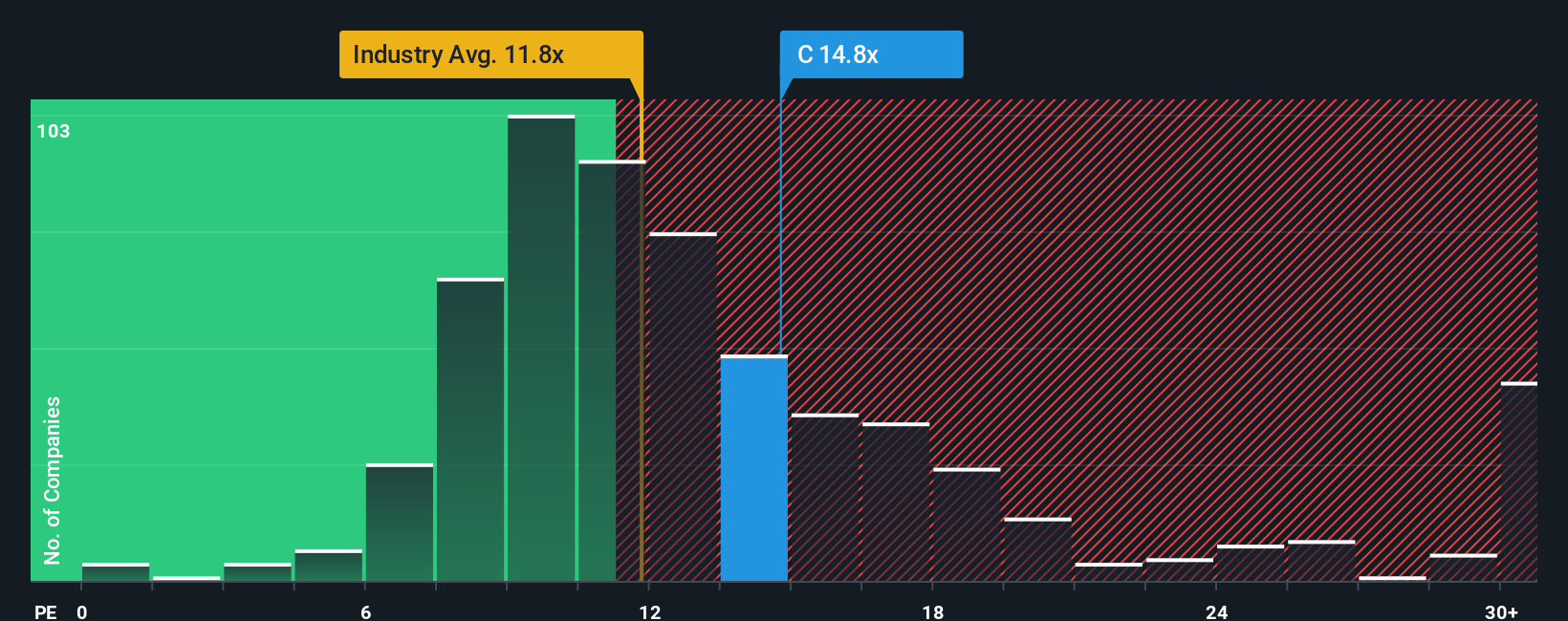

Citigroup’s current PE ratio stands at 13.94x, which is slightly above the peer average of 13.06x and well above the banking industry's average of 11.80x. While these benchmarks provide context, they do not always account for what truly makes a company distinct. That is where Simply Wall St's “Fair Ratio” comes into play. The Fair Ratio, calculated at 16.43x for Citigroup, considers factors beyond simple comparisons, including earnings growth, risk, profit margins, market cap, and industry trends, to paint a more comprehensive picture of fair value.

This proprietary Fair Ratio approach is more insightful because it tailors the valuation to Citigroup’s unique profile instead of relying solely on peer or industry averages, which might not reflect the company's specific prospects or challenges. Comparing the Fair Ratio of 16.43x to Citigroup’s actual PE of 13.94x, the stock appears to be undervalued by this measure. This suggests investors could be getting more earnings for their money relative to what would typically be expected given Citigroup’s current fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Citigroup Narrative

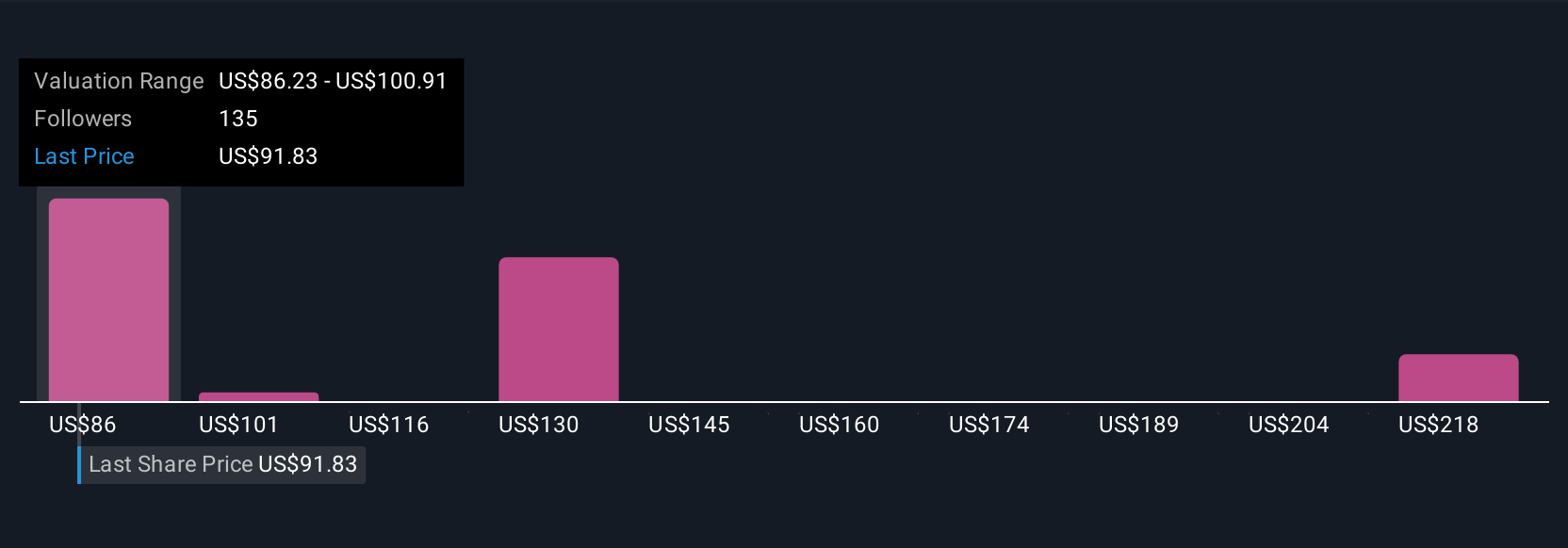

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives, a simple yet powerful tool that lets you define your own story behind Citigroup’s numbers by linking your expectations for its future (revenue, earnings, and margins) to a personal estimate of fair value.

Narratives connect your view of Citigroup’s business, where you think the company is headed and what key trends or risks matter most, to a financial forecast. They then calculate the fair value based on those assumptions, making investing more dynamic and insightful than relying on a single metric.

Available to millions of investors on Simply Wall St’s Community page, Narratives are easy to use and let you compare your fair value directly against the current share price. This helps you decide whether now is the right time to buy, hold, or sell.

The real power of Narratives is that they update automatically when fresh news or results emerge, keeping your outlook relevant and responsive to the latest developments.

For example, the most optimistic Narrative on Citigroup currently values the stock above $230 based on rapid digital asset growth, while the most cautious puts fair value closer to $77 due to tighter profit margins and ongoing transformation costs. This demonstrates how every investor can bring their own informed perspective to the table.

Do you think there's more to the story for Citigroup? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives