- United States

- /

- Banks

- /

- NYSE:C

An Analysis of Citigroup (NYSE:C) and Peers, as well as the Possibility of Unlocking Value

Citigroup Inc. (NYSE:C) has been on a rocky path in the last few years, and the stock reflects a lack of investor confidence. In the last five years, the share has grown only 14%, while the last year, saw a 4.6% growth. In a case like this, investors usually stay away - However, some like to evaluate the potential for a company to "flip" and unlock value.

A relative approach will allow us to see if investors are staying away from the company, and possibly leaving some upside on the table.

By looking at peers, we can see how Citigroup ranks on a relative basis. In the banking and finance sector, we see the following fundamentals:

- NYSE:JPM, P/E 9.4x, net margin 35.5%, ttm earnings $46.5b, market cap $437.8b

- NYSE:BAC, P/E 12.3x, net margin 32.6%, ttm earnings $30.6b, market cap $375.1b

- NYSE:WFC, P/E 10.6x, net margin 24.5%, ttm earnings $20.3b, market cap $214.4b

- NYSE:USB, P/E 11.5x, net margin 31.8%, ttm earnings $7.6b, market cap $87.8b

- NYSE:C, P/E 6.2x, net margin 27.6%, ttm earnings $20.8b, market cap 129.5b

The peer average P/E is 10.9x, and the industry P/E is 10.7x. Looking strictly on a relative basis, we can find Citigroup to be 42% to 43% underpriced.

There are a few things to keep in mind when analyzing stocks on a relative basis.

First, P/E ratios are backwards looking - they show us the past, while a stock's value lies in the future. This doesn't make the ratio obsolete, as it can be quite useful for analyzing stable and mature stocks.

Second, underpriced stocks, may be cheap for a reason. There may be some internal constraints in the company that discourage investors.

A company may be more at risk than peers, which leads investors to put less value on the cash flows.

As far as we can see, Citigroup does have more risk associated with it, as evident by the volatile stock price and the company's history. The assumption is, that investors punish weak management performance and bad decisions in a way that is reflected in the stock price.

Check out our latest analysis for Citigroup

The chart below, illustrates how investors react to the performance and decisions of management.

Currently, the stock is trading at 2019 levels, and has hardly gone up in the last 3 years. It seems that there are both internal and performance issues that are keeping the company from unlocking value.

Before we go on, now is a good time to explore why we are looking at a potential underperformer. Investors have multiple strategies, which include growth, value, dividend, contrarian investing etc. In this case, we are trying to explore the possibility that Citigroup will unlock its potential in the future, and since the stock is currently underperforming, that would mean a higher upside for investors. In a sense, we are trying to estimate the possibility that an activist, or internal forces will prompt the company to flip and become more efficient.

This is a high risk strategy, as large companies are set in their ways and meaningful improvements are hard to bring about.

On the other hand, we can see that the competitors may be fully priced-in, and it would be hard to expect higher returns from them as opposed to Citigroup.

Now let's take a deeper look at some performance measures and possibilities for improvement.

Profitability

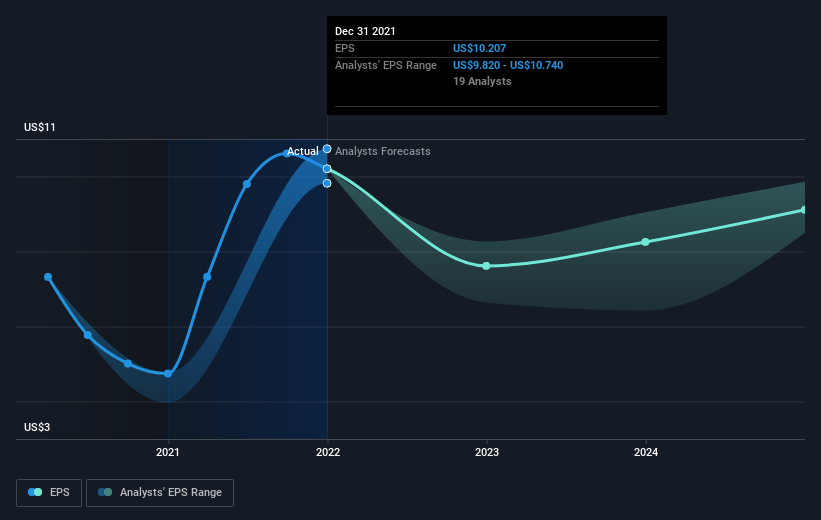

One reasonable way to assess how sentiment around a company has changed, is to compare the earnings per share (EPS) with the share price.

Over half a decade, Citigroup managed to grow its earnings per share at 17% a year. This EPS growth is higher than the 3% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

By averaging out analyst estimates, we can build a picture of what can future profits look like for C. In this case, it seems that profit was abnormally high in 2021, and is expected to normalize in the future.

The image below shows how EPS has tracked over time and what analysts expect to see in the future (if you click on the image, you can see greater detail).

We know that Citigroup has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

Returns

The company has medium returns with a ROE of 10.9% or 11.5% as per their latest results. The RoTCE (Return on Tangible Common Equity) is 13.4%, which means that the company is starting to be more effective in utilizing capital.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raising, along with any dividends, based on the assumption that the dividends are reinvested.

Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Citigroup's TSR for the last 5 years was 31%, which exceeds the share price return mentioned earlier.

The dividends paid by the company have thus boosted the total shareholder return, and new investors can obtain a good 3.1% dividend yield.

A Different Perspective

Citigroup may be able to unlock value by continuing investments in digital assets that can lower costs and improve the efficacy of operations, as well as improving the efficacy of management. When it comes to investors, there is a possibility that internal FinTech developments may allow the company to increase returns by employing less capital and lowering costs.

Considering the fundamentals, the company has stable earnings with a high profit margin. It also seems to be undervalued on a relative basis, however that measurement is backwards looking and investors might find it more useful to employ a future oriented valuation model.

In summary, Citigroup is not something to get overly excited about, but the potential improvements leave the possibility for higher upside compared to other peers. It might be worth putting the stock on a watch-list and scanning meaningful developments.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade Citigroup, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives