- United States

- /

- Banks

- /

- NYSE:BAP

Credicorp (NYSE:BAP): Valuation in Focus After Strong Results, Upgraded Outlook and Major Tax Win

Reviewed by Simply Wall St

Credicorp (NYSE:BAP) has been in the spotlight this month after delivering a set of impressive second quarter and first half results, along with a significant update to its 2025 guidance. The company boosted expectations for net interest margin, now targeting the upper end of its range, and saw risk costs revised downward thanks to solid credit quality. Just as important for investors, the Peruvian tax authority’s cancellation of a hefty S/1.6 billion tax assessment has removed a lingering cloud, shifting sentiment and putting more attention on fundamentals.

These updates follow a strong year for Credicorp’s stock. Shares have surged 62% over the past twelve months, with momentum especially strong in the past quarter when the stock jumped 23%. In addition to outpacing the broader market, upward revisions in earnings forecasts and renewed guidance demonstrate that this growth reflects operational improvements and reduced risk pressures rather than just market optimism.

With uncertainty fading and momentum building, the main question is whether there is real value left at these levels or if the market is already pricing in another year of strong execution. Has Credicorp’s promising outlook already been factored into its stock, or is there more upside to capture?

Most Popular Narrative: 4.6% Overvalued

According to community narrative, Credicorp is considered slightly overvalued, with key assumptions about top-line and bottom-line growth shaping this view.

Ongoing investments in digital platforms, AI, and end-to-end automation are boosting operational efficiency. These initiatives are enabling scalable service delivery with lower marginal costs, which is expected to further improve the group's net margin as revenue from digital channels grows.

Want to peek inside the financial engine behind this valuation? This narrative draws on bold digital expansion, transformative efficiency plays, and shifting revenue streams as its foundation. The future price depends on major factors such as the direction of technology, lending trends, and profit margins. If you are curious about the projections driving the current fair value, the numbers behind this story may challenge your expectations and highlight where analysts see this valuation heading.

Result: Fair Value of PEN243.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heightened regulatory scrutiny or a sharp turn in Peru’s political landscape could disrupt Credicorp’s revenues. This could quickly change the narrative around future growth.

Find out about the key risks to this Credicorp narrative.Another View: Discounted Cash Flow Tells a Different Story

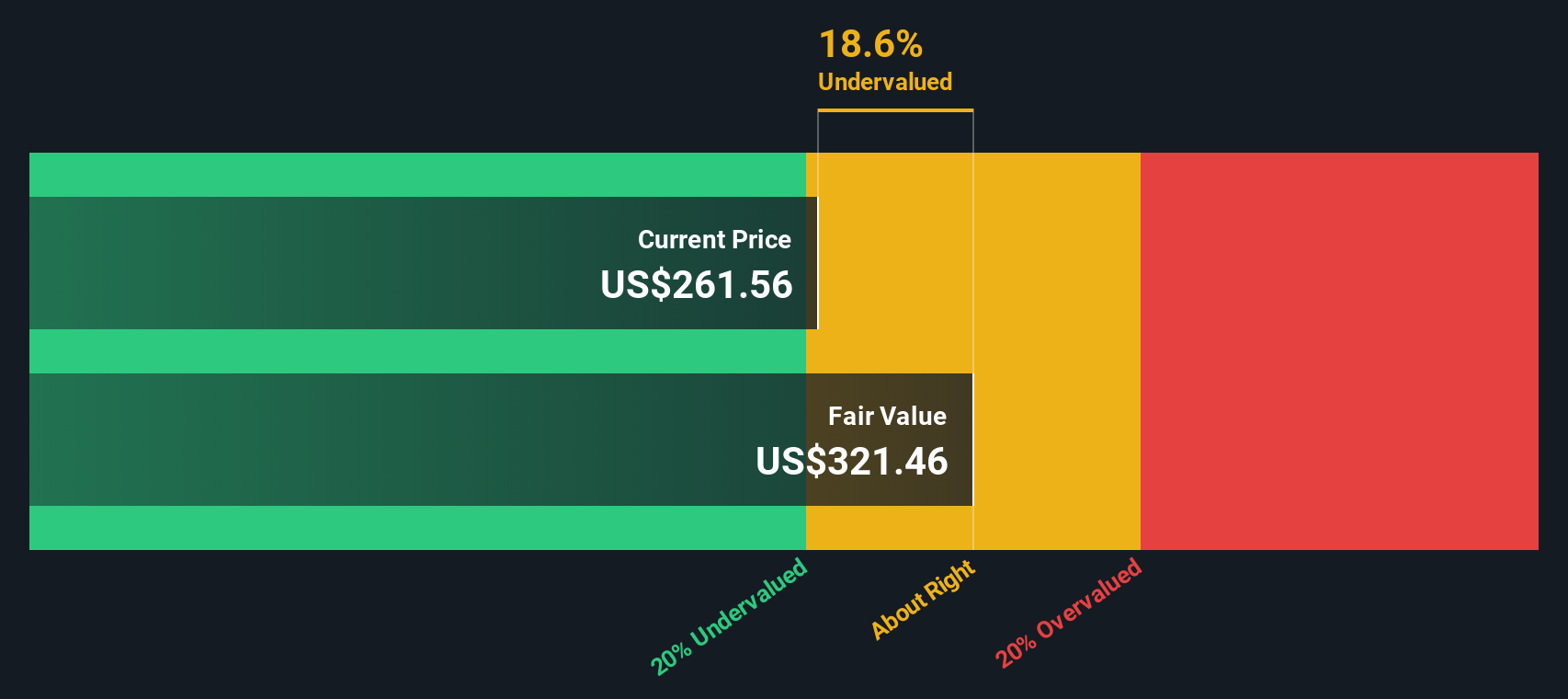

Looking from a different angle, our DCF model suggests Credicorp’s stock could actually be undervalued. While traditional valuation might lean one way, this approach raises new questions about what is really priced in. Which outlook feels more convincing to you?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Credicorp Narrative

If you see things differently or want to explore the numbers in your own way, you can analyse the data and craft your own perspective in just a few minutes, and do it your way.

A great starting point for your Credicorp research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not just stop with one stock. If you want to put your next dollar to work, check out these unique ways to uncover tomorrow’s winners using the Simply Wall Street Screener. Don’t miss your chance to get ahead of the curve in markets filled with opportunity:

- Target consistent income and beat low rates by selecting from dividend stocks with yields > 3%, which offer reliable payouts above 3%.

- Explore the growing trend of healthcare innovation and find opportunities among healthcare AI stocks that are transforming diagnostics and treatments with artificial intelligence.

- Stay at the forefront of breakthrough technologies by scanning quantum computing stocks, which power next-generation computing solutions and are reshaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAP

Credicorp

Provides various financial, insurance, and health services and products in Peru and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives