- United States

- /

- Banks

- /

- NYSE:ASB

Don't Race Out To Buy Associated Banc-Corp (NYSE:ASB) Just Because It's Going Ex-Dividend

Associated Banc-Corp (NYSE:ASB) stock is about to trade ex-dividend in 3 days. Typically, the ex-dividend date is one business day before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Accordingly, Associated Banc-Corp investors that purchase the stock on or after the 2nd of June will not receive the dividend, which will be paid on the 16th of June.

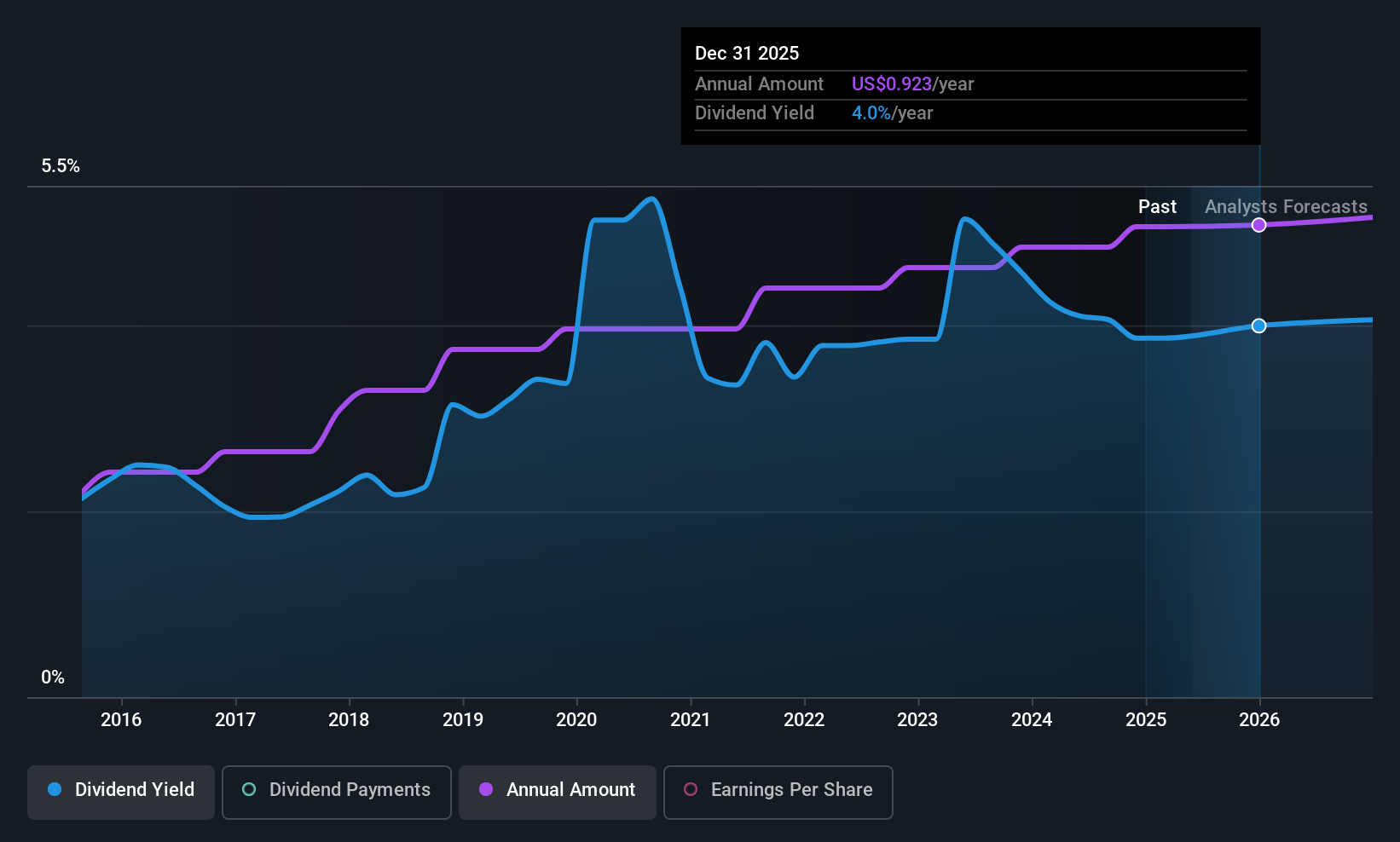

The company's next dividend payment will be US$0.23 per share, on the back of last year when the company paid a total of US$0.92 to shareholders. Last year's total dividend payments show that Associated Banc-Corp has a trailing yield of 4.0% on the current share price of US$23.12. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Associated Banc-Corp can afford its dividend, and if the dividend could grow.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Associated Banc-Corp paid out 107% of its earnings, which is more than we're comfortable with, unless there are mitigating circumstances.

When the dividend payout ratio is high, as it is in this case, the dividend is usually at greater risk of being cut in the future.

Check out our latest analysis for Associated Banc-Corp

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're discomforted by Associated Banc-Corp's 16% per annum decline in earnings in the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Associated Banc-Corp also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Associated Banc-Corp has delivered an average of 9.8% per year annual increase in its dividend, based on the past 10 years of dividend payments. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. Associated Banc-Corp is already paying out 107% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

Final Takeaway

From a dividend perspective, should investors buy or avoid Associated Banc-Corp? Not only are earnings per share shrinking, but Associated Banc-Corp is paying out a disconcertingly high percentage of its profit as dividends. It's not that we hate the business, but we feel that these characeristics are not desirable for investors seeking a reliable dividend stock to own for the long term. Associated Banc-Corp doesn't appear to have a lot going for it, and we're not inclined to take a risk on owning it for the dividend.

With that in mind though, if the poor dividend characteristics of Associated Banc-Corp don't faze you, it's worth being mindful of the risks involved with this business. For example - Associated Banc-Corp has 1 warning sign we think you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ASB

Associated Banc-Corp

A bank holding company, provides various banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, Missouri, and Minnesota.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)