- United States

- /

- Banks

- /

- NYSE:ABCB

Ameris Bancorp (ABCB): Assessing Valuation as Sector Optimism Grows After Big Bank Results and Fed Signals

Reviewed by Kshitija Bhandaru

Ameris Bancorp (ABCB) shares climbed after strong third-quarter earnings from major banks set a positive tone across the sector, while remarks from Federal Reserve Chair Jerome Powell hinted at looser liquidity conditions ahead.

See our latest analysis for Ameris Bancorp.

Ameris Bancorp’s share price has steadily climbed in 2024, bolstered by sector-wide optimism after upbeat big bank earnings and supportive Fed commentary. Momentum appears to be building, with a year-to-date share price return of 20.8% and a standout five-year total shareholder return of 184.6%.

If renewed interest in bank stocks has you thinking about your next move, now is a perfect chance to broaden your perspective and discover fast growing stocks with high insider ownership

Yet with shares up strongly this year and closing only a few percent below analyst targets, the question now is whether Ameris Bancorp remains undervalued or if markets have already factored in the next phase of growth.

Most Popular Narrative: 5.1% Undervalued

With Ameris Bancorp's fair value estimate at $77.67, just above its recent close at $73.70, analysts see modest room for upside, driven by optimism about the company's position in Southeastern markets and digital banking initiatives.

The company is benefitting from strong population migration and economic growth in its core Southeastern markets, providing a tailwind for ongoing loan and deposit growth, which is expected to drive higher revenue and expand market share. Accelerating digital banking enhancements and emphasis on treasury management are enabling Ameris to acquire and retain more granular, low-cost, noninterest-bearing deposits, supporting net interest margin sustainability and efficiency improvements.

Want the full inside track on these projections? The narrative's valuation leans on surprisingly ambitious future revenue targets and margin forecasts that defy the usual banking playbook. Dive deeper for the numbers that could change your view of Ameris Bancorp's growth potential.

Result: Fair Value of $77.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition for deposits and a reliance on growth in Southeastern markets could present challenges to Ameris Bancorp’s projected momentum if conditions change.

Find out about the key risks to this Ameris Bancorp narrative.

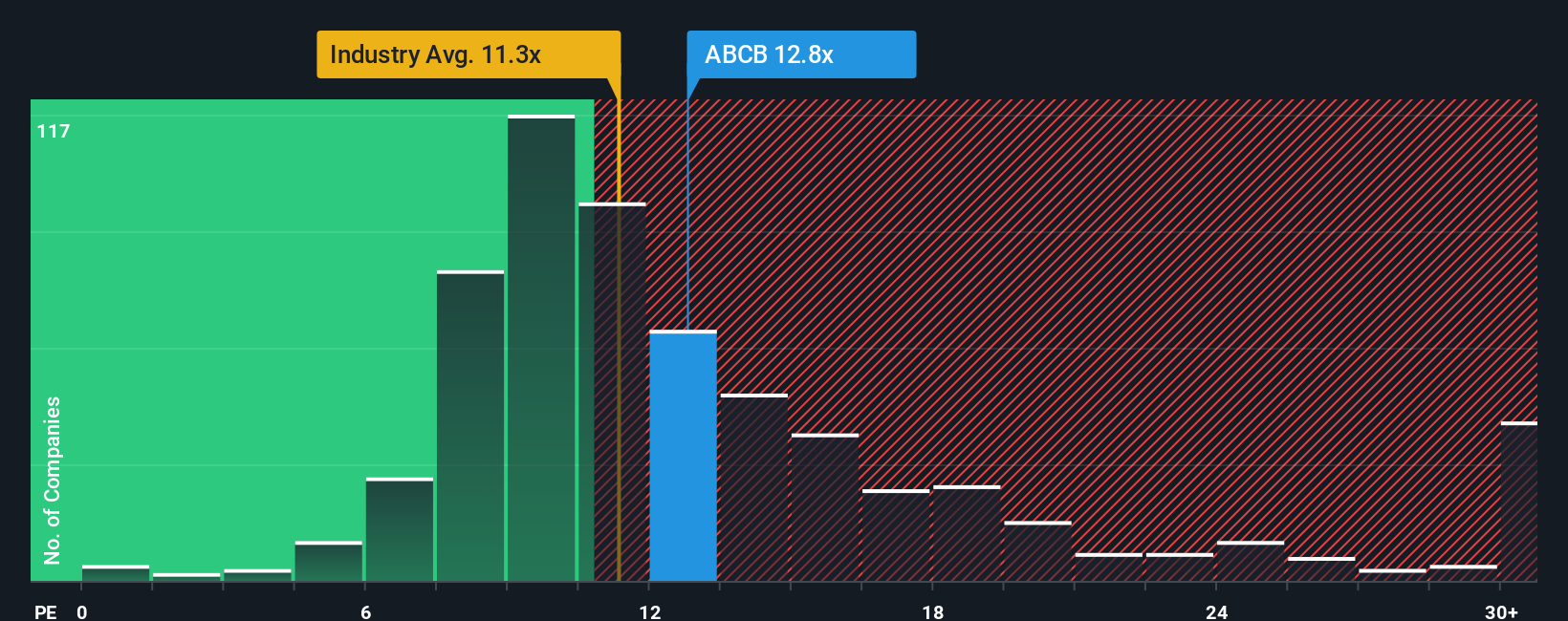

Another View: Multiples Point to Caution

While some valuation models paint Ameris Bancorp as an opportunity, a quick check against the market’s favorite ratio tells a more cautious story. Ameris trades at 12.9 times earnings, which is higher than both the US Banks industry average of 11.7x and the company’s own fair ratio of 12.1x. This slightly elevated number suggests less room for upside and hints at valuation risk if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameris Bancorp Narrative

If these conclusions don’t quite fit your perspective or you’d rather analyze the details yourself, you can quickly craft your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ameris Bancorp.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. The market is full of standout stocks and themes gaining momentum. Act now to see what your portfolio could be missing.

- Accelerate your returns by tapping into stable passive income, and check out these 18 dividend stocks with yields > 3% that consistently deliver impressive yields above 3%.

- Capitalize on the artificial intelligence boom with these 24 AI penny stocks disrupting industries and reshaping the future of automation and digital innovation.

- Seize early advantage in the next wave of finance with these 79 cryptocurrency and blockchain stocks making breakthroughs in blockchain and digital currency ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABCB

Ameris Bancorp

Operates as the bank holding company for Ameris Bank that provides range of banking services to retail and commercial customers.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives