- United States

- /

- Banks

- /

- NYSE:BAC

Will BAC’s New Alaska Airlines Card Accelerate Its Premium Credit Growth Strategy?

Reviewed by Simply Wall St

- Alaska Airlines recently launched its enhanced Atmos Rewards loyalty program and introduced the Atmos Rewards Summit Visa Infinite card in partnership with Bank of America, offering global travelers exclusive benefits such as a Global Companion Award, increased points earning on purchases, and access to airline lounges.

- This collaboration highlights Bank of America's continued expansion into premium travel credit cards, leveraging customer loyalty and co-branding opportunities with major airlines to attract and retain high-value clients.

- We'll explore how this prominent new partnership with Alaska Airlines could impact Bank of America's future growth through expanded travel-focused credit offerings.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Bank of America Investment Narrative Recap

To be a Bank of America shareholder, you need to believe in the bank’s ability to grow earnings through diversified services, digital innovation, and disciplined risk management despite near-term economic headwinds. The partnership with Alaska Airlines on a premium travel credit card is intended to deepen relationships with higher-value customers, but it is not expected to materially affect the main short-term catalysts or mitigate the largest risks, such as margin pressure from market volatility and increasing competition for deposits.

Of recent announcements, Bank of America’s launch of enhanced cash back rewards on its Customized Cash Rewards and Unlimited Cash Rewards credit cards stands out as a clear complement to its premium card efforts. While this product expansion helps maintain customer engagement, the primary short-term catalysts continue to revolve around digital investment and operational efficiency rather than credit card portfolio growth.

By contrast, investors should also be aware of increased competition for deposits, which could pressure net interest income and earnings if not managed carefully…

Read the full narrative on Bank of America (it's free!)

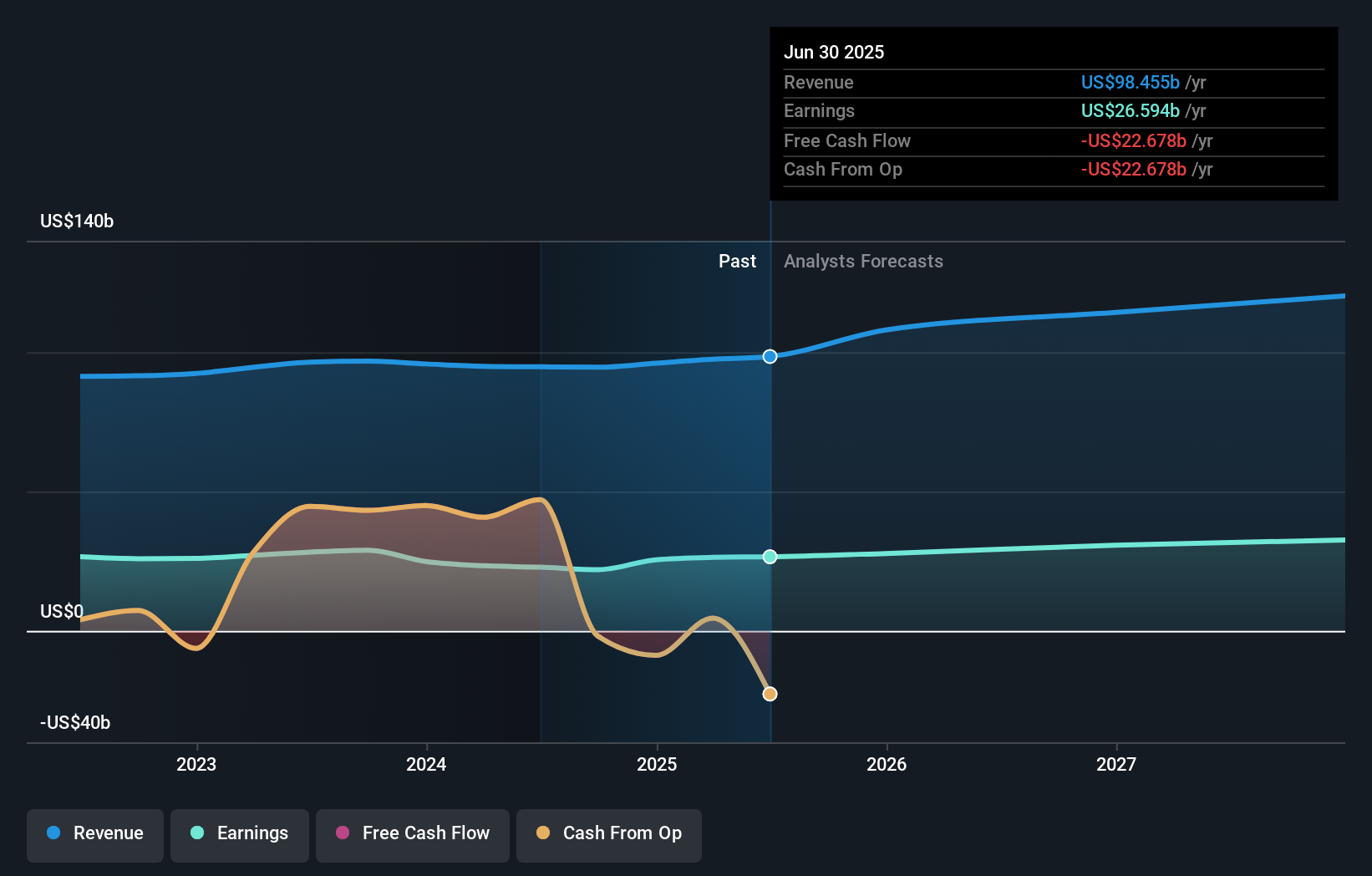

Bank of America's outlook points to $122.1 billion in revenue and $32.9 billion in earnings by 2028. This scenario assumes a 7.5% annual revenue growth rate and reflects a $6.3 billion increase in earnings from the current $26.6 billion.

Uncover how Bank of America's forecasts yield a $53.08 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 18 fair value estimates for Bank of America, ranging widely from US$38 to US$61.07 per share. Against this spread of retail opinions, keep in mind that the major catalyst remains the company’s investment in digital engagement, which could shape future growth opportunities.

Explore 18 other fair value estimates on Bank of America - why the stock might be worth as much as 23% more than the current price!

Build Your Own Bank of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of America research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bank of America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of America's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives