- United States

- /

- Banks

- /

- NYSE:C

Citigroup’s Funding Shift and Leadership Overhaul Could Be A Game Changer For Citigroup (C)

Reviewed by Sasha Jovanovic

- Citigroup Inc. has moved to redeem in full US$1.50 billions of its 4.000% Series W noncumulative preferred stock while continuing to issue a range of new senior unsecured notes and preferred depositary shares, reshaping its funding profile.

- Alongside this balance sheet repositioning, Citi is overhauling leadership in key franchises, including a new Japan ECM head and a planned CFO transition, while reorganizing U.S. retail banking into wealth and elevating U.S. Consumer Cards as a core business.

- We’ll now examine how Citi’s preferred stock redemption and broader balance sheet repositioning affect its existing investment narrative around restructuring and margins.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Citigroup Investment Narrative Recap

To own Citi today, you have to believe its multi‑year restructuring, tighter capital management and focus on core franchises can translate into better, more consistent returns. The Series W preferred redemption and fresh senior note issuance refine funding, but do not materially alter the near term story, where the key upside remains margin and efficiency progress while the main risk is that regulatory and transformation costs stay elevated longer than expected.

Against that backdrop, the CFO transition to Gonzalo Luchetti stands out. Moving a long‑time operator of U.S. Personal Banking into the finance seat puts someone steeped in consumer economics and cost discipline closer to capital allocation decisions, which matters if Citi is to turn balance sheet moves like this preferred redemption into sustained improvements in net interest margin and expense control.

Yet even as Citi leans into this reshaping, investors still need to be aware of the risk that persistent regulatory scrutiny and transformation spending could...

Read the full narrative on Citigroup (it's free!)

Citigroup's narrative projects $88.8 billion revenue and $17.2 billion earnings by 2028. This requires 6.8% yearly revenue growth and a roughly $4.3 billion earnings increase from $12.9 billion today.

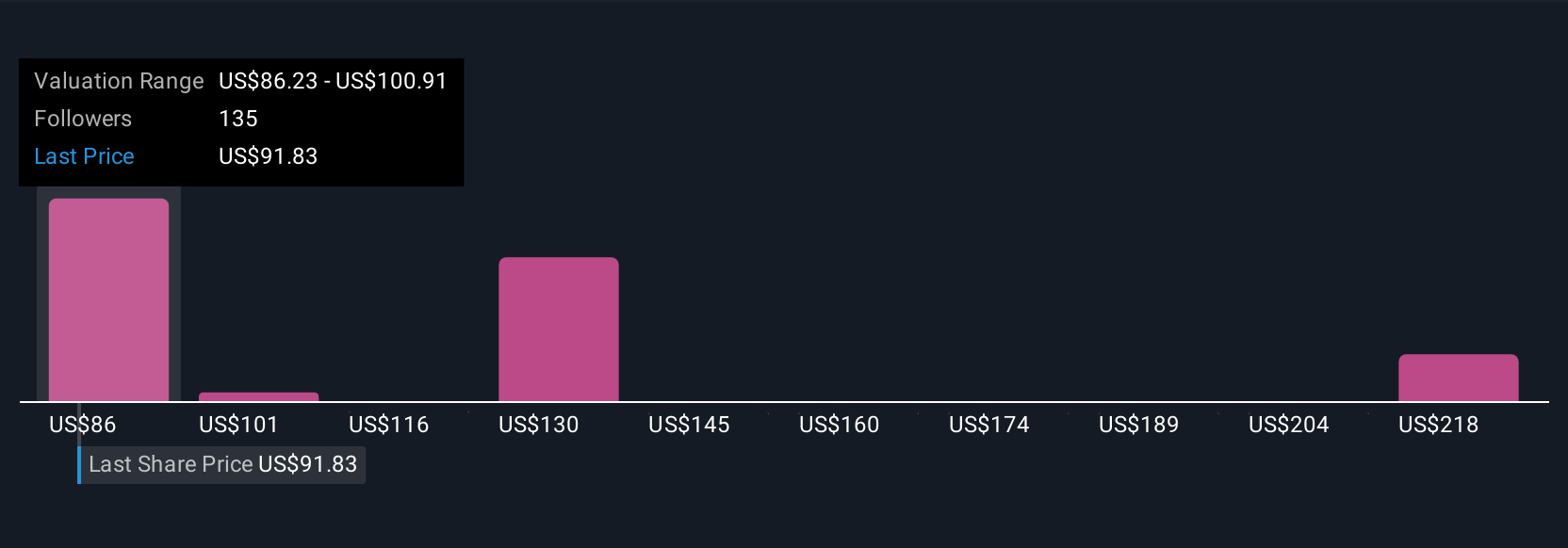

Uncover how Citigroup's forecasts yield a $114.33 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were already assuming Citi could lift annual earnings toward about US$20.0 billion, but their view of AI driven margin gains and global trade growth is far more upbeat than consensus, highlighting just how differently you and other shareholders might interpret the latest funding moves and balance sheet reshuffle.

Explore 13 other fair value estimates on Citigroup - why the stock might be worth over 2x more than the current price!

Build Your Own Citigroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citigroup research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Citigroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citigroup's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026